The Oracle: Issue #2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE ORACLE - OCTOBER ISSUE - #02<br />

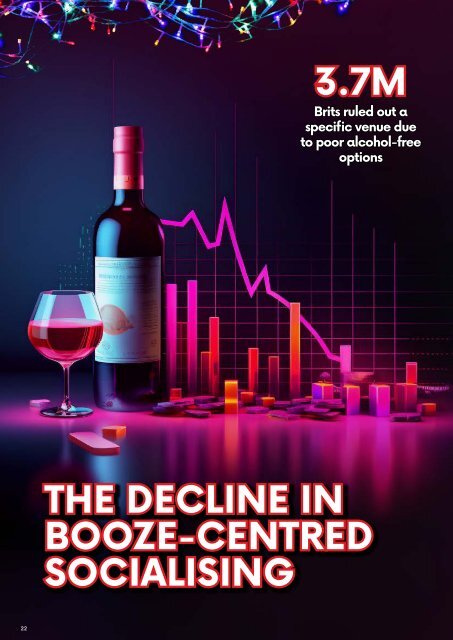

THE DECLINE IN<br />

3.7M<br />

Brits ruled out a<br />

specific venue due<br />

to poor alcohol-free<br />

options<br />

Does it surprise you that as many Brits moderated their alcohol<br />

income this summer as in ‘Dry January’?<br />

Many are planning to continue<br />

‘moderating’ their drinking across<br />

the upcoming festive season, with<br />

44% of Brits intending to drink less<br />

alcohol during Christmas 2023<br />

compared with 2022. KAM’s recent<br />

report, in partnership with Lucky<br />

Saint, found actively moderating<br />

alcohol consumption is now a yearround<br />

habit for UK adults.<br />

It seems that moderation has hit<br />

the mainstream!<br />

<strong>The</strong>re has been a significant<br />

fall in the number of UK adults<br />

consuming alcohol at least once<br />

a week, with the figure now at<br />

76.9% (down from 90% in 2022).<br />

This equates to a drop of 6.8m<br />

people drinking weekly, with all age<br />

groups reporting a decline in overall<br />

alcohol consumption. Within the<br />

18-24 age group – a core age group<br />

for competitive socialising venues<br />

- the figure has fallen fastest, from<br />

91% in 2022 down to 72% this year.<br />

This coincides with a whole raft of<br />

new consumers entering the low<br />

and no category within the last year<br />

- with 9.7m UK adults (19% of UK<br />

adults) trying low and no alcohol<br />

beer for the first time.<br />

Moderation has most certainly hit<br />

the mainstream and it’s part of a<br />

bigger shift in how we, as a nation,<br />

are spending our leisure time.<br />

We now see a modern consumer<br />

where socialising is not as centred<br />

around drinking culture, who is<br />

more aware of the risks of alcohol,<br />

and therefore is pro-actively taking<br />

action to ensure that they are<br />

drinking at what they consider to<br />

be responsible levels.<br />

But consumers don’t want to miss<br />

out on all the occasions where<br />

alcohol is normally present – going<br />

to the pub with friends, celebrating<br />

a birthday at home, or enjoying<br />

a beer while watching sport, for<br />

example. <strong>The</strong> increasing number<br />

of low alcohol or alcohol-free<br />

options available is therefore being<br />

welcomed with open arms. 30% of<br />

Brits intend to consume alcoholfree<br />

options over the festive period<br />

e.g. alcohol free wine or beer – and<br />

this rises to well over 1-in-3 in the<br />

millennial age bracket.<br />

Despite this long-term growth in<br />

low or alcohol-free occasions,<br />

venues are still at risk of losing<br />

customers, by giving them an<br />

underwhelming experience and<br />

not maximising potential sales<br />

on these low or alcohol-free<br />

occasions due to poor range and<br />

visibility. 3.7 million Brits ruled out<br />

a specific venue in the last three<br />

months alone due to poor alcoholfree<br />

options: totalling a missed<br />

opportunity of over £590.4m<br />

in revenue across the year for<br />

hospitality venues.<br />

During a recent chat with Luke<br />

Boase, founder of Lucky Saint,<br />

he highlighted that “whilst the<br />

low and no market continues<br />

to see tremendous growth, the<br />

opportunity for the UK remains<br />

significant. We trail behind many<br />

European nations in how we<br />

embrace low and no, with the likes<br />

of Spain, Germany and Sweden<br />

having larger market shares for low<br />

and no consumption compared to<br />

the UK.”<br />

Simon Farrow, Category Director<br />

for Tao Hospitality Group (who’s<br />

portfolio includes Hakkasan),<br />

have already taken the bold and<br />

innovative step to ‘zero proof’ their<br />

entire cocktail menu, providing<br />

like-for-like equivalents across the<br />

whole range. Simon proudly states<br />

that “1 in 8 of our cocktails are now<br />

alcohol-free. That’s a £4 to £12<br />

spend increase compared with<br />

people ordering sparkling water<br />

when they don’t want alcohol.”<br />

Venues must ensure they stay<br />

ahead of the curve, or they risk<br />

becoming less relevant for many<br />

potential customers, particularly<br />

Gen Z and Millennials, who tend<br />

to make up the largest proportion<br />

of all competitive socialising<br />

venue customers. <strong>The</strong> research<br />

shows that socialising in the UK is<br />

gradually becoming less alcoholdriven<br />

and more activity-led.<br />

LATEST RESEARCH<br />

BOOZE-CENTRED<br />

SOCIALISING<br />

Katie Jenkins, Marketing &<br />

Partnerships Director of KAM<br />

22<br />

23