You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

While the price action of JUP may not necessarily mirror<br />

the path of JTO, you can draw some assumptions:<br />

• The initial trading day of JUP is expected to be<br />

highly volatile, potentially providing opportunities<br />

for short-term traders.<br />

• The launch of JUP could generate significant<br />

excitement with a potential local peak in the first<br />

week of trading. A rapid increase, surpassing twice<br />

the initial quoted price, might signal a selling opportunity.<br />

• Conversely, a drawdown exceeding 50% from its<br />

initial quoted price could be interpreted as a buying<br />

opportunity.<br />

An “Overbought” Indicator - The JTO FDV / LDO FDV ratio<br />

Jito is like the Lido protocol. Their key distinction is that<br />

Jito is on Solana whereas Lido is on Ethereum. Therefore,<br />

when JTO was launched, a sound approach to pricing the<br />

token involved looking at the relationship between JTO<br />

Fully Diluted Valuation (FDV) and LDO’s (the governance<br />

token of Lido) FDV. This comparison allowed us to gauge<br />

how the market was valuing JTO in relation to its counterpart<br />

on Ethereum.<br />

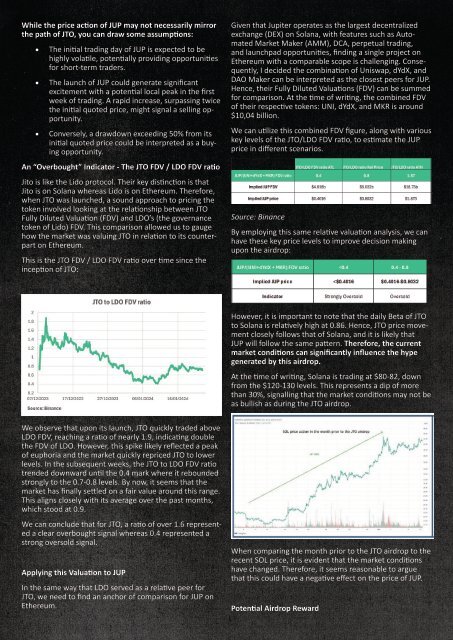

This is the JTO FDV / LDO FDV ratio over time since the<br />

inception of JTO:<br />

Given that Jupiter operates as the largest decentralized<br />

exchange (DEX) on Solana, with features such as Automated<br />

Market Maker (AMM), DCA, perpetual trading,<br />

and launchpad opportunities, finding a single project on<br />

Ethereum with a comparable scope is challenging. Consequently,<br />

I decided the combination of Uniswap, dYdX, and<br />

DAO Maker can be interpreted as the closest peers for JUP.<br />

Hence, their Fully Diluted Valuations (FDV) can be summed<br />

for comparison. At the time of writing, the combined FDV<br />

of their respective tokens: UNI, dYdX, and MKR is around<br />

$10,04 billion.<br />

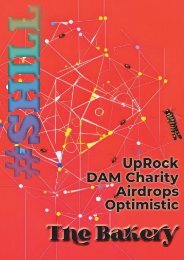

We can utilize this combined FDV figure, along with various<br />

key levels of the JTO/LDO FDV ratio, to estimate the JUP<br />

price in different scenarios.<br />

Source: Binance<br />

By employing this same relative valuation analysis, we can<br />

have these key price levels to improve decision making<br />

upon the airdrop:<br />

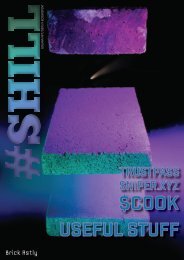

However, it is important to note that the daily Beta of JTO<br />

to Solana is relatively high at 0.86. Hence, JTO price movement<br />

closely follows that of Solana, and it is likely that<br />

JUP will follow the same pattern. Therefore, the current<br />

market conditions can significantly influence the hype<br />

generated by this airdrop.<br />

At the time of writing, Solana is trading at $80-82, down<br />

from the $120-130 levels. This represents a dip of more<br />

than 30%, signalling that the market conditions may not be<br />

as bullish as during the JTO airdrop.<br />

We observe that upon its launch, JTO quickly traded above<br />

LDO FDV, reaching a ratio of nearly 1.9, indicating double<br />

the FDV of LDO. However, this spike likely reflected a peak<br />

of euphoria and the market quickly repriced JTO to lower<br />

levels. In the subsequent weeks, the JTO to LDO FDV ratio<br />

trended downward until the 0.4 mark where it rebounded<br />

strongly to the 0.7-0.8 levels. By now, it seems that the<br />

market has finally settled on a fair value around this range.<br />

This aligns closely with its average over the past months,<br />

which stood at 0.9.<br />

We can conclude that for JTO, a ratio of over 1.6 represented<br />

a clear overbought signal whereas 0.4 represented a<br />

strong oversold signal.<br />

Applying this Valuation to JUP<br />

In the same way that LDO served as a relative peer for<br />

JTO, we need to find an anchor of comparison for JUP on<br />

Ethereum.<br />

When comparing the month prior to the JTO airdrop to the<br />

recent SOL price, it is evident that the market conditions<br />

have changed. Therefore, it seems reasonable to argue<br />

that this could have a negative effect on the price of JUP.<br />

Potential Airdrop Reward