You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

REGIONAL OVERVIEW<br />

At the end of <strong>2022</strong>, the total fleet in the region stood at 419<br />

business jets. The Middle East recorded the highest growth<br />

rate as a sub-region with the net addition of 32 aircraft, having<br />

seen its fleet reduced by 15 aircraft during the previous year.<br />

Of the 67 additions to the Middle East, 16 were Corporate<br />

Airliners. A total of 35 business jets left the Middle East<br />

during <strong>2022</strong>.<br />

Northern Africa saw a net reduction of three aircraft,<br />

having added two units to its fleet in <strong>2022</strong>, which was<br />

offset by the departure of five aircraft. The United Arab<br />

Emirates (UAE) saw the greatest fleet growth in the<br />

region, with 27 aircraft added, the majority of which were<br />

Corporate Airliners (eight) and Long Range Jets (13).<br />

Countries such as Israel, Qatar and Egypt each increased<br />

their fleets by three to seven aircraft.<br />

Saudi Arabia and Morocco, the countries which the most net<br />

deduction in <strong>2022</strong>, have seen consistent reductions in their<br />

fleets since 2019.<br />

Saudi Arabia, for instance, was projected to lose around<br />

600 HNWIs in <strong>2022</strong>, with a portion of that number migrating<br />

to the UAE, thereby potentially transferring business<br />

jet operations over to the Emirates. An anti-corruption<br />

campaign instigated by the Crown Prince over a two-year<br />

period (2017 - 2019) would have undoubtedly eroded trust<br />

and assurances in holding valuable assets and business<br />

interests within the Kingdom.<br />

Another important factor that had potentially shifted the<br />

momentum of business jet growth to the UAE in recent years<br />

was its diverse economy and less restrictive regulations<br />

for allowing multinational corporations to operate within<br />

the Emirates. In contrast to Saudi Arabia, where foreign<br />

companies operating without a local headquarters were<br />

subject to stringent regulations, the UAE had distinct<br />

advantages in attracting foreign investment and continuing<br />

to improve its infrastructure to support its thriving economy.<br />

It was, however, premature to predict that the Saudi<br />

business jet market will continue to decline. <strong>Business</strong><br />

initiatives such as Vision 2030 strived to make it easier for<br />

multinational companies to base their headquarters locally,<br />

thereby encouraging diversification for its economy and<br />

broadening its potential beyond oil resources. Expansion<br />

of aviation infrastructure had been taking place in projects<br />

across Riyadh and Jeddah to allow for more charter and<br />

private jet operations.<br />

Morocco’s business jet fleet steadily declined from 26 aircraft<br />

in 2019 to 20 in <strong>2022</strong>. The COVID-19 pandemic resulted in a<br />

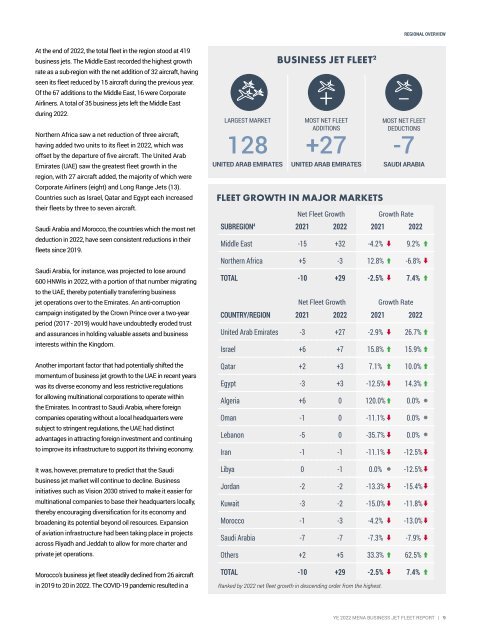

LARGEST MARKET<br />

128<br />

UNITED ARAB EMIRATES<br />

BUSINESS JET FLEET 2<br />

MOST NET FLEET<br />

ADDITIONS<br />

+27<br />

UNITED ARAB EMIRATES<br />

FLEET GROWTH IN MAJOR MARKETS<br />

Net <strong>Fleet</strong> Growth<br />

Ranked by <strong>2022</strong> net fleet growth in descending order from the highest.<br />

MOST NET FLEET<br />

DEDUCTIONS<br />

-7<br />

SAUDI ARABIA<br />

SUBREGION 4 2021 <strong>2022</strong> 2021 <strong>2022</strong><br />

Middle East -15 +32 -4.2% 9.2%<br />

Northern Africa +5 -3 12.8% -6.8%<br />

TOTAL -10 +29 -2.5% 7.4%<br />

Net <strong>Fleet</strong> Growth<br />

Growth Rate<br />

Growth Rate<br />

COUNTRY/REGION 2021 <strong>2022</strong> 2021 <strong>2022</strong><br />

United Arab Emirates -3 +27 -2.9% 26.7%<br />

Israel +6 +7 15.8% 15.9%<br />

Qatar +2 +3 7.1% 10.0%<br />

Egypt -3 +3 -12.5% 14.3%<br />

Algeria +6 0 120.0% 0.0%<br />

Oman -1 0 -11.1% 0.0%<br />

Lebanon -5 0 -35.7% 0.0%<br />

Iran -1 -1 -11.1% -12.5%<br />

Libya 0 -1 0.0% -12.5%<br />

Jordan -2 -2 -13.3% -15.4%<br />

Kuwait -3 -2 -15.0% -11.8%<br />

Morocco -1 -3 -4.2% -13.0%<br />

Saudi Arabia -7 -7 -7.3% -7.9%<br />

Others +2 +5 33.3% 62.5%<br />

TOTAL -10 +29 -2.5% 7.4%<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 9