Management Report - Nordzucker AG

Management Report - Nordzucker AG

Management Report - Nordzucker AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

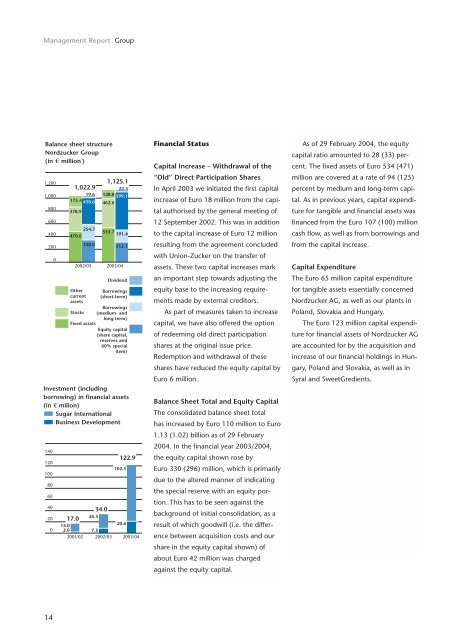

<strong>Management</strong> <strong>Report</strong> Group<br />

Balance sheet structure<br />

<strong>Nordzucker</strong> Group<br />

(in t million )<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

14<br />

0<br />

1,022.9<br />

19,6<br />

173.4 410.6<br />

378.9<br />

254.7<br />

470.6<br />

Other<br />

current<br />

assets<br />

338.0<br />

2002/03<br />

1,125.1<br />

22.5<br />

128.8 599.1<br />

462.6<br />

533.7<br />

191.4<br />

312.1<br />

2003/04<br />

Dividend<br />

Borrowings<br />

(short-term)<br />

Borrowings<br />

Stocks (medium- and<br />

long-term)<br />

Fixed assets<br />

Equity capital<br />

(share capital,<br />

reserves and<br />

60% special<br />

item)<br />

Investment (including<br />

borrowing) in financial assets<br />

(in t milion)<br />

Sugar International<br />

Business Development<br />

122.9<br />

102.3<br />

17.0<br />

34.0<br />

26.5<br />

15.0<br />

20.6<br />

2.0 7.5<br />

2001/02 2002/03 2003/04<br />

Financial Status<br />

Capital Increase – Withdrawal of the<br />

“Old” Direct Participation Shares<br />

In April 2003 we initiated the first capital<br />

increase of Euro 18 million from the capital<br />

authorised by the general meeting of<br />

12 September 2002. This was in addition<br />

to the capital increase of Euro 12 million<br />

resulting from the agreement concluded<br />

with Union-Zucker on the transfer of<br />

assets. These two capital increases mark<br />

an important step towards adjusting the<br />

equity base to the increasing requirements<br />

made by external creditors.<br />

As part of measures taken to increase<br />

capital, we have also offered the option<br />

of redeeming old direct participation<br />

shares at the original issue price.<br />

Redemption and withdrawal of these<br />

shares have reduced the equity capital by<br />

Euro 6 million.<br />

Balance Sheet Total and Equity Capital<br />

The consolidated balance sheet total<br />

has increased by Euro 110 million to Euro<br />

1.13 (1.02) billion as of 29 February<br />

2004. In the financial year 2003/2004,<br />

the equity capital shown rose by<br />

Euro 330 (296) million, which is primarily<br />

due to the altered manner of indicating<br />

the special reserve with an equity portion.<br />

This has to be seen against the<br />

background of initial consolidation, as a<br />

result of which goodwill (i.e. the difference<br />

between acquisition costs and our<br />

share in the equity capital shown) of<br />

about Euro 42 million was charged<br />

against the equity capital.<br />

As of 29 February 2004, the equity<br />

capital ratio amounted to 28 (33) percent.<br />

The fixed assets of Euro 534 (471)<br />

million are covered at a rate of 94 (125)<br />

percent by medium and long-term capital.<br />

As in previous years, capital expenditure<br />

for tangible and financial assets was<br />

financed from the Euro 107 (100) million<br />

cash flow, as well as from borrowings and<br />

from the capital increase.<br />

Capital Expenditure<br />

The Euro 65 million capital expenditure<br />

for tangible assets essentially concerned<br />

<strong>Nordzucker</strong> <strong>AG</strong>, as well as our plants in<br />

Poland, Slovakia and Hungary.<br />

The Euro 123 million capital expenditure<br />

for financial assets of <strong>Nordzucker</strong> <strong>AG</strong><br />

are accounted for by the acquisition and<br />

increase of our financial holdings in Hungary,<br />

Poland and Slovakia, as well as in<br />

Syral and SweetGredients.