You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

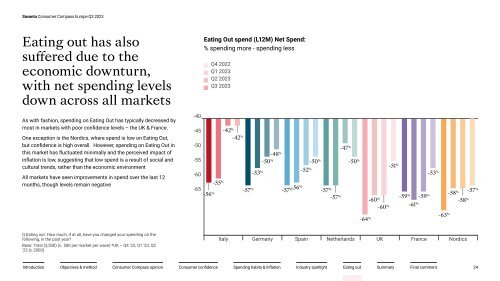

Savanta Consumer Compass Europe <strong>Q3</strong> <strong>2023</strong><br />

Eating out has also<br />

suffered due to the<br />

economic downturn,<br />

with net spending levels<br />

down across all markets<br />

Eating Out spend (L12M) Net Spend:<br />

% spending more - spending less<br />

Q4 2022<br />

Q1 <strong>2023</strong><br />

Q2 <strong>2023</strong><br />

<strong>Q3</strong> <strong>2023</strong><br />

As with fashion, spending on Eating Out has typically decreased by<br />

most in markets with poor confidence levels – the UK & France.<br />

One exception is the Nordics, where spend is low on Eating Out,<br />

but confidence is high overall. However, spending on Eating Out in<br />

this market has fluctuated minimally and the perceived impact of<br />

inflation is low, suggesting that low spend is a result of social and<br />

cultural trends, rather than the economic environment<br />

All markets have seen improvements in spend over the last 12<br />

months, though levels remain negative<br />

-40<br />

-45<br />

-50<br />

-55<br />

-60<br />

-65<br />

-56 % -55 % -42 % -42 %<br />

-48 % -50 % -50 % -51 % -53 %<br />

-47 %<br />

-50 % -52<br />

-53 % % -56<br />

-57 % -57 % % -57 % -58<br />

-57 % -59 %<br />

% -59 %<br />

-60 % -58 %<br />

-60 % -63 %<br />

-64 %<br />

-57 %<br />

-61 %<br />

Q Eating out: How much, if at all, have you changed your spending on the<br />

following, in the past year?<br />

Base: Total (3,500) (c. 500 per market per wave) *UK – Q4 ‘22, Q1 ’23, Q2<br />

‘23 (c.2000)<br />

Italy Germany Spain Netherlands UK France Nordics<br />

24