You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OPERATOR OVERVIEW<br />

TOP OPERATORS’ FLEET BY SIZE CATEGORY<br />

Corp. Airliner Long Range Large<br />

Medium Light Very Light<br />

0 4 8 12 16 20<br />

QATAR EXECUTIVE<br />

1<br />

18<br />

ROYAL JET<br />

9<br />

2<br />

JET AVIATION<br />

1<br />

8<br />

1<br />

DC AVIATION<br />

6<br />

2<br />

1<br />

NAS PRIVATE AVIATION<br />

3<br />

5<br />

1<br />

EMPIRE AVIATION<br />

5 3<br />

1<br />

SKY PRIME AVIATION<br />

4<br />

1<br />

4<br />

ARAB WINGS<br />

2<br />

4<br />

2<br />

EXECUJET MIDDLE EAST<br />

1<br />

4<br />

3<br />

DUBAI AIR WING<br />

7<br />

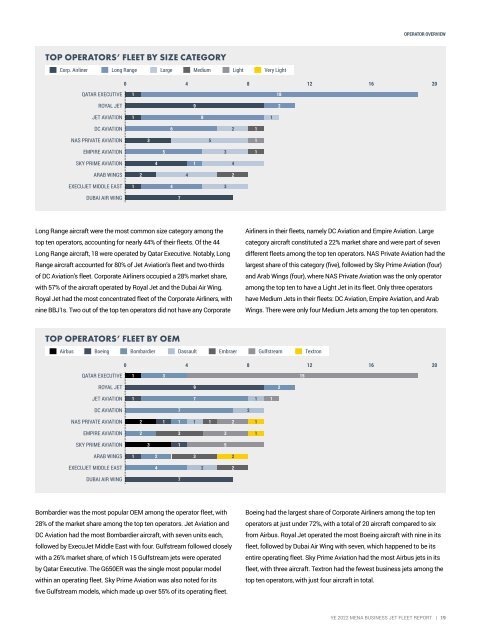

Long Range aircraft were the most common size category among the<br />

top ten operators, accounting for nearly 44% of their fleets. Of the 44<br />

Long Range aircraft, 18 were operated by Qatar Executive. Notably, Long<br />

Range aircraft accounted for 80% of Jet Aviation’s fleet and two-thirds<br />

of DC Aviation’s fleet. Corporate Airliners occupied a 28% market share,<br />

with 57% of the aircraft operated by Royal Jet and the Dubai Air Wing.<br />

Royal Jet had the most concentrated fleet of the Corporate Airliners, with<br />

nine BBJ1s. Two out of the top ten operators did not have any Corporate<br />

Airliners in their fleets, namely DC Aviation and Empire Aviation. Large<br />

category aircraft constituted a 22% market share and were part of seven<br />

different fleets among the top ten operators. NAS Private Aviation had the<br />

largest share of this category (five), followed by Sky Prime Aviation (four)<br />

and Arab Wings (four), where NAS Private Aviation was the only operator<br />

among the top ten to have a Light Jet in its fleet. Only three operators<br />

have Medium Jets in their fleets: DC Aviation, Empire Aviation, and Arab<br />

Wings. There were only four Medium Jets among the top ten operators.<br />

TOP OPERATORS’ FLEET BY OEM<br />

Airbus Boeing Bombardier<br />

Dassault Embraer Gulfstream Textron<br />

0 4 8 12 16 20<br />

QATAR EXECUTIVE<br />

1<br />

3<br />

15<br />

ROYAL JET<br />

9<br />

2<br />

JET AVIATION<br />

1<br />

7<br />

1<br />

1<br />

DC AVIATION<br />

7<br />

2<br />

NAS PRIVATE AVIATION<br />

2<br />

1 1 1 1 2 1<br />

EMPIRE AVIATION<br />

2 3 3<br />

1<br />

SKY PRIME AVIATION<br />

3<br />

1<br />

5<br />

ARAB WINGS<br />

1<br />

2<br />

3<br />

2<br />

EXECUJET MIDDLE EAST<br />

4<br />

2 2<br />

DUBAI AIR WING<br />

7<br />

Bombardier was the most popular OEM among the operator fleet, with<br />

28% of the market share among the top ten operators. Jet Aviation and<br />

DC Aviation had the most Bombardier aircraft, with seven units each,<br />

followed by ExecuJet Middle East with four. Gulfstream followed closely<br />

with a 26% market share, of which 15 Gulfstream jets were operated<br />

by Qatar Executive. The G650ER was the single most popular model<br />

within an operating fleet. Sky Prime Aviation was also noted for its<br />

five Gulfstream models, which made up over 55% of its operating fleet.<br />

Boeing had the largest share of Corporate Airliners among the top ten<br />

operators at just under 72%, with a total of 20 aircraft compared to six<br />

from Airbus. Royal Jet operated the most Boeing aircraft with nine in its<br />

fleet, followed by Dubai Air Wing with seven, which happened to be its<br />

entire operating fleet. Sky Prime Aviation had the most Airbus jets in its<br />

fleet, with three aircraft. Textron had the fewest business jets among the<br />

top ten operators, with just four aircraft in total.<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 19