You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AIRCRAFT REGRISTRY OVERVIEW<br />

OFFSHORE REGISTRY<br />

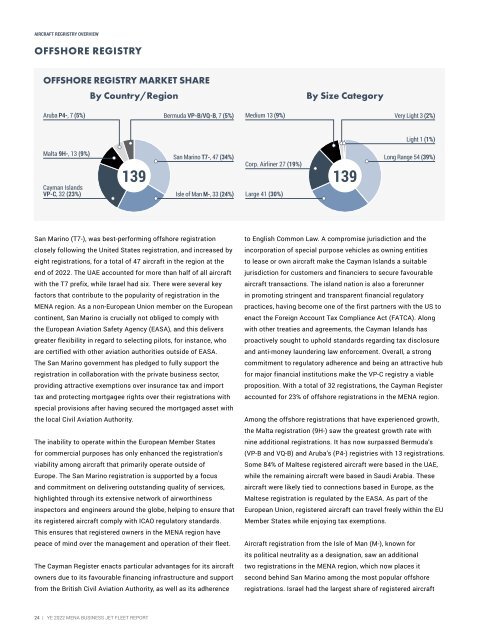

OFFSHORE REGISTRY MARKET SHARE<br />

By Country/Region<br />

By Size Category<br />

Aruba P4-, 7 (5%)<br />

Bermuda VP-B/VQ-B, 7 (5%)<br />

Medium 13 (9%)<br />

Very Light 3 (2%)<br />

Light 1 (1%)<br />

Malta 9H-, 13 (9%)<br />

139<br />

San Marino T7-, 47 (34%)<br />

Cayman Islands<br />

VP-C, 32 (23%) Isle of Man M-, 33 (24%)<br />

Corp. Airliner 27 (19%)<br />

Large 41 (30%)<br />

139<br />

Long Range 54 (39%)<br />

San Marino (T7-), was best-performing offshore registration<br />

closely following the United States registration, and increased by<br />

eight registrations, for a total of 47 aircraft in the region at the<br />

end of <strong>2022</strong>. The UAE accounted for more than half of all aircraft<br />

with the T7 prefix, while Israel had six. There were several key<br />

factors that contribute to the popularity of registration in the<br />

<strong>MENA</strong> region. As a non-European Union member on the European<br />

continent, San Marino is crucially not obliged to comply with<br />

the European Aviation Safety Agency (EASA), and this delivers<br />

greater flexibility in regard to selecting pilots, for instance, who<br />

are certified with other aviation authorities outside of EASA.<br />

The San Marino government has pledged to fully support the<br />

registration in collaboration with the private business sector,<br />

providing attractive exemptions over insurance tax and import<br />

tax and protecting mortgagee rights over their registrations with<br />

special provisions after having secured the mortgaged asset with<br />

the local Civil Aviation Authority.<br />

The inability to operate within the European Member States<br />

for commercial purposes has only enhanced the registration’s<br />

viability among aircraft that primarily operate outside of<br />

Europe. The San Marino registration is supported by a focus<br />

and commitment on delivering outstanding quality of services,<br />

highlighted through its extensive network of airworthiness<br />

inspectors and engineers around the globe, helping to ensure that<br />

its registered aircraft comply with ICAO regulatory standards.<br />

This ensures that registered owners in the <strong>MENA</strong> region have<br />

peace of mind over the management and operation of their fleet.<br />

The Cayman Register enacts particular advantages for its aircraft<br />

owners due to its favourable financing infrastructure and support<br />

from the British Civil Aviation Authority, as well as its adherence<br />

to English Common Law. A compromise jurisdiction and the<br />

incorporation of special purpose vehicles as owning entities<br />

to lease or own aircraft make the Cayman Islands a suitable<br />

jurisdiction for customers and financiers to secure favourable<br />

aircraft transactions. The island nation is also a forerunner<br />

in promoting stringent and transparent financial regulatory<br />

practices, having become one of the first partners with the US to<br />

enact the Foreign Account Tax Compliance Act (FATCA). Along<br />

with other treaties and agreements, the Cayman Islands has<br />

proactively sought to uphold standards regarding tax disclosure<br />

and anti-money laundering law enforcement. Overall, a strong<br />

commitment to regulatory adherence and being an attractive hub<br />

for major financial institutions make the VP-C registry a viable<br />

proposition. With a total of 32 registrations, the Cayman Register<br />

accounted for 23% of offshore registrations in the <strong>MENA</strong> region.<br />

Among the offshore registrations that have experienced growth,<br />

the Malta registration (9H-) saw the greatest growth rate with<br />

nine additional registrations. It has now surpassed Bermuda’s<br />

(VP-B and VQ-B) and Aruba’s (P4-) registries with 13 registrations.<br />

Some 84% of Maltese registered aircraft were based in the UAE,<br />

while the remaining aircraft were based in Saudi Arabia. These<br />

aircraft were likely tied to connections based in Europe, as the<br />

Maltese registration is regulated by the EASA. As part of the<br />

European Union, registered aircraft can travel freely within the EU<br />

Member States while enjoying tax exemptions.<br />

Aircraft registration from the Isle of Man (M-), known for<br />

its political neutrality as a designation, saw an additional<br />

two registrations in the <strong>MENA</strong> region, which now places it<br />

second behind San Marino among the most popular offshore<br />

registrations. Israel had the largest share of registered aircraft<br />

24 | <strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT