Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LEASING MARKET<br />

LEASING MARKET<br />

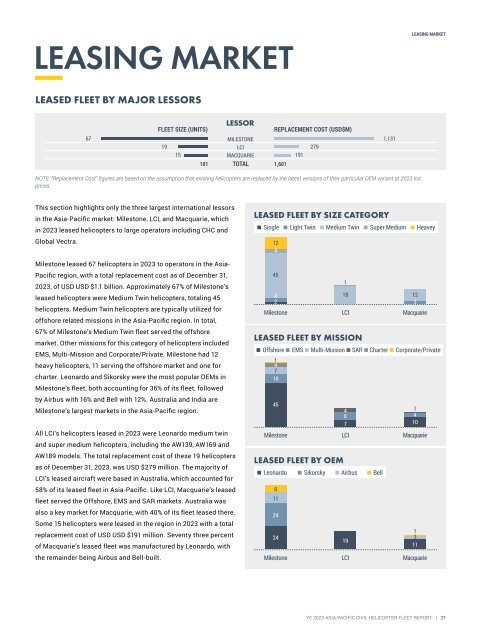

LEASED FLEET BY MAJOR LESSORS<br />

67<br />

FLEET SIZE (UNITS)<br />

19<br />

15<br />

LESSOR<br />

MILESTONE<br />

LCI<br />

MACQUARIE<br />

101 TOTAL 1,601<br />

REPLACEMENT COST (USD$M)<br />

191<br />

279<br />

1,131<br />

NOTE: “Replacement Cost” figures are based on the assumption that existing helicopters are replaced by the latest versions of their particular OEM variant at <strong>2023</strong> list<br />

prices.<br />

This section highlights only the three largest international lessors<br />

in the Asia-Pacific market: Milestone, LCI, and Macquarie, which<br />

in <strong>2023</strong> leased helicopters to large operators including CHC and<br />

Global Vectra.<br />

LEASED FLEET BY SIZE CATEGORY<br />

Single<br />

12<br />

4<br />

Light Twin<br />

Medium Twin<br />

Super Medium<br />

Heavey<br />

Milestone leased 67 helicopters in <strong>2023</strong> to operators in the Asia-<br />

Pacific region, with a total replacement cost as of December 31,<br />

<strong>2023</strong>, of USD USD $1.1 billion. Approximately 67% of Milestone’s<br />

leased helicopters were Medium Twin helicopters, totaling 45<br />

helicopters. Medium Twin helicopters are typically utilized for<br />

offshore related missions in the Asia-Pacific region. In total,<br />

45<br />

4 18<br />

2<br />

Milestone<br />

1<br />

LCI<br />

12<br />

3<br />

Macquarie<br />

67% of Milestone’s Medium Twin fleet served the offshore<br />

market. Other missions for this category of helicopters included<br />

EMS, Multi-Mission and Corporate/Private. Milestone had 12<br />

heavy helicopters, 11 serving the offshore market and one for<br />

charter. Leonardo and Sikorsky were the most popular OEMs in<br />

Milestone’s fleet, both accounting for 36% of its fleet, followed<br />

LEASED FLEET BY MISSION<br />

Offshore<br />

1<br />

4<br />

7<br />

10<br />

EMS<br />

Multi-Mission<br />

SAR<br />

Charter<br />

Corporate/Private<br />

by Airbus with 16% and Bell with 12%. Australia and India are<br />

Milestone’s largest markets in the Asia-Pacific region.<br />

All LCI’s helicopters leased in <strong>2023</strong> were Leonardo medium twin<br />

and super medium helicopters, including the AW139, AW169 and<br />

45<br />

Milestone<br />

4<br />

8<br />

7<br />

LCI<br />

1<br />

4<br />

10<br />

Macquarie<br />

AW189 models. The total replacement cost of these 19 helicopters<br />

as of December 31, <strong>2023</strong>, was USD $279 million. The majority of<br />

LCI’s leased aircraft were based in Australia, which accounted for<br />

LEASED FLEET BY OEM<br />

Leonardo<br />

Sikorsky<br />

Airbus<br />

Bell<br />

58% of its leased fleet in Asia-Pacific. Like LCI, Macquarie’s leased<br />

fleet served the Offshore, EMS and SAR markets. Australia was<br />

8<br />

11<br />

also a key market for Macquarie, with 40% of its fleet leased there.<br />

Some 15 helicopters were leased in the region in <strong>2023</strong> with a total<br />

replacement cost of USD USD $191 million. Seventy three percent<br />

of Macquarie’s leased fleet was manufactured by Leonardo, with<br />

24<br />

24<br />

19<br />

1<br />

3<br />

11<br />

the remainder being Airbus and Bell-built.<br />

Milestone<br />

LCI<br />

Macquarie<br />

<strong>YE</strong> <strong>2023</strong> ASIA-PACIFIC CIVIL HELICOPTER FLEET REPORT | 27