You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EXECUTIVE SUMMARY<br />

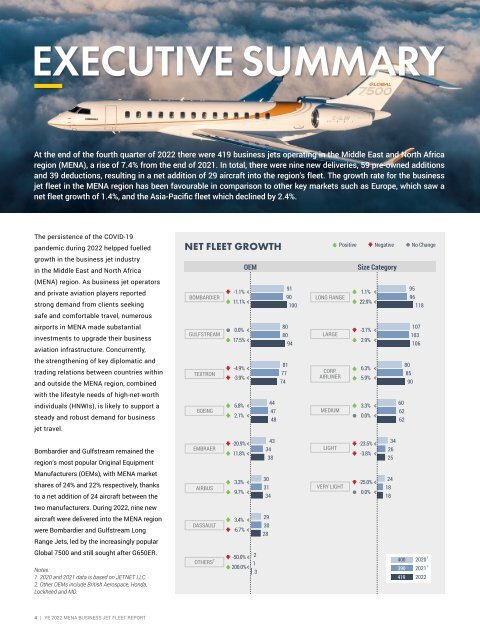

At the end of the fourth quarter of <strong>2022</strong> there were 419 business jets operating in the Middle East and North Africa<br />

region (<strong>MENA</strong>), a rise of 7.4% from the end of 2021. In total, there were nine new deliveries, 59 pre-owned additions<br />

and 39 deductions, resulting in a net addition of 29 aircraft into the region’s fleet. The growth rate for the business<br />

jet fleet in the <strong>MENA</strong> region has been favourable in comparison to other key markets such as Europe, which saw a<br />

net fleet growth of 1.4%, and the Asia-Pacific fleet which declined by 2.4%.<br />

The persistence of the COVID-19<br />

pandemic during <strong>2022</strong> helpped fuelled<br />

growth in the business jet industry<br />

in the Middle East and North Africa<br />

(<strong>MENA</strong>) region. As business jet operators<br />

and private aviation players reported<br />

strong demand from clients seeking<br />

safe and comfortable travel, numerous<br />

airports in <strong>MENA</strong> made substantial<br />

investments to upgrade their business<br />

aviation infrastructure. Concurrently,<br />

the strengthening of key diplomatic and<br />

trading relations between countries within<br />

and outside the <strong>MENA</strong> region, combined<br />

with the lifestyle needs of high-net-worth<br />

individuals (HNWIs), is likely to support a<br />

steady and robust demand for business<br />

jet travel.<br />

NET FLEET GROWTH<br />

Positive Negative No Change<br />

BOMBARDIER<br />

GULFSTREAM<br />

TEXTRON<br />

BOEING<br />

-1.1%<br />

11.1%<br />

0.0%<br />

17.5%<br />

-4.9%<br />

-3.9%<br />

6.8%<br />

2.1%<br />

OEM<br />

44<br />

47<br />

48<br />

80<br />

80<br />

81<br />

77<br />

74<br />

91<br />

90<br />

100<br />

94<br />

LONG RANGE<br />

LARGE<br />

CORP.<br />

AIRLINER<br />

MEDIUM<br />

Size Category<br />

1.1%<br />

22.9%<br />

-3.7%<br />

2.9%<br />

6.3%<br />

5.9%<br />

3.3%<br />

0.0%<br />

60<br />

62<br />

62<br />

80<br />

85<br />

95<br />

96<br />

90<br />

107<br />

103<br />

118<br />

106<br />

Bombardier and Gulfstream remained the<br />

region’s most popular Original Equipment<br />

EMBRAER<br />

-20.9%<br />

11.8%<br />

43<br />

34<br />

38<br />

LIGHT<br />

-23.5%<br />

-3.8%<br />

34<br />

26<br />

25<br />

Manufacturers (OEMs), with <strong>MENA</strong> market<br />

shares of 24% and 22% respectively, thanks<br />

to a net addition of 24 aircraft between the<br />

AIRBUS<br />

3.3%<br />

9.7%<br />

30<br />

31<br />

34<br />

VERY LIGHT<br />

-25.0%<br />

0.0%<br />

24<br />

18<br />

18<br />

two manufacturers. During <strong>2022</strong>, nine new<br />

aircraft were delivered into the <strong>MENA</strong> region<br />

were Bombardier and Gulfstream Long<br />

Range Jets, led by the increasingly popular<br />

DASSAULT<br />

3.4%<br />

-6.7%<br />

29<br />

30<br />

28<br />

Global 7500 and still sought after G650ER.<br />

Notes:<br />

1. 2020 and 2021 data is based on JETNET LLC.<br />

2. Other OEMs include British Aerospace, Honda,<br />

Lockheed and MD.<br />

OTHERS 2<br />

-50.0%<br />

200.0%<br />

2<br />

1<br />

3<br />

400<br />

390<br />

419<br />

2020 1<br />

2021 1<br />

<strong>2022</strong><br />

4 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT