Interserve Project Services Supply Chain Development

Interserve Project Services Supply Chain Development

Interserve Project Services Supply Chain Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

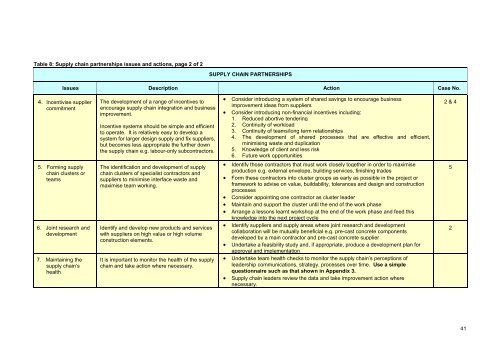

Table 8: <strong>Supply</strong> chain partnerships issues and actions, page 2 of 2<br />

SUPPLY CHAIN PARTNERSHIPS<br />

Issues Description Action Case No.<br />

4. Incentivise supplier<br />

commitment<br />

5. Forming supply<br />

chain clusters or<br />

teams<br />

6. Joint research and<br />

development<br />

7. Maintaining the<br />

supply chain’s<br />

health<br />

The development of a range of incentives to<br />

encourage supply chain integration and business<br />

improvement.<br />

Incentive systems should be simple and efficient<br />

to operate. It is relatively easy to develop a<br />

system for larger design supply and fix suppliers,<br />

but becomes less appropriate the further down<br />

the supply chain e.g. labour-only subcontractors.<br />

The identification and development of supply<br />

chain clusters of specialist contractors and<br />

suppliers to minimise interface waste and<br />

maximise team working.<br />

Identify and develop new products and services<br />

with suppliers on high value or high volume<br />

construction elements.<br />

It is important to monitor the health of the supply<br />

chain and take action where necessary.<br />

• Consider introducing a system of shared savings to encourage business<br />

improvement ideas from suppliers<br />

• Consider introducing non-financial incentives including:<br />

1. Reduced abortive tendering<br />

2. Continuity of workload<br />

3. Continuity of teams/long term relationships<br />

4. The development of shared processes that are effective and efficient,<br />

minimising waste and duplication<br />

5. Knowledge of client and less risk<br />

6. Future work opportunities<br />

• Identify those contractors that must work closely together in order to maximise<br />

production e.g. external envelope, building services, finishing trades<br />

• Form these contractors into cluster groups as early as possible in the project or<br />

framework to advise on value, buildability, tolerances and design and construction<br />

processes<br />

• Consider appointing one contractor as cluster leader<br />

• Maintain and support the cluster until the end of the work phase<br />

• Arrange a lessons learnt workshop at the end of the work phase and feed this<br />

knowledge into the next project cycle<br />

• Identify suppliers and supply areas where joint research and development<br />

collaboration will be mutually beneficial e.g. pre-cast concrete components<br />

developed by a main contractor and pre-cast concrete supplier<br />

• Undertake a feasibility study and, if appropriate, produce a development plan for<br />

approval and implementation<br />

• Undertake team health checks to monitor the supply chain’s perceptions of<br />

leadership communications, strategy. processes over time. Use a simple<br />

questionnaire such as that shown in Appendix 3.<br />

• <strong>Supply</strong> chain leaders review the data and take improvement action where<br />

necessary.<br />

2 & 4<br />

5<br />

2<br />

41