CHAPTER I Global Investment Trends

CHAPTER I Global Investment Trends

CHAPTER I Global Investment Trends

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

28<br />

World <strong>Investment</strong> Report 2011: Non-Equity Modes of International Production and Development<br />

closing stores in developed markets in Europe. 23<br />

General Electric (United States), the world’s largest<br />

TNC in terms of foreign assets, is also emblematic<br />

of this shift, having announced recently that it intends<br />

to intensify its focus on emerging markets –<br />

which account for 40 per cent of the firm’s industrial<br />

revenues – in order to reduce costs and increase<br />

revenue growth. 24<br />

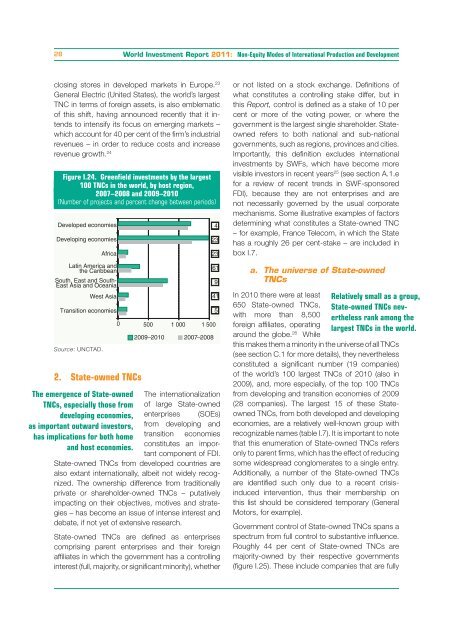

Figure I.24. Greenfield investments by the largest<br />

100 TNCs in the world, by host region,<br />

2007–2008 and 2009–2010<br />

(Number of projects and percent change between periods)<br />

Developed economies<br />

Developing economies<br />

Latin America and<br />

the Caribbean<br />

South, East and South-<br />

East Asia and Oceania<br />

Transition economies<br />

Source: UNCTAD.<br />

Africa<br />

West Asia<br />

2. State-owned TNCs<br />

The emergence of State-owned<br />

TNCs, especially those from<br />

developing economies,<br />

as important outward investors,<br />

has implications for both home<br />

and host economies.<br />

0 500 1 000 1 500<br />

2009–2010 2007–2008<br />

4<br />

23<br />

23<br />

61<br />

9<br />

41<br />

The internationalization<br />

of large State-owned<br />

enterprises (SOEs)<br />

from developing and<br />

transition economies<br />

constitutes an important<br />

component of FDI.<br />

State-owned TNCs from developed countries are<br />

also extant internationally, albeit not widely recognized.<br />

The ownership difference from traditionally<br />

private or shareholder-owned TNCs – putatively<br />

impacting on their objectives, motives and strategies<br />

– has become an issue of intense interest and<br />

debate, if not yet of extensive research.<br />

State-owned TNCs are defined as enterprises<br />

comprising parent enterprises and their foreign<br />

affiliates in which the government has a controlling<br />

interest (full, majority, or significant minority), whether<br />

5<br />

or not listed on a stock exchange. Definitions of<br />

what constitutes a controlling stake differ, but in<br />

this Report, control is defined as a stake of 10 per<br />

cent or more of the voting power, or where the<br />

government is the largest single shareholder. Stateowned<br />

refers to both national and sub-national<br />

governments, such as regions, provinces and cities.<br />

Importantly, this definition excludes international<br />

investments by SWFs, which have become more<br />

visible investors in recent years 25 (see section A.1.e<br />

for a review of recent trends in SWF-sponsored<br />

FDI), because they are not enterprises and are<br />

not necessarily governed by the usual corporate<br />

mechanisms. Some illustrative examples of factors<br />

determining what constitutes a State-owned TNC<br />

– for example, France Telecom, in which the State<br />

has a roughly 26 per cent-stake – are included in<br />

box I.7.<br />

a. The universe of State-owned<br />

TNCs<br />

In 2010 there were at least<br />

650 State-owned TNCs,<br />

with more than 8,500<br />

foreign affiliates, operating<br />

around the globe. 26 Relatively small as a group,<br />

State-owned TNCs nevertheless<br />

rank among the<br />

largest TNCs in the world.<br />

While<br />

this makes them a minority in the universe of all TNCs<br />

(see section C.1 for more details), they nevertheless<br />

constituted a significant number (19 companies)<br />

of the world’s 100 largest TNCs of 2010 (also in<br />

2009), and, more especially, of the top 100 TNCs<br />

from developing and transition economies of 2009<br />

(28 companies). The largest 15 of these Stateowned<br />

TNCs, from both developed and developing<br />

economies, are a relatively well-known group with<br />

recognizable names (table I.7). It is important to note<br />

that this enumeration of State-owned TNCs refers<br />

only to parent firms, which has the effect of reducing<br />

some widespread conglomerates to a single entry.<br />

Additionally, a number of the State-owned TNCs<br />

are identified such only due to a recent crisisinduced<br />

intervention, thus their membership on<br />

this list should be considered temporary (General<br />

Motors, for example).<br />

Government control of State-owned TNCs spans a<br />

spectrum from full control to substantive influence.<br />

Roughly 44 per cent of State-owned TNCs are<br />

majority-owned by their respective governments<br />

(figure I.25). These include companies that are fully