Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUSINESS JETS | <strong>MENA</strong><br />

<strong>YE</strong> <strong>2022</strong><br />

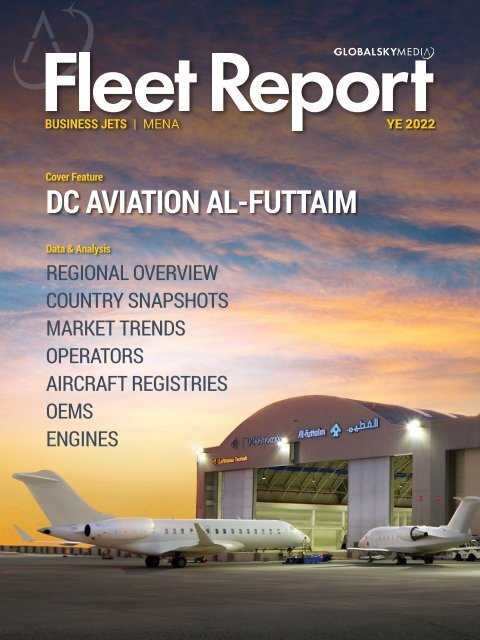

Cover Feature<br />

DC AVIATION AL-FUTTAIM<br />

Data & Analysis<br />

REGIONAL OVERVIEW<br />

COUNTRY SNAPSHOTS<br />

MARKET TRENDS<br />

OPERATORS<br />

AIRCRAFT REGISTRIES<br />

OEMS<br />

ENGINES<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | I

II | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | III

CONTENTS<br />

PUBLISHER<br />

04<br />

08<br />

10<br />

14<br />

16<br />

18<br />

40<br />

EXECUTIVE SUMMARY<br />

The Executive Summary is where you will find a quick<br />

overview of all of the headline findings from the report.<br />

REGIONAL OVERVIEW<br />

The Regional Overview shows a high-level snapshot of the<br />

Asia-Pacific fleet by region and country.<br />

COUNTRY SNAPSHOTS<br />

The Major Country Snapshots give a brief overview of the<br />

business jet fleets in each country/region, and includes the<br />

total fleet size, number of transactions and biggest operators.<br />

CELEBRATING TEN <strong>YE</strong>ARS IN THE<br />

MIDDLE EAST<br />

DC AVIATION AI-FUTTAIM<br />

DC Aviation Al-Futtaim shares the excitement of marching<br />

into the tenth year of operation and its perception of moving<br />

forward.<br />

MARKET TRENDS<br />

The Market Trends section looks at the deliveries and<br />

transactions in the region, with data presented by OEM, type<br />

and value.<br />

MARKET UPDATES<br />

The Market Updates section is where you’ll find more granular<br />

data on the aircraft and engines in the region.<br />

18 Operator Overview<br />

22 Aircraft Registry Overview<br />

26 OEM Overview<br />

34 Engine Overview<br />

APPENDIX<br />

EDITORIAL & MARKET RESEARCH<br />

Alud Davies<br />

Casper Zhuang<br />

Charlie Xu<br />

Dennis Lau<br />

Jeffrey Tang<br />

Liana Liu<br />

Mia Yao<br />

Qianyun Zhou<br />

Samuel Gao<br />

Silvia Huang<br />

Xiangyun Ning<br />

DESIGN<br />

Amy Liu-Lhuissier<br />

Kirsten Ackland<br />

Luna Huang<br />

ADVERTISING/ENQUIRIES:<br />

Joey Wong<br />

jwong@globalsky.media<br />

(852) 9582 0117<br />

www.globalsky.media<br />

Global Sky Media is part of Asian Sky Group. The materials and<br />

information provided by Global Sky Media in this report are for<br />

reference only. While such information was compiled using the best<br />

available data as of December 31, <strong>2022</strong>, any information we provide<br />

about how we may interpret the data and market, or how certain<br />

issues may be addressed is provided generally without considering<br />

your specific circumstances. Such information should not be regarded<br />

as a substitute for professional advice. Independent professional<br />

advice should be sought before taking action on any matters to which<br />

information provided in this report may be relevant.<br />

Global Sky Media shall not be liable for any losses, damage, costs<br />

or expenses howsoever caused, arising directly or indirectly from<br />

the use of or inability to use this report or use of or reliance upon<br />

any information or material provided in this report or otherwise in<br />

connection with any representation, statement or information on or<br />

contained in this report.<br />

COVER IMAGE<br />

DC Aviation Al-Futtaim<br />

Global Sky Media endeavors to ensure that the information contained<br />

in this report is accurate as at the date of publication, but does not<br />

guarantee or warrant its accuracy or completeness, or accept any<br />

liability of whatever nature for any losses, damage, costs or expenses<br />

howsoever caused, whether arising directly or indirectly from any error<br />

or omission in compiling such information. This report also uses third<br />

party information not compiled by Global Sky Media. Global Sky Media<br />

is not responsible for such information and makes no representation<br />

about the accuracy, completeness or any other aspect of information<br />

contained. The information, data, articles, or resources provided by<br />

any other parties do not in any way signify that Global Sky Media<br />

endorses the same.<br />

IV | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 1

PUBLISHER’S NOTE<br />

One year ago when I joined<br />

Global Sky Media it was called<br />

Asian Sky Media. The company<br />

had been producing a number<br />

of market intelligence reports<br />

not only for business jet<br />

fleets, but for helicopter<br />

fleets, infrastructure, training<br />

and charter, and a quarterly<br />

report to provide an up-to-date<br />

market overview and summary for business jets and helicopters.<br />

The geographical coverage of all of these reports was always<br />

Asia-Pacific.<br />

Our name change from Asian Sky to Global Sky was our<br />

statement to our readers and to the aviation industry, that we are<br />

not only about Asia-Pacific anymore. We are going to be much<br />

more than that moving forward.<br />

reports, I am delighted to tell you that we have expanded our<br />

coverage to go beyond Asia-Pacific. The same insights and data<br />

that you have become accustomed to, are now available in our<br />

Middle East and North Africa (<strong>MENA</strong>) and Europe editions. We<br />

always obtain our data from multiple sources including, where<br />

possible, directly from the operators themselves. The criteria<br />

remain the same for fleet reports, where the aircraft must be in<br />

service, must be used only for civil purposes, and must be based<br />

in the region to be counted.<br />

To our existing readers, supporters and clients, I hope our<br />

expanded coverage will give you even greater value than in the<br />

past. To our new readers around the world, I hope our intelligence<br />

brings you valuable knowledge to assist your businesses. You<br />

can look forward to more international research for other types of<br />

aircraft and aviation services throughout the year.<br />

Since the summer of last year we have been writing daily news<br />

and delivering it through our upgraded and personalized website<br />

alongside our weekly newsletter sent to thousands of subscribers<br />

worldwide. Our research, such as the publication you are reading<br />

now, has taken significant steps forward in becoming truly worldclass,<br />

by achieving higher levels of professionalism.<br />

Our global news coverage now includes business aviation,<br />

general aviation, helicopters and advanced air mobility. For our<br />

Sincerely,<br />

Tan Rahman<br />

Publisher<br />

Global Sky Media<br />

SPECIAL THANKS TO OUR CONTRIBUTORS<br />

2 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

\<br />

BUSINESS AVIATION SIMPLIFIED.<br />

WHEN BUSINESS AIRCRAFT FINANCING<br />

IS ALL YOU DO, EXPERTISE FOLLOWS.<br />

From operating costs to tax implications, few business assets are as unique as an aircraft.<br />

Which is why it make sense to work with a financing partner who focuses exclusively on business aviation. Global Jet Capital brings<br />

decades of collective experience—and thousands of aircraft transactions—to the business of business aviation. So, whether you’re<br />

acquiring your first aircraft, adding to your fleet, or considering an upgrade, you can count on a simple, straightforward process and<br />

a customized solution that meets your needs. Simple.<br />

844.436.8200 \ info@globaljetcapital.com \ globaljetcapital.com<br />

LEASING & LENDING SOLUTIONS<br />

HONG KONG \ NEW YORK \ ZURICH<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 3

EXECUTIVE SUMMARY<br />

At the end of the fourth quarter of <strong>2022</strong> there were 419 business jets operating in the Middle East and North Africa<br />

region (<strong>MENA</strong>), a rise of 7.4% from the end of 2021. In total, there were nine new deliveries, 59 pre-owned additions<br />

and 39 deductions, resulting in a net addition of 29 aircraft into the region’s fleet. The growth rate for the business<br />

jet fleet in the <strong>MENA</strong> region has been favourable in comparison to other key markets such as Europe, which saw a<br />

net fleet growth of 1.4%, and the Asia-Pacific fleet which declined by 2.4%.<br />

The persistence of the COVID-19<br />

pandemic during <strong>2022</strong> helpped fuelled<br />

growth in the business jet industry<br />

in the Middle East and North Africa<br />

(<strong>MENA</strong>) region. As business jet operators<br />

and private aviation players reported<br />

strong demand from clients seeking<br />

safe and comfortable travel, numerous<br />

airports in <strong>MENA</strong> made substantial<br />

investments to upgrade their business<br />

aviation infrastructure. Concurrently,<br />

the strengthening of key diplomatic and<br />

trading relations between countries within<br />

and outside the <strong>MENA</strong> region, combined<br />

with the lifestyle needs of high-net-worth<br />

individuals (HNWIs), is likely to support a<br />

steady and robust demand for business<br />

jet travel.<br />

NET FLEET GROWTH<br />

Positive Negative No Change<br />

BOMBARDIER<br />

GULFSTREAM<br />

TEXTRON<br />

BOEING<br />

-1.1%<br />

11.1%<br />

0.0%<br />

17.5%<br />

-4.9%<br />

-3.9%<br />

6.8%<br />

2.1%<br />

OEM<br />

44<br />

47<br />

48<br />

80<br />

80<br />

81<br />

77<br />

74<br />

91<br />

90<br />

100<br />

94<br />

LONG RANGE<br />

LARGE<br />

CORP.<br />

AIRLINER<br />

MEDIUM<br />

Size Category<br />

1.1%<br />

22.9%<br />

-3.7%<br />

2.9%<br />

6.3%<br />

5.9%<br />

3.3%<br />

0.0%<br />

60<br />

62<br />

62<br />

80<br />

85<br />

95<br />

96<br />

90<br />

107<br />

103<br />

118<br />

106<br />

Bombardier and Gulfstream remained the<br />

region’s most popular Original Equipment<br />

EMBRAER<br />

-20.9%<br />

11.8%<br />

43<br />

34<br />

38<br />

LIGHT<br />

-23.5%<br />

-3.8%<br />

34<br />

26<br />

25<br />

Manufacturers (OEMs), with <strong>MENA</strong> market<br />

shares of 24% and 22% respectively, thanks<br />

to a net addition of 24 aircraft between the<br />

AIRBUS<br />

3.3%<br />

9.7%<br />

30<br />

31<br />

34<br />

VERY LIGHT<br />

-25.0%<br />

0.0%<br />

24<br />

18<br />

18<br />

two manufacturers. During <strong>2022</strong>, nine new<br />

aircraft were delivered into the <strong>MENA</strong> region<br />

were Bombardier and Gulfstream Long<br />

Range Jets, led by the increasingly popular<br />

DASSAULT<br />

3.4%<br />

-6.7%<br />

29<br />

30<br />

28<br />

Global 7500 and still sought after G650ER.<br />

Notes:<br />

1. 2020 and 2021 data is based on JETNET LLC.<br />

2. Other OEMs include British Aerospace, Honda,<br />

Lockheed and MD.<br />

OTHERS 2<br />

-50.0%<br />

200.0%<br />

2<br />

1<br />

3<br />

400<br />

390<br />

419<br />

2020 1<br />

2021 1<br />

<strong>2022</strong><br />

4 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

EXECUTIVE SUMMARY<br />

Gulfstream had the highest net increase of 14 aircraft, with five<br />

new deliveries, 13 pre-owned additions, and four deductions. Airbus<br />

and Boeing contributed net additions of three and one aircraft,<br />

respectively. Dassault and Textron were the only top OEMs in the<br />

region to incur net reductions in the <strong>MENA</strong> region. Three Hawker<br />

800/XP and two Citation 500/501 aircraft left the region along<br />

with three other Textron models. Although there were five Textron<br />

aircraft added to the <strong>MENA</strong> region, the additions did not offset the<br />

deductions, resulting in a net decrease in Textron’s <strong>MENA</strong> fleet. A<br />

total of six Dassault aircraft departed from the region including two<br />

Falcon 900 aircraft, with four pre-owned additions, Dassault’s <strong>MENA</strong><br />

fleet decreased to 28 in <strong>2022</strong>.<br />

With 22 units, the Long Range G650ER was one of the most popular<br />

models in the region, followed by Textron’s Hawker 800/XP and the<br />

BBJ1, both of which had 19 units.<br />

Bombardier’s strong regional presence was led by popular models<br />

such as the Global 5000 (18), Global 6000 (16), and Challenger<br />

605 (15). Gulfstream’s G450 (16), G650 (16) and GIV/GIV-SP (15),<br />

Embraer’s Legacy 600 (15), and Airbus’s ACJ319 (12) were also well<br />

represented in the region.<br />

With many HNWIs from around the world relocating their residences<br />

and establishing business interests in the <strong>MENA</strong> region, it is perhaps<br />

unsurprising that business jets serving these clients generally fly<br />

longer routes. The United Arab Emirates (UAE), for instance, had some<br />

of the busiest international business jet routes in the second quarter<br />

(Q2), with 138 flights to and from the Maldives and a quarterly high<br />

of 208 flights to and from India. This trend is expected to continue<br />

as the UAE incentivises HNWIs with its low taxes, renowned wealth<br />

management services, and convenient infrastructure.<br />

Long Range models accounted for 118 aircraft, or 28% of the total <strong>MENA</strong><br />

fleet, which clearly reflected the region’s demand for long-distance<br />

routes and high end aircraft. The top three countries with the greatest<br />

number of Long Range business jets included the UAE (42), Qatar (20),<br />

and Israel (15). It is worth noting that Corporate Airliners were even more<br />

popular in the <strong>MENA</strong> region compared to the Asia-Pacific and European<br />

business jet markets. Corporate Airliners had a 21% share of the <strong>MENA</strong><br />

business jet fleet, compared to a 9% share in the Asia-Pacific fleet, and<br />

only a 2% share in the European fleet. The availability of large scale,<br />

modern infrastructure particularly at Middle East airports made them an<br />

attractive hub for business jet to establish their operating routes from<br />

other regions travelling into <strong>MENA</strong>.<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 5

EXECUTIVE SUMMARY<br />

<strong>MENA</strong> BUSINESS JET FLEET GROWTH<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

417 -1.2% 412 2.2% 421<br />

-4.3% 403 1.7% 410 0.7% 413 -3.1% 400 -2.5% 7.4%<br />

390<br />

2014<br />

CAGR<br />

2014 to <strong>2022</strong><br />

0.1%<br />

2015 2016 2017 2018 2019 2020 2021 <strong>2022</strong><br />

419<br />

NOTE: Historical fleet data is based on JETNET LLC.<br />

The overall trend in the <strong>MENA</strong> business jet market since 2014 has<br />

been stable thanks to positive growth in the years 2016, 2018, 2019,<br />

and <strong>2022</strong>, offset by net reductions in 2015, 2017, the COVID-19<br />

pandemic years. The <strong>MENA</strong> jet fleet experienced its greatest<br />

growth rate most recently at 7.4%, which is the highest increase<br />

since 2014. Overall aircraft numbers however still fell short of the<br />

421 seen in 2016.<br />

Three countries accounted for slightly more than 60% of the total<br />

number of business jet aircraft in the <strong>MENA</strong> region, namely the UAE<br />

(128), Saudi Arabia (82), and Israel (51). The Middle East was home<br />

to over 90% of business jets in the <strong>MENA</strong> region (378), having added<br />

32 aircraft from the previous year and surpassing the pre-pandemic<br />

figure (371) of 2019. Having seen a net deduction of three business<br />

jets during <strong>2022</strong>, the sub-region of Northern Africa had a fleet of 41<br />

jets at the end of <strong>2022</strong>.<br />

Nine of the top 20 operators saw fleet growth of between one to four<br />

business jets. Qatar Executive solidified its position as the <strong>MENA</strong><br />

region’s largest operator with its current 19-strong fleet.<br />

in the region which steadily increased, rising from 113 in 2020 to<br />

139 in <strong>2022</strong>. Offshore registrations have allowed business jets in<br />

the region to benefit from tax breaks, simplified paperwork, and cost<br />

savings associated with registering their aircraft outside of their<br />

home country.<br />

There was an appreciable degree of variance across the region<br />

over domestic registrations, with countries such as Qatar and<br />

Egypt having 85% and 63% of their business jet fleets registered<br />

domestically and countries such as Algeria and Morocco with over<br />

90%. In contrast, less than 30% of the business jet fleets in Israel<br />

and Jordan were registered locally. Just under half of the business<br />

jets in the region’s two largest fleets, the UAE and Saudi Arabia, were<br />

registered domestically.<br />

Rolls-Royce and Pratt & Whitney had the most engine installations in<br />

the <strong>MENA</strong> region. Rolls-Royce was the leader in long-range engines,<br />

with the BR700 engine powering the most popular Long Range<br />

models in the region, such as the Gulfstream G650/ER, G550 and the<br />

Bombardier Global series.<br />

Offshore registrations are an emerging trend for business jets based<br />

in the region, as evidenced the total number of offshore registrations<br />

6 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

The effort<br />

behind effortless<br />

1<br />

1<br />

Effortless — Wherever, and however, you fly, you can trust us to be there.<br />

In the air, on the ground, and at every moment in between. A global team<br />

of experts, dedicated to enabling your perfect flight, with passion.<br />

JetAviation.com<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 7

REGIONAL OVERVIEW<br />

1815<br />

MOROCCO<br />

23<br />

20<br />

88<br />

ALGERIA<br />

610<br />

11<br />

11<br />

8<br />

65<br />

LIBYA<br />

13<br />

OTHERS<br />

8<br />

7<br />

343977 108 65<br />

1618 2325 131266<br />

6863<br />

44<br />

51<br />

ISRAEL<br />

21<br />

9<br />

LEBANON<br />

24<br />

EGYPT<br />

9<br />

89<br />

13<br />

JORDAN<br />

82<br />

11<br />

SAUDI ARABIA<br />

30<br />

33<br />

QATAR<br />

8<br />

7<br />

IRAN<br />

7898<br />

KUWAIT<br />

17<br />

15<br />

101<br />

UNITED ARAB<br />

EMIRATES<br />

8<br />

128<br />

8<br />

OMAN<br />

50400<br />

-3.1%<br />

2020 1<br />

4939052419<br />

-2.5% 7.4%<br />

2021 1 <strong>2022</strong><br />

NOTES:<br />

1. 2020 and 2021 data is based on JETNET LLC.<br />

2. <strong>Fleet</strong> distribution is based on business jets in service and their active bases of operation.<br />

3. Others include Bahrain, Djibouti, Iraq, Syria and Tunisia.<br />

4. Region is defined in appendix on page 38.<br />

8 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

REGIONAL OVERVIEW<br />

At the end of <strong>2022</strong>, the total fleet in the region stood at 419<br />

business jets. The Middle East recorded the highest growth<br />

rate as a sub-region with the net addition of 32 aircraft, having<br />

seen its fleet reduced by 15 aircraft during the previous year.<br />

Of the 67 additions to the Middle East, 16 were Corporate<br />

Airliners. A total of 35 business jets left the Middle East<br />

during <strong>2022</strong>.<br />

Northern Africa saw a net reduction of three aircraft,<br />

having added two units to its fleet in <strong>2022</strong>, which was<br />

offset by the departure of five aircraft. The United Arab<br />

Emirates (UAE) saw the greatest fleet growth in the<br />

region, with 27 aircraft added, the majority of which were<br />

Corporate Airliners (eight) and Long Range Jets (13).<br />

Countries such as Israel, Qatar and Egypt each increased<br />

their fleets by three to seven aircraft.<br />

Saudi Arabia and Morocco, the countries which the most net<br />

deduction in <strong>2022</strong>, have seen consistent reductions in their<br />

fleets since 2019.<br />

Saudi Arabia, for instance, was projected to lose around<br />

600 HNWIs in <strong>2022</strong>, with a portion of that number migrating<br />

to the UAE, thereby potentially transferring business<br />

jet operations over to the Emirates. An anti-corruption<br />

campaign instigated by the Crown Prince over a two-year<br />

period (2017 - 2019) would have undoubtedly eroded trust<br />

and assurances in holding valuable assets and business<br />

interests within the Kingdom.<br />

Another important factor that had potentially shifted the<br />

momentum of business jet growth to the UAE in recent years<br />

was its diverse economy and less restrictive regulations<br />

for allowing multinational corporations to operate within<br />

the Emirates. In contrast to Saudi Arabia, where foreign<br />

companies operating without a local headquarters were<br />

subject to stringent regulations, the UAE had distinct<br />

advantages in attracting foreign investment and continuing<br />

to improve its infrastructure to support its thriving economy.<br />

It was, however, premature to predict that the Saudi<br />

business jet market will continue to decline. <strong>Business</strong><br />

initiatives such as Vision 2030 strived to make it easier for<br />

multinational companies to base their headquarters locally,<br />

thereby encouraging diversification for its economy and<br />

broadening its potential beyond oil resources. Expansion<br />

of aviation infrastructure had been taking place in projects<br />

across Riyadh and Jeddah to allow for more charter and<br />

private jet operations.<br />

Morocco’s business jet fleet steadily declined from 26 aircraft<br />

in 2019 to 20 in <strong>2022</strong>. The COVID-19 pandemic resulted in a<br />

LARGEST MARKET<br />

128<br />

UNITED ARAB EMIRATES<br />

BUSINESS JET FLEET 2<br />

MOST NET FLEET<br />

ADDITIONS<br />

+27<br />

UNITED ARAB EMIRATES<br />

FLEET GROWTH IN MAJOR MARKETS<br />

Net <strong>Fleet</strong> Growth<br />

Ranked by <strong>2022</strong> net fleet growth in descending order from the highest.<br />

MOST NET FLEET<br />

DEDUCTIONS<br />

-7<br />

SAUDI ARABIA<br />

SUBREGION 4 2021 <strong>2022</strong> 2021 <strong>2022</strong><br />

Middle East -15 +32 -4.2% 9.2%<br />

Northern Africa +5 -3 12.8% -6.8%<br />

TOTAL -10 +29 -2.5% 7.4%<br />

Net <strong>Fleet</strong> Growth<br />

Growth Rate<br />

Growth Rate<br />

COUNTRY/REGION 2021 <strong>2022</strong> 2021 <strong>2022</strong><br />

United Arab Emirates -3 +27 -2.9% 26.7%<br />

Israel +6 +7 15.8% 15.9%<br />

Qatar +2 +3 7.1% 10.0%<br />

Egypt -3 +3 -12.5% 14.3%<br />

Algeria +6 0 120.0% 0.0%<br />

Oman -1 0 -11.1% 0.0%<br />

Lebanon -5 0 -35.7% 0.0%<br />

Iran -1 -1 -11.1% -12.5%<br />

Libya 0 -1 0.0% -12.5%<br />

Jordan -2 -2 -13.3% -15.4%<br />

Kuwait -3 -2 -15.0% -11.8%<br />

Morocco -1 -3 -4.2% -13.0%<br />

Saudi Arabia -7 -7 -7.3% -7.9%<br />

Others +2 +5 33.3% 62.5%<br />

TOTAL -10 +29 -2.5% 7.4%<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 9

COUNTRY SNAPSHOTS<br />

significant drop in demand for air travel, which had a significant impact on the<br />

country’s aviation industry. Exports reduced by 30%, which resulted in 17,500<br />

redundancies in 2020. The overall economy contracted by 6.3% that year, but<br />

has since recovered to grow by 7.4% in <strong>2022</strong>.<br />

Morocco and Israel signed an agreement in the first quarter of <strong>2022</strong> to<br />

collaborate on civilian aviation projects, bolstering the prospect of the<br />

sector gaining a stronger foothold in the country.<br />

After two years of decline due to disruptions in air travel caused by the<br />

global pandemic, the <strong>MENA</strong> region’s business jet fleet had started to<br />

grow again. As scheduled commercial flights were disrupted, the region’s<br />

established capacity of business jets became a driving force in maintaining<br />

invaluable operations for business, private, and humanitarian needs.<br />

<strong>Business</strong> jet travel had been highlighted as a viable tool for achieving a<br />

variety of goals through sporting events such as the FIFA World Cup <strong>2022</strong><br />

in Qatar, humanitarian operations in Iraq, and increased demand for air<br />

travel within the <strong>MENA</strong> region. Furthermore, a strengthening of trade and<br />

diplomatic relations between nations in the <strong>MENA</strong> region also looked set<br />

to stimulate additional demand for business jet travel in the region, as<br />

evidenced with the Abraham Accords agreement signed between the UAE<br />

and Israel.<br />

MAJOR COUNTRY SNAPSHOTS<br />

United Arab Emirates<br />

The United Arab Emirates had 128 business jets, having grown by 27<br />

jets with four new deliveries, 36 pre-owned additions, and 13 deductions<br />

- more than any other country in the <strong>MENA</strong> region in <strong>2022</strong>. The UAE<br />

accounted for 31% of <strong>MENA</strong>’s jet fleet, with a fleet 36% bigger than the<br />

next largest market, Saudi Arabia. Over half of the UAE’s fleet was based<br />

in Dubai, while around a quarter (including the majority of Corporate<br />

Airliners) were based in the capital of Abu Dhabi. Approximately 40% of<br />

the fleet was registered locally (A6-). Five of the top ten operators in the<br />

region had a base in the UAE, four of which saw expansions in their fleets.<br />

Bombardier was the most popular OEM with around a third of the<br />

UAE fleet, while Boeing was the most popular Corporate Airliner OEM,<br />

which includes 19 BBJ1 and BBJ2 models in the UAE fleet. Boeing had<br />

over a fifth of the UAE fleet with a range of models from the 737 to the<br />

787, which were primarily operated by Dubai Air Wing, Royal Jet, and<br />

Presidential Flight. Besides BBJ1 with 15 aircraft, the most popular<br />

aircraft models in the UAE include the Global 5000, Global 6000, Legacy<br />

600, and G650, each with seven aircraft. The UAE led the charts for<br />

having the highest proportion of Corporate Airliner, Large, and Long<br />

Range aircraft in the region, while the Medium and Very Light aircraft<br />

take a merger 13% of UAE’s total fleet. The average age of aircraft across<br />

the fleet was 13 years, which was below the regional average of 15 years.<br />

Saudi Arabia<br />

Saudi Arabia had 82 business jets, down by seven year-on-year with<br />

three pre-owned additions and ten deductions. Having had arguably the<br />

largest fleet of business jets in the region before the onset of the global<br />

pandemic, it accounted for just under 20% of <strong>MENA</strong>’s fleet in <strong>2022</strong>. The<br />

majority of business jets (65%) were based in the administrative capital<br />

of Riyadh, while around a third were based in Jeddah. Just over 40% of<br />

the fleet was registered locally (HZ-), while aircraft with registrations<br />

in the United States (N) and the Cayman Islands (VP-C) making up<br />

more than 45% of the fleet. Three of the top ten <strong>MENA</strong> operators had a<br />

presence in the country. NAS Private Aviation and Sky Prime Aviation<br />

Services had the largest fleets in Saudi Arabia, with nine aircraft each.<br />

Despite a reduction of one aircraft from the previous year, Gulfstream<br />

remained the most popular OEM in the country. Gulfstream’s most<br />

popular model, the G450, had ten aircraft in the fleet, while the Hawker<br />

10 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

COUNTRY SNAPSHOTS<br />

900 XP and Challenger 605 each had five aircraft. Airbus and Boeing<br />

each had 15 aircraft in the Saudi Arabia business jet fleet, making the<br />

Corporate Airliner being the most popular category with a market share<br />

of 37% in the country. The most popular models in the Airbus fleet are the<br />

Airbus ACJ 318 and 319, with four aircraft each.<br />

consists entirely of the Long Range G650ER, which was also most<br />

popular model in Qatar overall. Airbus and Boeing contributed seven<br />

aircraft to the fleet, with notable models including the Boeing 747<br />

corporate variant, the Airbus A340, and the ACJ320. The Global 5000<br />

was Bombardier’s most popular model in the fleet, with four aircraft.<br />

With market shares of 37% and 32% respectively, the Corporate Airliner<br />

and Large categories accounted for the majority of the Saudi Arabia<br />

fleet. Long Range aircraft accounted for 17% of the market. The average<br />

age of all aircraft in the country was 15.8 years, which was slightly higher<br />

than the regional average.<br />

Israel<br />

Israel had 51 business jets at the end of <strong>2022</strong>, an increase of<br />

seven aircraft with nine pre-owned additions and two deductions.<br />

It accounted for 12% of <strong>MENA</strong>’s jet fleet. The private and charterbased<br />

fleet primarily operates to and from Tel Aviv’s Ben Gurion<br />

Airport. Domestic registrations (4X-) made up 24% of aircraft based<br />

in the country, while 16% were registered in the United States (N),<br />

and the majority (53%) were registered in offshore jurisdictions. 20<br />

were registered in the Isle of Man (M-), and six were registered in San<br />

Marino (T7-). Arrow Aviation was the country’s primary business jet<br />

operator, having grown to a fleet of six jets.<br />

Bombardier and Textron continued to be the market leading OEMs<br />

in the Israel business jet market. The Hawker 800/XP was the most<br />

popular type in Israel, with nine aircraft in service. Bombardier’s most<br />

popular models include the Challenger 604 and the Global Express<br />

XRS, each with five aircraft in the fleet, as well as the Global 6000, with<br />

four aircraft in the fleet. The most common aircraft categories in the<br />

fleet were Long Range (15) , Medium (13), and Large (13). The Israel<br />

business jet fleet had an average age of 17.3 years, which was 2.3<br />

years older than the regional average.<br />

Qatar<br />

The Qatari fleet had 33 business jets, up three aircraft over 2021 with<br />

three new deliveries, one pre-owned addition, and one deduction. It<br />

accounted for just under 8% of the <strong>MENA</strong> fleet. A total of 28 of the 33<br />

aircraft were registered domestically (A7-), the second highest proportion<br />

of domestically registered aircraft in the Middle East subregion. Its largest<br />

operator was Qatar Executive with its 19-strong fleet. Qatar Executive<br />

had the largest fleet of Gulfstream business jets (15) among the top ten<br />

operators, accounting for 20% of Gulfstream jets in the <strong>MENA</strong> region.<br />

Qatar Executive had the largest share of Long Range aircraft among<br />

the top ten <strong>MENA</strong> based in the region, with 18 Long Range aircraft and<br />

around 40% of the market share among those operators.<br />

Gulfstream was the leading OEM of the Qatar based fleet accounting<br />

for more than 45% of the market. The Gulfstream fleet in Qatar<br />

With 20 aircraft, the Long Range category was the most common,<br />

followed by Corporate Airliner (seven). It was worth noting that there<br />

were no Medium Jets operating in Qatar. The average age of the fleet<br />

in Qatar was 7.9 years, making it the youngest in the <strong>MENA</strong> region.<br />

Egypt<br />

Egypt’s fleet comprised 24 jets, which grew by three aircraft over 2021<br />

with three pre-owned additions. It accounted for 6% of the <strong>MENA</strong> jet<br />

fleet. <strong>Business</strong> jet operations were primarily based in Alexandria, Cairo<br />

and Sharm El Sheikh. Egypt had a wide network of airports that can<br />

cater for private and chartered flights across the country; going as far<br />

north as Port Said, and Aswan in the south. Some 63% of all business<br />

jets were registered domestically (SU-) while three were registered<br />

in the United States (N), two in the Isle of Man (M-), and three in San<br />

Marino (T7-) bringing the total number of offshore registrations to five<br />

aircraft. Cairo based Smart Aviation Company had the largest fleet with<br />

four aircraft - all Citation 680 Sovereigns, two of which specialize in air<br />

ambulance operations.<br />

Some 46% of the Egypt business jet fleet were Cessna Citation models,<br />

which made Textron the dominant OEM in the market. The most popular<br />

model was the Citation 680 Sovereign (six), followed by the Citation 510<br />

Mustang (four). Medium Jets were the most common category in the<br />

fleet with nine aircraft, followed by the Long Range (five), Large (four) and<br />

Very Light (four) categories. The average age of the Egypt business jet<br />

fleet was 14.8 years, slightly below the regional average.<br />

Morocco<br />

Morocco’s fleet had 20 business jets at the end of <strong>2022</strong>, which decreased<br />

by three aircraft year-on-year with one pre-owned addition and four<br />

deductions. It accounted for 5% of the <strong>MENA</strong> fleet and was overtaken by<br />

Egypt in terms of the total number of aircraft in <strong>2022</strong>. Only two jets in the<br />

Moroccan fleet were not registered domestically (CN-), with both being<br />

registered in the United States (N). Air Ocean Maroc was the largest<br />

operator, with a fleet of two Hawker 800/XP, one Legacy 600, and one<br />

Cessna Citation 650 exclusively used for air ambulance operations.<br />

Textron had the largest market share in Morocco in terms of OEMs, with<br />

models such as the Hawker 800/XP, Citation 650, and Hawker 900/XP<br />

accounting for 40% of the total fleet. Dassault models accounted for onefifth<br />

of the fleet. The most common aircraft sizes were Light (six) and<br />

Medium (eight). The average age of all aircraft in the country was 20.4<br />

years, which was more than five years higher than the regional average.<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 11

COUNTRY SNAPSHOTS<br />

Kuwait<br />

Kuwait’s fleet had 15 business jets, having seen two jets leave the<br />

country during <strong>2022</strong>. It accounted for 4% of the <strong>MENA</strong> jet fleet. <strong>Business</strong><br />

jet operations were mainly based at Kuwait International Airport (KWI).<br />

Kuwait Airways Corporation was the largest operator, with a fleet of five<br />

jets. Seven business jets had domestic registrations (9K-), four had US<br />

registrations (N), and three had offshore registrations in San Marino (T7-).<br />

Gulfstream and Embraer were the two leading OEMs in the country, with<br />

a combined market share of 73%. The G650 was the most popular model<br />

with five aircraft, followed by the Legacy 600 with four. There were three<br />

Airbus Corporate Airliners in the fleet, including the A310, A320, and<br />

A340. The most popular size categories were Long Range (six), Large<br />

(five), and Corporate Airliner (four). The average age of the Kuwait fleet<br />

was 14.5 years, which was slightly lower than the regional average.<br />

Algeria<br />

Algeria’s fleet remained unchanged from the previous year, with 11<br />

business jets which made up 3% of the <strong>MENA</strong> jet fleet. There were up<br />

to eight airports in the country which handle business jets, including<br />

Algiers, Constantine, and Ouargla. With the exception of an offshore<br />

(Aruba) registered aircraft, the vast majority of the fleet was registered<br />

in Algeria (7T-).<br />

Only two business jet OEMs had a presence in Algeria, with the most<br />

popular models being the Large GIV/GIV-SP/G400 series (four) and<br />

the Light Citation 560XL series (three). The two OEMs’ most common<br />

aircraft categories were Large (four) and Light (four). There were no<br />

Very Light Jets in the Algeria fleet. The fleet had an average age of<br />

21.3 years, which was more than six years above the regional average.<br />

from Bombardier, Dassault, Embraer, and Textron. Arab Wings was<br />

the largest operator in Jordan with a fleet of eight aircraft. Three of its<br />

aircraft had domestic registrations (JY-) while five aircraft were offshore<br />

registered. Offshore registrations made up 45% of all registrations in<br />

the fleet. The Cayman Islands (VP-C) was the most popular offshore<br />

registration with three aircraft in total.<br />

The Hawker 800/XP was the most popular model with two aircraft in<br />

the fleet. Embraer and Bombardier were the leading OEMs with each<br />

having three aircraft. The most common aircraft categories were Large<br />

(four), and Medium (four), followed by the Corporate Airliner (three). The<br />

average age of the Jordan fleet was 21.5 years, which was more than six<br />

years higher than the regional average.<br />

Bahrain<br />

The Bahrain fleet had nine business jets at the end of <strong>2022</strong>, having<br />

increased by five aircraft with three pre-owned additions and two new<br />

deliveries. It accounted for 2% of the <strong>MENA</strong> jet fleet. Six of its aircraft<br />

were registered domestically (A9C-). <strong>Business</strong> jet operations were mainly<br />

based at Bahrain International Airport, King Fahd International Airport,<br />

and Al-Ahsa International Airport.<br />

Some 55% of the Bahrain fleet consisted of Gulfstream models, including<br />

the G600, G650ER, and the G550. There were two Corporate Airliners<br />

including one Boeing 767, and a British Aerospace BAe 146. The most<br />

common aircraft category was Long Range, with six aircraft in the fleet.<br />

The average age of the Bahrain fleet was 11.7 years, which was more<br />

than three years younger than the regional average.<br />

Jordan<br />

Jordan’s fleet comprised 11 jets, with two deductions during <strong>2022</strong>. The<br />

fleet was relatively diverse in terms of OEM share, and included models<br />

12 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

COUNTRY SNAPSHOTS<br />

TOTAL FLEET BY COUNTRY/REGION AND OEM<br />

419 in Total<br />

BOMBARDIER<br />

GULFSTREAM<br />

TEXTRON<br />

BOEING<br />

EMBRAER<br />

AIRBUS<br />

DASSAULT<br />

OTHERS<br />

TOTAL<br />

% OF TOTAL<br />

UNITED ARAB EMIRATES 42 21 3 26 18 7 10 1 128 31%<br />

SAUDI ARABIA 14 21 10 15 3 15 4 82 20%<br />

ISRAEL 20 10 18 1 1 1 51 12%<br />

QATAR 6 15 3 3 1 4 1 33 8%<br />

EGYPT 4 3 13 1 3 24 6%<br />

MOROCCO 2 3 10 1 4 20 5%<br />

KUWAIT 1 6 5 3 15 4%<br />

ALGERIA 5 6 11 3%<br />

JORDAN 3 2 2 3 1 11 3%<br />

BAHRAIN 1 5 1 1 1 9 2%<br />

LEBANON 1 4 3 1 9 2%<br />

OMAN 1 5 1 1 8 2%<br />

IRAN 1 1 1 2 2 7 2%<br />

LIBYA 4 3 7 2%<br />

DJIBOUTI 1 1 2

DC AVIATION AL-FUTTAIM<br />

CELEBRATES TEN <strong>YE</strong>ARS<br />

IN THE MIDDLE EAST<br />

In June 2010 Dubai opened the first stage of its sprawling new<br />

airport. Officially named Al Maktoum International Airport, but<br />

known more colloquially as Dubai World Central, or DWC for short,<br />

the airport was originally designed to help alleviate pressure<br />

on Dubai International Airport, which at the time was already<br />

bursting at the seams thanks to the rapid expansion of the local<br />

Emirates Airline.<br />

The airport itself is built to the south of Dubai and once completed,<br />

will cover more than 35,000 acres and will handle up to 260 million<br />

passengers annually when it is due to be completed in 2027.<br />

One of the first stages of the airport’s development would see the<br />

majority of business aircraft movements transfer across to the<br />

new airport. Local operators, as well as those that had a presence<br />

in the region, were hesitant, especially given the added distance<br />

into the centre of Dubai – DWC is 37km from the centre of Dubai,<br />

whereas Dubai International Airport is just 4.6km. Another airport,<br />

Sharjah Airport 24km from central Dubai, was also picking up<br />

traction for business aviation movements as an alternative to Dubai<br />

International Airport.<br />

One of the first companies to see the potential of DWC was<br />

Germany’s DC Aviation. Based in Stuttgart, DC Aviation was already<br />

managing an aircraft in Dubai on behalf of a UAE client, so when<br />

the opportunity to move into DWC presented itself, the company<br />

began making plans to set up a new facility at the airport.<br />

“At the time, everybody thought we were crazy because it’s in the<br />

middle of nowhere,” says Paul James, Director of Sales/Aircraft<br />

Management for the company. “But we were the first to set up a<br />

facility at DWC.”<br />

To enter the market DC Aviation partnered with Al-Futtaim Group,<br />

a UAE-based conglomerate which operates retail partnerships,<br />

automotive franchises and owns malls across the Middle East. The<br />

two companies knew each other well, as DC Aviation was already<br />

operating an aircraft on behalf of the Al-Futtaim Group.<br />

The joint venture, now named DC Aviation Al-Futtaim, is celebrating<br />

its tenth anniversary in 2023, having begun operations at DWC<br />

in 2013. Since then, the facility has grown to include an FBO, as<br />

well as two hangars with a combined space of 13,500sq feet. Its<br />

maintenance capabilities at DWC, which uses an extension of<br />

its Stuttgart line station EASA approvals as well as GCAA 145<br />

approvals, currently service Bombardier’s Challenger and Global<br />

family aircraft, as well as Dassault’s Falcon 7X.<br />

According to James, <strong>2022</strong> was a great year for the company.<br />

Alongside an increase in movements through its FBO, James<br />

also says that its hangars are almost running at full capacity. The<br />

company also added several new aircraft to its fleet, with more to<br />

come in 2023.<br />

“In terms of growth, <strong>2022</strong> was a fantastic year for us, as has been<br />

the case for most people in the industry. Our FBO has seen a 28%<br />

increase in business and the hangar has been at almost 98%,” says<br />

James. “We also added two new aircraft into the fleet last year,<br />

including an Airbus and a Falcon 7X, and we just added a Global<br />

14 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

DC AVIATION AL-FUTTAIM<br />

7500 in December. We have a Global 6000 coming up, and two more<br />

aircraft due to join the fleet this year.”<br />

laws and setting up businesses. All of that is driving growth, and<br />

people feel confident to go there and do business,” says James.<br />

The Middle East, and Dubai specifically, is well known for being<br />

a large cabin aircraft market, which also has one of the highest<br />

percentages of corporate airliners in the world. It is perhaps<br />

surprising then that one of the DC Aviation Al-Futtaim fleet is a<br />

smaller Pilatus PC-12 turboprop.<br />

Although the aircraft had been in the managed fleet for some<br />

time, James says that the owner released it to the charter market<br />

during <strong>2022</strong>’s World Cup in Qatar, almost as an experiment to see<br />

how it would fare against the more established large jet aircraft in<br />

the market.<br />

“We’ve had a PC-12 which had been in the fleet with us for some<br />

time, but the owner decided to put it for charter. It’s actually the<br />

Middle East’s first propeller-driven charter aircraft, which we<br />

debuted during the World Cup,” says James. “It proved to be a<br />

success, so the owner decided to put it on the charter market<br />

full-time.”<br />

The company also says it is seeing growth in India. “Dubai has been<br />

home to many Ultra and High Net worth individuals and families, so<br />

we are able to provide services to those particular clientele.”<br />

To enter the market DC<br />

Aviation partnered with<br />

Al-Futtaim Group, a UAE-based<br />

conglomerate which operates<br />

retail partnerships, automotive<br />

franchises and owns malls<br />

across the Middle East.”<br />

DC Aviation was followed into DWC by many other business<br />

aviation companies. In terms of movements, DWC has managed to<br />

capture most business aircraft, with up to 70% of aircraft choosing<br />

to use DWC when visiting Dubai.<br />

Dubai’s location makes it the perfect place to capture business<br />

from the rest of the region. Although the local airline Emirates<br />

touches almost all parts of the globe with sometimes multiple-daily<br />

frequencies, the transitory nature of a big portion of its passengers<br />

who are just changing planes in Dubai almost hides the fact that<br />

Dubai is a major destination itself, especially for visitors from<br />

around the region as well as Africa.<br />

Two of the countries that have seen a lot of activity are Saudi<br />

Arabia and India, the former being in growth mode following a 2018<br />

government anti-corruption crackdown.<br />

“Since the Crown Prince laid out his Vision 2030 where he wants to<br />

modernize Saudi Arabia, we have seen a new impetus for growth.<br />

He’s very much modernizing the country, updating the country’s<br />

So, for the next few years, the company will look at expanding its<br />

fleet in the region. At the end of <strong>2022</strong>, the company had ten aircraft<br />

in its managed fleet in Dubai, which includes nine super-midsize<br />

and up jets, and the Pilatus PC-12 turboprop.<br />

“Aircraft management is always the priority because that feeds into<br />

the FBO side, the maintenance and the hangar parking, so I would<br />

say that aircraft management is the priority,” says James.<br />

“At the end of the day, we are a 360-degree management company,<br />

providing Ground Handling Services, Aircraft Maintenance and any<br />

other fields required to look after our client’s assets and individual<br />

needs,” he added.<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 15

MARKET TRENDS<br />

BUSINESS JET ADDITIONS & DEDUCTIONS<br />

MOVEMENTS<br />

<strong>2022</strong><br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

390 9<br />

<strong>Fleet</strong><br />

2021<br />

New<br />

Deliveries<br />

59 -39<br />

Pre-Owned<br />

Additions<br />

Deductions<br />

419<br />

<strong>Fleet</strong><br />

<strong>2022</strong><br />

9<br />

New Deliveries<br />

59<br />

Pre-owned<br />

Additions<br />

39<br />

Deductions<br />

2<br />

Intra-<strong>MENA</strong><br />

Movements<br />

There were 419 business jets in operation in the <strong>MENA</strong> region at the end of <strong>2022</strong>, a net increase of 29 aircraft with nine<br />

new deliveries, 59 pre-owned additions, and 39 deductions. Out of all transactions in <strong>2022</strong>, there were two intra-regional<br />

movements. The Long Range (26), Corporate Airliner (16), and Large (16) categories accounted for 85% of all additions in<br />

the region.<br />

The United Arab Emirates took the largest number of new deliveries in<br />

the region. Gulfstream was the leading OEM in terms of new deliveries,<br />

introducing five aircraft that accounted for more than 55% of new<br />

deliveries and USD$329.4 million in value, which was 54% of the total new<br />

deliveries value. With three aircraft each, the G650ER and Global 7500<br />

were the most popular models for new deliveries, both with class-leading<br />

cabin amenities and advanced avionics. The remaining models that saw<br />

new deliveries, the G600 and the Global 6500, reinforced the region’s high<br />

demand for Long Range business jets. The combined aircraft value for<br />

new deliveries from Bombardier and Gulfstream amounted to USD$610<br />

million. The Global 7500 is expected to challenge the G650ER’s market<br />

leading position, as the Bombardier jet offered a more spacious cabin with<br />

an extra two meters in length, as well as generous amenities like a standup<br />

shower and ergonomic seating branded “The Nuage.”<br />

Bombardier and Gulfstream led the major OEMs in pre-owned additions,<br />

accounting for 22% of total pre-owned additions, respectively. Corporate<br />

Airliners from Airbus and Boeing collectively contributed over USD$654.8<br />

million in pre-owned aircraft value, the highest among all size categories.<br />

The most popular pre-owned Gulfstream models added to the fleet<br />

include the G200, G550, GIV/GIV SP. Embraer added nine pre-owned jets<br />

to its <strong>MENA</strong> jet fleet, including six Legacy 600 jets, totaling more than<br />

USD$ 83.9 million in aircraft value. The Legacy 600 had the most preowned<br />

additions added to the <strong>MENA</strong>’s fleet.<br />

TOP MODELS IN <strong>2022</strong><br />

New Deliveries<br />

3 3<br />

Global<br />

7500<br />

G650ER<br />

Pre-Owned Additions<br />

6<br />

Legacy<br />

600<br />

Deductions<br />

3<br />

5<br />

BBJ1<br />

4<br />

G IV/<br />

GIV-SP/<br />

G400<br />

2<br />

G600<br />

1<br />

<strong>2022</strong><br />

Global<br />

6500<br />

3 3 3<br />

Global<br />

7500<br />

G550<br />

<strong>2022</strong><br />

G200<br />

<strong>2022</strong><br />

2 2 2 2 2 2 2 2<br />

Gulfstream and Bombardier contributed 26 pre-owned aircraft to the<br />

fleet, for a combined value of USD$620.1 million. The 13 additions from<br />

Bombardier contributed the second largest share among the major<br />

OEMs at USD$385.9 million, or almost 26% of the total pre-owned value.<br />

Hawker<br />

800/XP<br />

Boeing<br />

707<br />

Legacy<br />

600<br />

Boeing<br />

737<br />

Global<br />

Express<br />

XRS<br />

Citation<br />

500/501<br />

(I/ISP)<br />

Lineage<br />

1000<br />

Falcon<br />

900<br />

G450<br />

16 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

100+80<br />

91+91+63+63+35+28+28+7+7<br />

96+96+84+72+60+48+12<br />

MARKET TRENDS<br />

Corporate Airliner OEM Boeing contributed the highest share in pre-owned<br />

aircraft value at USD$450.9 million with nine aircraft, including five BBJ1s,<br />

which equated to just over 30% of the total value. Dassault contributed<br />

four aircraft worth USD$95.8 million, while Textron contributed five<br />

aircraft worth USD$16.3 million.<br />

Among the nations to take pre-owned deliveries, the United Arab Emirates<br />

took the largest share with 36 pre-owned aircraft, followed by Israel with<br />

eight. The average age of pre-owned aircraft added to the fleet is 15.4<br />

years, which was slightly older than the regional average.<br />

In <strong>2022</strong>, a total of 39 deductions from the <strong>MENA</strong> region were recorded,<br />

amounting to USD$453.7 million. Textron experienced the most<br />

reductions among the major OEMs, with eight aircraft leaving the fleet,<br />

three of which were Hawker 800/XPs, the highest number of departures<br />

among all aircraft models. The eight Textron aircraft amounted to a<br />

value of USD$20.9 million. Corporate Airliners saw the most deductions<br />

by size category with 11 aircraft departing, of which eight were from<br />

Boeing. The deductions among Corporate Airliners amounted to over<br />

USD$244.4 million.<br />

Embraer experienced the second highest net loss of aircraft in terms of<br />

value among its regional fleet among major OEMs, which amounted to<br />

USD$78.6 million with the departure of five aircraft, including models<br />

such as the Legacy 600 (two) and the Lineage 1000 (two). Six Dassault<br />

aircraft, including two Falcon 900s, left the region, which were valued at<br />

USD$45.8 million. Four Gulfstream jets worth USD$38.3 million, including<br />

two G450s, also departed from the <strong>MENA</strong> fleet.<br />

The average age of aircraft which left from the region stood at 22.9, which<br />

is almost eight years older than the regional average.<br />

BUSINESS JET MOVEMENTS 1,2<br />

FLEET SIZE (UNITS)<br />

FOR MORE INFORMATION ON JET MOVEMENTS, PLEASE REFER TO THE OEM OVERVIEW.<br />

New Deliveries<br />

AIRCRAFT VALUE (USD$M) 3<br />

5<br />

4<br />

GULFSTREAM<br />

BOMBARDIER<br />

94+80<br />

$281.0<br />

$329.4<br />

9<br />

TOTAL<br />

$610.4<br />

Pre-owned Additions<br />

13<br />

GULFSTREAM<br />

13<br />

9<br />

9<br />

FLEET SIZE (UNITS) AIRCRAFT VALUE (USD$M) 3<br />

BOMBARDIER<br />

5<br />

4<br />

4<br />

1<br />

1<br />

$234.2<br />

BOEING<br />

EMBRAER<br />

TEXTRON<br />

AIRBUS<br />

DASSAULT<br />

52+86+100+19+4+45+21+2+1<br />

$16.3<br />

$83.9<br />

$95.8<br />

$203.9<br />

BRITISH AEROSPACE<br />

MD<br />

$8.0<br />

$4.3<br />

59 TOTAL<br />

$1,483.2<br />

$385.9<br />

$450.9<br />

8<br />

8<br />

7<br />

6<br />

5<br />

4<br />

Deductions<br />

FLEET SIZE (UNITS) AIRCRAFT VALUE (USD$M) 3<br />

1<br />

TEXTRON<br />

BOEING<br />

BOMBARDIER<br />

DASSAULT<br />

EMBRAER<br />

GULFSTREAM<br />

AIRBUS<br />

39 TOTAL<br />

$453.7<br />

12+95+37+25+44+21+18<br />

NOTE : 1. Pre-owned Additions and Deductions do not necessary indicate aircraft transactions. They also include aircraft that have changed their base region,<br />

returned to use, or retired. Intra-<strong>MENA</strong> movements are also excluded. 2. OEMs that had no business jet movement in <strong>2022</strong> were not listed in the table. 3. Aircraft<br />

Value is sourced from third party valuation sources and Global Sky Media research, which are based on the aircraft’s year of manufacture, with assumptions of<br />

standard equipment, configuration and average yearly utilization.<br />

$20.9<br />

$45.8<br />

$38.3<br />

$33.0<br />

$65.6<br />

$78.6<br />

$171.5<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 17

MARKET UPDATES<br />

OPERATOR OVERVIEW<br />

The top 20 <strong>MENA</strong>-based operators accounted for 38% of the<br />

regional fleet, with a total of 158 business jets. The United Arab<br />

Emirates was home to 38% of the region’s operators. Qatar<br />

Executive was the largest operator, with 19 aircraft in <strong>2022</strong>.<br />

The operator had the youngest fleet age at 4.4 years, over ten<br />

years younger than the regional average. The operator also had<br />

the greatest proportion of Gulfstream jets among the top ten<br />

operators, with 15 jets.<br />

Based in Abu Dhabi, Royal Jet was the second largest operator,<br />

with 11 aircraft, and had the greatest proportion of Corporate<br />

Airliners among other operators with a fleet of nine BBJ1s. Jet<br />

Aviation was the third largest operator. NAS Private Aviation had<br />

a fleet of nine jets and the largest proportion of Large category<br />

aircraft among the top ten operators with five in the fleet. Sky<br />

Prime Aviation retained a fleet of nine aircraft, with the majority<br />

being Large Jets and Corporate Airliners. Both Empire Aviation<br />

and DC Aviation also completed the year with nine aircraft in<br />

their respective fleets. DC Aviation had the greatest proportion<br />

of Bombardier jets in its fleet alongside Jet Aviation, with both<br />

operators each having seven Bombardier aircraft.<br />

TOP 20 OPERATORS BY FLEET SIZE 1,2<br />

QATAR EXECUTIVE<br />

ROYAL JET<br />

JET AVIATION<br />

NAS PRIVATE AVIATION<br />

SKY PRIME AVIATION<br />

DC AVIATION<br />

EMPIRE AVIATION<br />

ARAB WINGS<br />

EXECUJET MIDDLE EAST<br />

DUBAI AIR WING<br />

ALPHA STAR AVIATION<br />

ARROW AVIATION<br />

HYPERION AVIATION<br />

AVIATION HOUSE INVESTMENTS<br />

ROYAL FLIGHT OF OMAN<br />

19<br />

11<br />

10<br />

9<br />

9<br />

9<br />

9<br />

8<br />

8<br />

7<br />

6<br />

6<br />

5<br />

5<br />

5<br />

TOP 10 OPERATORS<br />

The top ten operators had a concentrated distribution of aircraft<br />

across three main countries, accounting for 36% of all aircraft<br />

located within the United Arab Emirates (43), Saudi Arabia (24),<br />

and Qatar (20).<br />

SMART AVIATION<br />

EMIRATES FLIGHT TRAINING ACADEMY<br />

KUWAIT AIRWAYS<br />

GAMA AVIATION<br />

BLUE SQUARE AVIATION<br />

5<br />

5<br />

5<br />

5<br />

4<br />

TOP 20<br />

OPERATORS =<br />

38% OF<br />

TOTAL FLEET<br />

AIR OCEAN MAROC<br />

4<br />

NOTE:<br />

1. Special mission and government operators are not included.<br />

2. Operators under the same corporate group and using the same brand<br />

name are grouped together.<br />

GULF WINGS<br />

4<br />

18 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT

OPERATOR OVERVIEW<br />

TOP OPERATORS’ FLEET BY SIZE CATEGORY<br />

Corp. Airliner Long Range Large<br />

Medium Light Very Light<br />

0 4 8 12 16 20<br />

QATAR EXECUTIVE<br />

1<br />

18<br />

ROYAL JET<br />

9<br />

2<br />

JET AVIATION<br />

1<br />

8<br />

1<br />

DC AVIATION<br />

6<br />

2<br />

1<br />

NAS PRIVATE AVIATION<br />

3<br />

5<br />

1<br />

EMPIRE AVIATION<br />

5 3<br />

1<br />

SKY PRIME AVIATION<br />

4<br />

1<br />

4<br />

ARAB WINGS<br />

2<br />

4<br />

2<br />

EXECUJET MIDDLE EAST<br />

1<br />

4<br />

3<br />

DUBAI AIR WING<br />

7<br />

Long Range aircraft were the most common size category among the<br />

top ten operators, accounting for nearly 44% of their fleets. Of the 44<br />

Long Range aircraft, 18 were operated by Qatar Executive. Notably, Long<br />

Range aircraft accounted for 80% of Jet Aviation’s fleet and two-thirds<br />

of DC Aviation’s fleet. Corporate Airliners occupied a 28% market share,<br />

with 57% of the aircraft operated by Royal Jet and the Dubai Air Wing.<br />

Royal Jet had the most concentrated fleet of the Corporate Airliners, with<br />

nine BBJ1s. Two out of the top ten operators did not have any Corporate<br />

Airliners in their fleets, namely DC Aviation and Empire Aviation. Large<br />

category aircraft constituted a 22% market share and were part of seven<br />

different fleets among the top ten operators. NAS Private Aviation had the<br />

largest share of this category (five), followed by Sky Prime Aviation (four)<br />

and Arab Wings (four), where NAS Private Aviation was the only operator<br />

among the top ten to have a Light Jet in its fleet. Only three operators<br />

have Medium Jets in their fleets: DC Aviation, Empire Aviation, and Arab<br />

Wings. There were only four Medium Jets among the top ten operators.<br />

TOP OPERATORS’ FLEET BY OEM<br />

Airbus Boeing Bombardier<br />

Dassault Embraer Gulfstream Textron<br />

0 4 8 12 16 20<br />

QATAR EXECUTIVE<br />

1<br />

3<br />

15<br />

ROYAL JET<br />

9<br />

2<br />

JET AVIATION<br />

1<br />

7<br />

1<br />

1<br />

DC AVIATION<br />

7<br />

2<br />

NAS PRIVATE AVIATION<br />

2<br />

1 1 1 1 2 1<br />

EMPIRE AVIATION<br />

2 3 3<br />

1<br />

SKY PRIME AVIATION<br />

3<br />

1<br />

5<br />

ARAB WINGS<br />

1<br />

2<br />

3<br />

2<br />

EXECUJET MIDDLE EAST<br />

4<br />

2 2<br />

DUBAI AIR WING<br />

7<br />

Bombardier was the most popular OEM among the operator fleet, with<br />

28% of the market share among the top ten operators. Jet Aviation and<br />

DC Aviation had the most Bombardier aircraft, with seven units each,<br />

followed by ExecuJet Middle East with four. Gulfstream followed closely<br />

with a 26% market share, of which 15 Gulfstream jets were operated<br />

by Qatar Executive. The G650ER was the single most popular model<br />

within an operating fleet. Sky Prime Aviation was also noted for its<br />

five Gulfstream models, which made up over 55% of its operating fleet.<br />

Boeing had the largest share of Corporate Airliners among the top ten<br />

operators at just under 72%, with a total of 20 aircraft compared to six<br />

from Airbus. Royal Jet operated the most Boeing aircraft with nine in its<br />

fleet, followed by Dubai Air Wing with seven, which happened to be its<br />

entire operating fleet. Sky Prime Aviation had the most Airbus jets in its<br />

fleet, with three aircraft. Textron had the fewest business jets among the<br />

top ten operators, with just four aircraft in total.<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 19

Global Sky News<br />

Stay informed with your weekly roundup<br />

of all the biggest aviation news delivered<br />

straight to your inbox. Sign up to Global<br />

Sky News for curated stories in business<br />

aviation, general aviation, helicopters<br />

and advanced air mobility.<br />

SCAN TO<br />

SIGN UP<br />

20 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT<br />

www.globalsky.media/newsletter-sign-up

UNLEASH<br />

THE POWER<br />

OF DATA<br />

The MedAire360 Portal gives you access to near<br />

real-time threat info and intelligence in one<br />

easy-to-use interface. Map-based risk analysis,<br />

including flight level risk, weaponry range and<br />

risk, and civil aviation warnings - the information<br />

needed to make informed decisions.<br />

EXPERT CARE, EVERYWHERE.<br />

WWW.MEDAIRE.COM/360<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 21

AIRCRAFT REGRISTRY OVERVIEW<br />

MARKET UPDATES<br />

AIRCRAFT REGISTRY OVERVIEW<br />

Registration within a chosen jurisdiction determines the legal parameters over the operational allowances and<br />

certification requirements imposed upon registered aircraft, in addition to defining legal guidance over asset<br />

management and support from the local Civil Aviation Authority (CAA).<br />

NET FLEET GROWTH BY REGISTRY<br />

400<br />

390<br />

419<br />

UNITED STATES<br />

N<br />

ISLE OF MAN<br />

M-<br />

CAYMAN ISLANDS<br />

VP-C<br />

2020 1<br />

2021 1<br />

<strong>2022</strong><br />

22 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT<br />

0+0+12 0+11+0 12+0+0 0+0+10 0+10+0 4+0+0 0+0+6 0+8+0 9+0+0 0+0+7 0+8+0 8+0+0 0+0+7 0+7+0 10+0+0 0+0+7 0+7+0 6+0+0 0+0+7 0+7+0 9+0+0 0+0+42 0+32+0 33+0+0<br />

0+0+51 0+53+0 56+0+0 0+0+49 0+44+0 52+0+0 0+0+47 0+39+0 34+0+0 0+0+33 0+37+0 41+0+0 0+0+33 0+31+0 34+0+0 0+0+32 0+29+0 28+0+0 0+0+29 0+25+0 24+0+0 0+0+18 0+23+0 24+0+0 0+0+16 0+15+0 15+0+0 0+0+13 0+4+0 1+0+0<br />

56<br />

53<br />

51<br />

52<br />

44<br />

49<br />

34<br />

39<br />

47<br />

41<br />

37<br />

33<br />

34<br />

31<br />

33<br />

28<br />

29<br />

32<br />

24<br />

25<br />

29<br />

24<br />

23<br />

18<br />

15<br />

15<br />

16<br />

1<br />

4<br />

13<br />

NOTE:<br />

1. 2020 and 2021 data is based on JETNET LLC.<br />

BERMUDA<br />

VP-B/VQ-B<br />

UNITED ARAB EMIRATES<br />

A6-<br />

SAN MARINO<br />

T7-<br />

SAUDI ARABIA<br />

HZ-<br />

QATAR<br />

A7-<br />

MOROCCO<br />

CN-<br />

EGYPT<br />

SU-<br />

MALTA<br />

9H-<br />

ISRAEL<br />

4X-<br />

ALGERIA<br />

7T-<br />

IRAN<br />

EP-<br />

LIBYA<br />

5A-<br />

ARUBA<br />

P4-<br />

KUWAIT<br />

9K-<br />

OTHERS<br />

12<br />

11<br />

12<br />

4<br />

10<br />

10<br />

9<br />

8<br />

6<br />

8<br />

8<br />

7<br />

10<br />

7<br />

7<br />

6<br />

7<br />

7<br />

9<br />

7<br />

7<br />

33<br />

32<br />

42<br />

The United Arab Emirates (A6-) retained its position<br />

as the most popular aircraft registration in the<br />

region, with a market share of 12%. Among the<br />

business jet fleet based within the UAE, around<br />

40% are under the A6- registration. The number<br />

of registrations has fallen consecutively over the<br />

past two years, but with a favourable business<br />

environment, especially for foreign companies<br />

setting up operations within the UAE, the UAE<br />

registry remains an attractive proposition for<br />

stationing business jets in the UAE.<br />

Saudi Arabia (HZ-) had a similar proportion of<br />

domestically registered aircraft in its fleet to the<br />

UAE, at 40%; however, the count of registrations<br />

had likewise witnessed a continuous drop, and<br />

most recently, four aircraft were deregistered from<br />

Saudi Arabia in <strong>2022</strong>. The proportion of aircraft<br />

in the fleet with registrations from the United<br />

States and offshore jurisdictions has been steadily<br />

increasing, with both types of registrations now<br />

accounting for over 57% of registered aircraft in the<br />

Kingdom. Offshore registries now account for 35%<br />

of its registered aircraft, including 19 aircraft with<br />

the Cayman Islands (VP-C). The Caribbean based<br />

registration held the greatest number of registrations<br />

outside of the local jurisdiction, exceeding the<br />

number of US registrations in the fleet.<br />

Having dropped by eight aircraft in 2021, the United<br />

States registry (N) rebounded with five registrations<br />

to a total of 49 registrations in the <strong>MENA</strong> region and<br />

stood as the second most popular registration with<br />

a share of 11% of all registrations currently based<br />

in the region. Kuwait had the highest proportion<br />

of aircraft registered in the US, at just under 27%,

AIRCRAFT REGISTRY OVERVIEW<br />

REGISTRY COMPOSITION<br />

Local United States Offshore 1<br />

Others 2<br />

TOTAL<br />

FLEET<br />

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

UNITED ARAB EMIRATES<br />

128<br />

40% 7%<br />

46%<br />

7%<br />

SAUDI ARABIA<br />

82<br />

40%<br />

22%<br />

35%<br />

2%<br />

ISRAEL<br />

51<br />

24%<br />

16% 53% 8%<br />

QATAR<br />

33<br />

85%<br />

6%<br />

6%<br />

3%<br />

BASE COUNTRY/REGION<br />

EGYPT<br />

MOROCCO<br />

KUWAIT<br />

JORDAN<br />

ALGERIA<br />

24<br />

20<br />

15<br />

11<br />

11<br />

27%<br />

47%<br />

63%<br />

13%<br />

21%<br />

90%<br />

27% 20%<br />

9% 45%<br />

91%<br />

18%<br />

4%<br />

10%<br />

7%<br />

9%<br />

LEBANON<br />

9<br />

56%<br />

33%<br />

11%<br />

OMAN<br />

8<br />

38%<br />

38%<br />

25%<br />

IRAN<br />

7<br />

86%<br />

14%<br />

LIBYA<br />

7<br />

100%<br />

NOTE:<br />

1. Offshore Registrations include: Aruba, Bermuda, Cayman Islands, Guernsey, Isle of Man, Malta and San Marino.<br />

2. Others indicates any registration besides Local, US and Offshore.<br />

while Saudi Arabia had 22% of its aircraft registered in the<br />

United States.<br />

The strong legal and authoritative oversight provided by the US<br />

government based Federal Aviation Administration (FAA) remains<br />

a foundational pillar for business jet owners operating their<br />

aircraft in the <strong>MENA</strong> region. Registered owners stand to benefit<br />

from stable aircraft residual values and appropriately enforced<br />

legal counsel over the registration rights and security interests<br />

over their assets, drawing from the FAA’s vast experience and<br />

renowned excellence over the maintenance and operation of<br />

their registered aircraft around the world. The FAA provides<br />

well defined compliance processes and ensures aircraft safety<br />

by providing the Notice Criteria Tool (NCT) and authorizing<br />

airworthiness certification both within the FAA (through<br />

authorized Air Carrier Operating Certificates) and in partnership<br />

with the US Department of Transportation for domestic use.<br />

The Department of Transport also provides legal oversight and<br />

remediation over the transfer and sale of aircraft, especially<br />

protecting owners from unlawful and unethical trading practices.<br />

Combined with an efficient and digitalized documentation and<br />

filing process, the United States registration has proven to ensure<br />

the security and satisfaction of customer interests end-to-end<br />

throughout the registration agreement.<br />

The domestic registrations that saw positive growth in <strong>2022</strong><br />

include Qatar, Egypt, and Israel. With four additional registrations<br />

completed during the year, over 85% of the Qatari business jet<br />

fleet was registered locally, representing one of the highest<br />

proportions of domestic registrations alongside other <strong>MENA</strong><br />

countries such as Iran, Morocco, and Algeria. Both Egypt (SU-)<br />

and Israel (4X-) added one locally registered aircraft to their<br />

respective fleets.<br />

In contrast, countries that saw net reductions in their<br />

domestically registered fleet of aircraft include Morocco, Iran,<br />

and Libya. Among the <strong>MENA</strong> countries that saw fleet reductions,<br />

Morocco saw the most de-registrations from its CN- registry,<br />

with five aircraft having left the country during the year. Despite<br />

the reductions, Morocco retained a high proportion of domestic<br />

registrations, with 90% of its fleet carrying the CN- registration.<br />

This could be partly explained by the strong presence of Light<br />

and Very Light Jets (a total of seven aircraft).<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 23

AIRCRAFT REGRISTRY OVERVIEW<br />

OFFSHORE REGISTRY<br />

OFFSHORE REGISTRY MARKET SHARE<br />

By Country/Region<br />

By Size Category<br />

Aruba P4-, 7 (5%)<br />