Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100+80<br />

91+91+63+63+35+28+28+7+7<br />

96+96+84+72+60+48+12<br />

MARKET TRENDS<br />

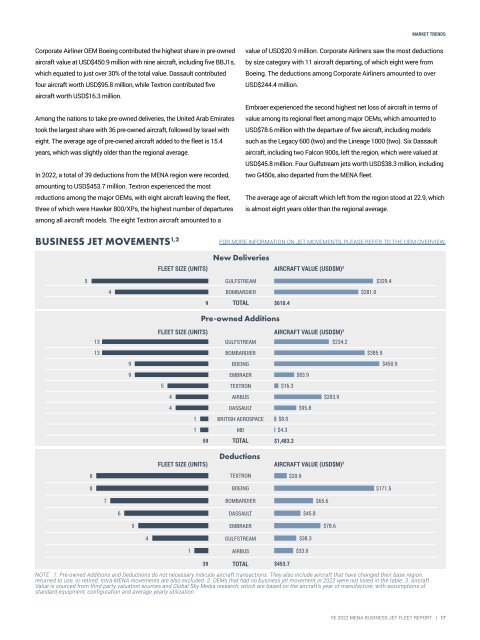

Corporate Airliner OEM Boeing contributed the highest share in pre-owned<br />

aircraft value at USD$450.9 million with nine aircraft, including five BBJ1s,<br />

which equated to just over 30% of the total value. Dassault contributed<br />

four aircraft worth USD$95.8 million, while Textron contributed five<br />

aircraft worth USD$16.3 million.<br />

Among the nations to take pre-owned deliveries, the United Arab Emirates<br />

took the largest share with 36 pre-owned aircraft, followed by Israel with<br />

eight. The average age of pre-owned aircraft added to the fleet is 15.4<br />

years, which was slightly older than the regional average.<br />

In <strong>2022</strong>, a total of 39 deductions from the <strong>MENA</strong> region were recorded,<br />

amounting to USD$453.7 million. Textron experienced the most<br />

reductions among the major OEMs, with eight aircraft leaving the fleet,<br />

three of which were Hawker 800/XPs, the highest number of departures<br />

among all aircraft models. The eight Textron aircraft amounted to a<br />

value of USD$20.9 million. Corporate Airliners saw the most deductions<br />

by size category with 11 aircraft departing, of which eight were from<br />

Boeing. The deductions among Corporate Airliners amounted to over<br />

USD$244.4 million.<br />

Embraer experienced the second highest net loss of aircraft in terms of<br />

value among its regional fleet among major OEMs, which amounted to<br />

USD$78.6 million with the departure of five aircraft, including models<br />

such as the Legacy 600 (two) and the Lineage 1000 (two). Six Dassault<br />

aircraft, including two Falcon 900s, left the region, which were valued at<br />

USD$45.8 million. Four Gulfstream jets worth USD$38.3 million, including<br />

two G450s, also departed from the <strong>MENA</strong> fleet.<br />

The average age of aircraft which left from the region stood at 22.9, which<br />

is almost eight years older than the regional average.<br />

BUSINESS JET MOVEMENTS 1,2<br />

FLEET SIZE (UNITS)<br />

FOR MORE INFORMATION ON JET MOVEMENTS, PLEASE REFER TO THE OEM OVERVIEW.<br />

New Deliveries<br />

AIRCRAFT VALUE (USD$M) 3<br />

5<br />

4<br />

GULFSTREAM<br />

BOMBARDIER<br />

94+80<br />

$281.0<br />

$329.4<br />

9<br />

TOTAL<br />

$610.4<br />

Pre-owned Additions<br />

13<br />

GULFSTREAM<br />

13<br />

9<br />

9<br />

FLEET SIZE (UNITS) AIRCRAFT VALUE (USD$M) 3<br />

BOMBARDIER<br />

5<br />

4<br />

4<br />

1<br />

1<br />

$234.2<br />

BOEING<br />

EMBRAER<br />

TEXTRON<br />

AIRBUS<br />

DASSAULT<br />

52+86+100+19+4+45+21+2+1<br />

$16.3<br />

$83.9<br />

$95.8<br />

$203.9<br />

BRITISH AEROSPACE<br />

MD<br />

$8.0<br />

$4.3<br />

59 TOTAL<br />

$1,483.2<br />

$385.9<br />

$450.9<br />

8<br />

8<br />

7<br />

6<br />

5<br />

4<br />

Deductions<br />

FLEET SIZE (UNITS) AIRCRAFT VALUE (USD$M) 3<br />

1<br />

TEXTRON<br />

BOEING<br />

BOMBARDIER<br />

DASSAULT<br />

EMBRAER<br />

GULFSTREAM<br />

AIRBUS<br />

39 TOTAL<br />

$453.7<br />

12+95+37+25+44+21+18<br />

NOTE : 1. Pre-owned Additions and Deductions do not necessary indicate aircraft transactions. They also include aircraft that have changed their base region,<br />

returned to use, or retired. Intra-<strong>MENA</strong> movements are also excluded. 2. OEMs that had no business jet movement in <strong>2022</strong> were not listed in the table. 3. Aircraft<br />

Value is sourced from third party valuation sources and Global Sky Media research, which are based on the aircraft’s year of manufacture, with assumptions of<br />

standard equipment, configuration and average yearly utilization.<br />

$20.9<br />

$45.8<br />

$38.3<br />

$33.0<br />

$65.6<br />

$78.6<br />

$171.5<br />

<strong>YE</strong> <strong>2022</strong> <strong>MENA</strong> BUSINESS JET FLEET REPORT | 17