CHAPTER I Global Investment Trends

CHAPTER I Global Investment Trends

CHAPTER I Global Investment Trends

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CHAPTER</strong> I <strong>Global</strong> <strong>Investment</strong> <strong>Trends</strong> 33<br />

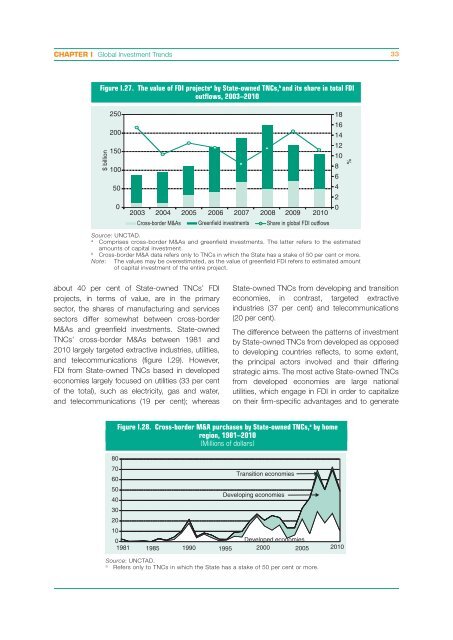

Figure I.27. The value of FDI projects a by State-owned TNCs, b and its share in total FDI<br />

outflows, 2003–2010<br />

$ billion<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2003 2004 2005 2006 2007 2008 2009 2010<br />

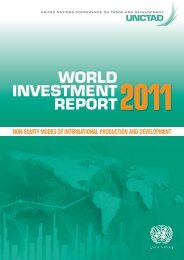

about 40 per cent of State-owned TNCs’ FDI<br />

projects, in terms of value, are in the primary<br />

sector, the shares of manufacturing and services<br />

sectors differ somewhat between cross-border<br />

M&As and greenfield investments. State-owned<br />

TNCs’ cross-border M&As between 1981 and<br />

2010 largely targeted extractive industries, utilities,<br />

and telecommunications (figure I.29). However,<br />

FDI from State-owned TNCs based in developed<br />

economies largely focused on utilities (33 per cent<br />

of the total), such as electricity, gas and water,<br />

and telecommunications (19 per cent); whereas<br />

Cross-border M&As Greenfield investments Share in global FDI outflows<br />

Source: UNCTAD.<br />

a Comprises cross-border M&As and greenfield investments. The latter refers to the estimated<br />

amounts of capital investment.<br />

b Cross-border M&A data refers only to TNCs in which the State has a stake of 50 per cent or more.<br />

Note: The values may be overestimated, as the value of greenfield FDI refers to estimated amount<br />

of capital investment of the entire project.<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

State-owned TNCs from developing and transition<br />

economies, in contrast, targeted extractive<br />

industries (37 per cent) and telecommunications<br />

(20 per cent).<br />

The difference between the patterns of investment<br />

by State-owned TNCs from developed as opposed<br />

to developing countries reflects, to some extent,<br />

the principal actors involved and their differing<br />

strategic aims. The most active State-owned TNCs<br />

from developed economies are large national<br />

utilities, which engage in FDI in order to capitalize<br />

on their firm-specific advantages and to generate<br />

Figure I.28. Cross-border M&A purchases by State-owned TNCs, a by home<br />

region, 1981–2010<br />

(Millions of dollars)<br />

Transition economies<br />

Developing economies<br />

0<br />

Developed economies<br />

1981 1985 1990 1995 2000 2005 2010<br />

Source: UNCTAD.<br />

a Refers only to TNCs in which the State has a stake of 50 per cent or more.<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

%