My Forsyth _ Spring 2023

Women in Business, Homeownership, Finances, Food, Health & Wellness, and Architecture are just a few of the articles you'll find in the latest issue of your community magazine. Sit back and enjoy. Happy reading!

Women in Business, Homeownership, Finances, Food, Health & Wellness, and Architecture are just a few of the articles you'll find in the latest issue of your community magazine. Sit back and enjoy. Happy reading!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

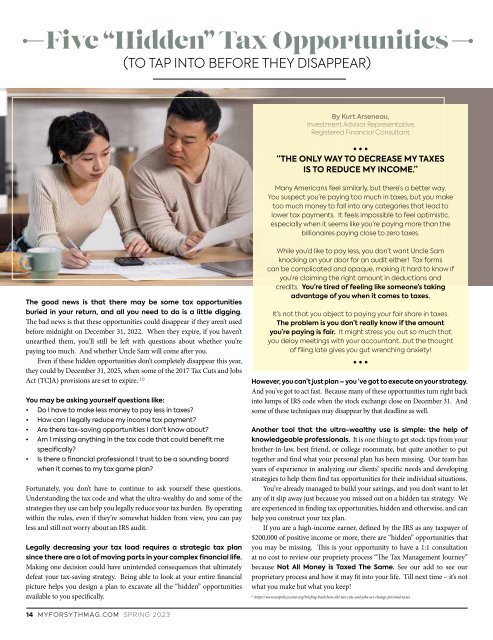

Five “Hidden” Tax Opportunities<br />

(TO TAP INTO BEFORE THEY DISAPPEAR)<br />

By Kurt Arseneau,<br />

Investment Advisor Representative,<br />

Registered Financial Consultant<br />

“THE ONLY WAY TO DECREASE MY TAXES<br />

IS TO REDUCE MY INCOME.”<br />

Many Americans feel similarly, but there’s a better way.<br />

You suspect you’re paying too much in taxes, but you make<br />

too much money to fall into any categories that lead to<br />

lower tax payments. It feels impossible to feel optimistic,<br />

especially when it seems like you’re paying more than the<br />

billionaires paying close to zero taxes.<br />

The good news is that there may be some tax opportunities<br />

buried in your return, and all you need to do is a little digging.<br />

The bad news is that these opportunities could disappear if they aren’t used<br />

before midnight on December 31, 2022. When they expire, if you haven’t<br />

unearthed them, you’ll still be left with questions about whether you’re<br />

paying too much. And whether Uncle Sam will come after you.<br />

Even if these hidden opportunities don’t completely disappear this year,<br />

they could by December 31, 2025, when some of the 2017 Tax Cuts and Jobs<br />

Act (TCJA) provisions are set to expire. (1)<br />

You may be asking yourself questions like:<br />

• Do I have to make less money to pay less in taxes?<br />

• How can I legally reduce my income tax payment?<br />

• Are there tax-saving opportunities I don’t know about?<br />

• Am I missing anything in the tax code that could benefit me<br />

specifically?<br />

• Is there a financial professional I trust to be a sounding board<br />

when it comes to my tax game plan?<br />

Fortunately, you don’t have to continue to ask yourself these questions.<br />

Understanding the tax code and what the ultra-wealthy do and some of the<br />

strategies they use can help you legally reduce your tax burden. By operating<br />

within the rules, even if they’re somewhat hidden from view, you can pay<br />

less and still not worry about an IRS audit.<br />

Legally decreasing your tax load requires a strategic tax plan<br />

since there are a lot of moving parts in your complex financial life.<br />

Making one decision could have unintended consequences that ultimately<br />

defeat your tax-saving strategy. Being able to look at your entire financial<br />

picture helps you design a plan to excavate all the “hidden” opportunities<br />

available to you specifically.<br />

While you’d like to pay less, you don’t want Uncle Sam<br />

knocking on your door for an audit either! Tax forms<br />

can be complicated and opaque, making it hard to know if<br />

you’re claiming the right amount in deductions and<br />

credits. You’re tired of feeling like someone’s taking<br />

advantage of you when it comes to taxes.<br />

It’s not that you object to paying your fair share in taxes.<br />

The problem is you don’t really know if the amount<br />

you’re paying is fair. It might stress you out so much that<br />

you delay meetings with your accountant…but the thought<br />

of filing late gives you gut wrenching anxiety!<br />

However, you can’t just plan – you ‘ve got to execute on your strategy.<br />

And you’ve got to act fast. Because many of these opportunities turn right back<br />

into lumps of IRS code when the stock exchange close on December 31. And<br />

some of these techniques may disappear by that deadline as well.<br />

Another tool that the ultra-wealthy use is simple: the help of<br />

knowledgeable professionals. It is one thing to get stock tips from your<br />

brother-in-law, best friend, or college roommate, but quite another to put<br />

together and find what your personal plan has been missing. Our team has<br />

years of experience in analyzing our clients’ specific needs and developing<br />

strategies to help them find tax opportunities for their individual situations.<br />

You’ve already managed to build your savings, and you don’t want to let<br />

any of it slip away just because you missed out on a hidden tax strategy. We<br />

are experienced in finding tax opportunities, hidden and otherwise, and can<br />

help you construct your tax plan.<br />

If you are a high-income earner, defined by the IRS as any taxpayer of<br />

$200,000 of positive income or more, there are “hidden” opportunities that<br />

you may be missing. This is your opportunity to have a 1:1 consultation<br />

at no cost to review our propriety process “The Tax Management Journey”<br />

because Not All Money is Taxed The Same. See our add to see our<br />

proprietary process and how it may fit into your life. Till next time – it’s not<br />

what you make but what you keep!<br />

(1<br />

https://www.taxpolicycenter.org/briefing-book/how-did-tax-cuts-and-jobs-act-change-personal-taxes<br />

14 MYFORSYTHMAG.COM SPRING <strong>2023</strong>