CHAPTER I Global Investment Trends

CHAPTER I Global Investment Trends

CHAPTER I Global Investment Trends

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8<br />

World <strong>Investment</strong> Report 2011: Non-Equity Modes of International Production and Development<br />

Russian Federation, India and China – have gained<br />

ground as important investors in recent years as<br />

the result of rapid economic growth in their home<br />

countries, abundant financial resources and strong<br />

motivations to acquire resources and strategic<br />

assets abroad (section C).<br />

In 2010 there were seven mega-deals (over<br />

$3 billion) involving developing and transition<br />

economies (or 12 per cent of the total) (annex table<br />

I.7), compared to only two (or 3 per cent of the total)<br />

in 2009. Firms from developing Asia expanded their<br />

acquisitions in 2010 beyond their own regions. For<br />

example China’s outward FDI showed substantial<br />

increases in Latin America (chapter II; ECLAC,<br />

2011). Transition-economy firms also increased<br />

their purchases in other transition economies in<br />

2010.<br />

b. FDI by sector and industry<br />

In the aftermath of the<br />

crisis, FDI in manufacturing<br />

bounced back while<br />

services sector FDI is still<br />

in decline.<br />

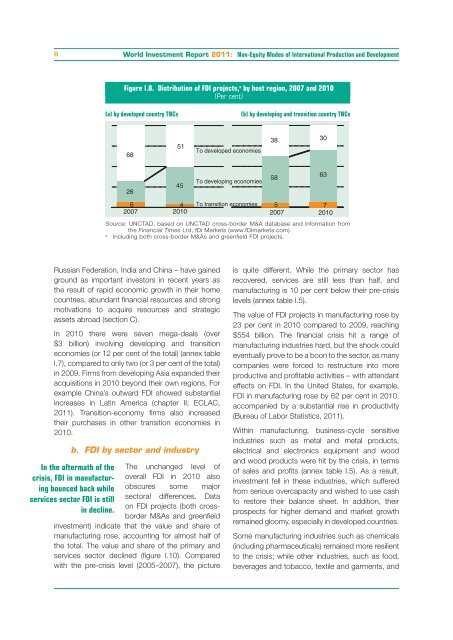

Figure I.8. Distribution of FDI projects, a by host region, 2007 and 2010<br />

(Per cent)<br />

(a) by developed country TNCs<br />

68<br />

26<br />

6 4 To transition economies 5 7<br />

2007 2010 2007 2010<br />

Source: UNCTAD, based on UNCTAD cross-border M&A database and information from<br />

the Financial Times Ltd, fDi Markets (www.fDimarkets.com).<br />

a Including both cross-border M&As and greenfield FDI projects.<br />

The unchanged level of<br />

overall FDI in 2010 also<br />

obscures some major<br />

sectoral differences. Data<br />

on FDI projects (both crossborder<br />

M&As and greenfield<br />

investment) indicate that the value and share of<br />

manufacturing rose, accounting for almost half of<br />

the total. The value and share of the primary and<br />

services sector declined (figure I.10). Compared<br />

with the pre-crisis level (2005–2007), the picture<br />

51<br />

45<br />

To developed economies<br />

To developing economies<br />

(b) by developing and transition country TNCs<br />

38<br />

58<br />

is quite different. While the primary sector has<br />

recovered, services are still less than half, and<br />

manufacturing is 10 per cent below their pre-crisis<br />

levels (annex table I.5).<br />

The value of FDI projects in manufacturing rose by<br />

23 per cent in 2010 compared to 2009, reaching<br />

$554 billion. The financial crisis hit a range of<br />

manufacturing industries hard, but the shock could<br />

eventually prove to be a boon to the sector, as many<br />

companies were forced to restructure into more<br />

productive and profitable activities – with attendant<br />

effects on FDI. In the United States, for example,<br />

FDI in manufacturing rose by 62 per cent in 2010,<br />

accompanied by a substantial rise in productivity<br />

(Bureau of Labor Statistics, 2011).<br />

Within manufacturing, business-cycle sensitive<br />

industries such as metal and metal products,<br />

electrical and electronics equipment and wood<br />

and wood products were hit by the crisis, in terms<br />

of sales and profits (annex table I.5). As a result,<br />

investment fell in these industries, which suffered<br />

from serious overcapacity and wished to use cash<br />

to restore their balance sheet. In addition, their<br />

prospects for higher demand and market growth<br />

remained gloomy, especially in developed countries.<br />

Some manufacturing industries such as chemicals<br />

(including pharmaceuticals) remained more resilient<br />

to the crisis; while other industries, such as food,<br />

beverages and tobacco, textile and garments, and<br />

30<br />

63