Cambodia Country Study Working Paper Series No. 44 ... - CDRI

Cambodia Country Study Working Paper Series No. 44 ... - CDRI

Cambodia Country Study Working Paper Series No. 44 ... - CDRI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

��������������������������������������������������������������������<br />

����������������������������������������������������������������������������������������������<br />

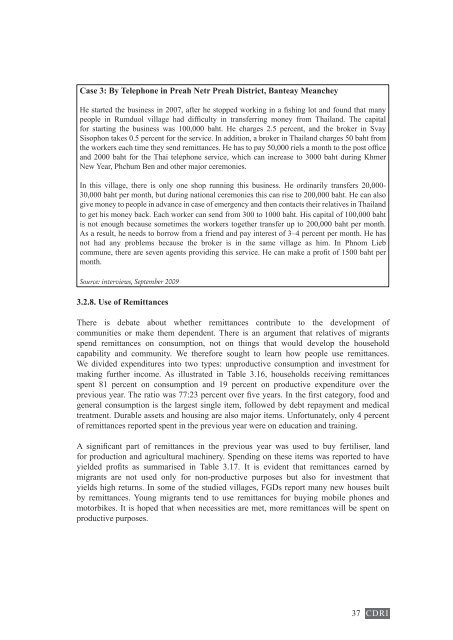

������� ��� �������� �������� ���� ���������� ��� ������������� ������ ����� ���������� ���� ��������<br />

for starting the business was 100,000 baht. He charges 2.5 percent, and the broker in Svay<br />

Sisophon takes 0.5 percent for the service. In addition, a broker in Thailand charges 50 baht from<br />

��������������������������������������������������������������������������������������������������<br />

and 2000 baht for the Thai telephone service, which can increase to 3000 baht during Khmer<br />

�������������������������������������������������<br />

In this village, there is only one shop running this business. He ordinarily transfers 20,000-<br />

30,000 baht per month, but during national ceremonies this can rise to 200,000 baht. He can also<br />

give money to people in advance in case of emergency and then contacts their relatives in Thailand<br />

to get his money back. Each worker can send from 300 to 1000 baht. His capital of 100,000 baht<br />

is not enough because sometimes the workers together transfer up to 200,000 baht per month.<br />

As a result, he needs to borrow from a friend and pay interest of 3–4 percent per month. He has<br />

not had any problems because the broker is in the same village as him. In Phnom Lieb<br />

���������������������������������������������������������������������������������������������<br />

month.<br />

Source: interviews, September 2009<br />

3.2.8. Use of Remittances<br />

There is debate about whether remittances contribute to the development of<br />

communities or make them dependent. There is an argument that relatives of migrants<br />

spend remittances on consumption, not on things that would develop the household<br />

capability and community. We therefore sought to learn how people use remittances.<br />

We divided expenditures into two types: unproductive consumption and investment for<br />

making further income. As illustrated in Table 3.16, households receiving remittances<br />

spent 81 percent on consumption and 19 percent on productive expenditure over the<br />

������������������������������������������������������������������������������������������<br />

general consumption is the largest single item, followed by debt repayment and medical<br />

������������������������������������������������������������������������������������������<br />

of remittances reported spent in the previous year were on education and training.<br />

�� ����������� ����� ��� ������������ ��� ���� ��������� ����� ���� ����� ��� ���� ������������ �����<br />

for production and agricultural machinery. Spending on these items was reported to have<br />

�������� ������� ��� ����������� ��� ������ ������ ��� ��� �������� ����� ������������ ������� ���<br />

migrants are not used only for non-productive purposes but also for investment that<br />

yields high returns. In some of the studied villages, FGDs report many new houses built<br />

by remittances. Young migrants tend to use remittances for buying mobile phones and<br />

motorbikes. It is hoped that when necessities are met, more remittances will be spent on<br />

productive purposes.<br />

37 <strong>CDRI</strong>