A rePort: How is a head- liner actually produced? friedrich ... - polytec

A rePort: How is a head- liner actually produced? friedrich ... - polytec

A rePort: How is a head- liner actually produced? friedrich ... - polytec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

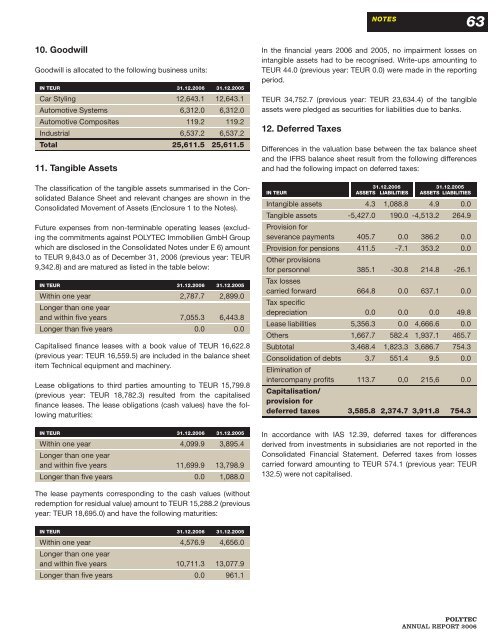

10. Goodwill<br />

Goodwill <strong>is</strong> allocated to the following business units:<br />

IN TEUR 31.12.2006 31.12.2005<br />

Car Styling 12,643.1 12,643.1<br />

Automotive Systems 6,312.0 6,312.0<br />

Automotive Composites 119.2 119.2<br />

Industrial 6,537.2 6,537.2<br />

Total 25,611.5 25,611.5<br />

11. Tangible Assets<br />

The classifi cation of the tangible assets summar<strong>is</strong>ed in the Consolidated<br />

Balance Sheet and relevant changes are shown in the<br />

Consolidated Movement of Assets (Enclosure 1 to the Notes).<br />

Future expenses from non-terminable operating leases (excluding<br />

the commitments against POLYTEC Immobilien GmbH Group<br />

which are d<strong>is</strong>closed in the Consolidated Notes under E 6) amount<br />

to TEUR 9,843.0 as of December 31, 2006 (previous year: TEUR<br />

9,342.8) and are matured as l<strong>is</strong>ted in the table below:<br />

IN TEUR 31.12.2006 31.12.2005<br />

Within one year<br />

Longer than one year<br />

2,787.7 2,899.0<br />

and within fi ve years 7,055.3 6,443.8<br />

Longer than fi ve years 0.0 0.0<br />

Capital<strong>is</strong>ed fi nance leases with a book value of TEUR 16,622.8<br />

(previous year: TEUR 16,559.5) are included in the balance sheet<br />

item Technical equipment and machinery.<br />

Lease obligations to third parties amounting to TEUR 15,799.8<br />

(previous year: TEUR 18,782.3) resulted from the capital<strong>is</strong>ed<br />

fi nance leases. The lease obligations (cash values) have the following<br />

maturities:<br />

IN TEUR 31.12.2006 31.12.2005<br />

Within one year<br />

Longer than one year<br />

4,099.9 3,895.4<br />

and within fi ve years 11,699.9 13,798.9<br />

Longer than fi ve years 0.0 1,088.0<br />

The lease payments corresponding to the cash values (without<br />

redemption for residual value) amount to TEUR 15,288.2 (previous<br />

year: TEUR 18,695.0) and have the following maturities:<br />

IN TEUR 31.12.2006 31.12.2005<br />

Within one year<br />

Longer than one year<br />

4,576.9 4,656.0<br />

and within fi ve years 10,711.3 13,077.9<br />

Longer than fi ve years 0.0 961.1<br />

In the fi nancial years 2006 and 2005, no impairment losses on<br />

intangible assets had to be recogn<strong>is</strong>ed. Write-ups amounting to<br />

TEUR 44.0 (previous year: TEUR 0.0) were made in the reporting<br />

period.<br />

TEUR 34,752.7 (previous year: TEUR 23,634.4) of the tangible<br />

assets were pledged as securities for liabilities due to banks.<br />

12. Deferred Taxes<br />

NOTES<br />

Differences in the valuation base between the tax balance sheet<br />

and the IFRS balance sheet result from the following differences<br />

and had the following impact on deferred taxes:<br />

31.12.2006 31.12.2005<br />

IN TEUR ASSETS LIABILITIES ASSETS LIABILITIES<br />

Intangible assets 4.3 1,088.8 4.9 0.0<br />

Tangible assets<br />

Prov<strong>is</strong>ion for<br />

-5,427.0 190.0 -4,513.2 264.9<br />

severance payments 405.7 0.0 386.2 0.0<br />

Prov<strong>is</strong>ion for pensions<br />

Other prov<strong>is</strong>ions<br />

411.5 -7.1 353.2 0.0<br />

for personnel<br />

Tax losses<br />

385.1 -30.8 214.8 -26.1<br />

carried forward<br />

Tax specifi c<br />

664.8 0.0 637.1 0.0<br />

depreciation 0.0 0.0 0.0 49.8<br />

Lease liabilities 5,356.3 0.0 4,666.6 0.0<br />

Others 1,667.7 582.4 1,937.1 465.7<br />

Subtotal 3,468.4 1,823.3 3,686.7 754.3<br />

Consolidation of debts<br />

Elimination of<br />

3.7 551.4 9.5 0.0<br />

intercompany profi ts<br />

Capital<strong>is</strong>ation/<br />

prov<strong>is</strong>ion for<br />

113.7 0,0 215,6 0.0<br />

deferred taxes 3,585.8 2,374.7 3,911.8 754.3<br />

63<br />

In accordance with IAS 12.39, deferred taxes for differences<br />

derived from investments in subsidiaries are not reported in the<br />

Consolidated Financial Statement. Deferred taxes from losses<br />

carried forward amounting to TEUR 574.1 (previous year: TEUR<br />

132.5) were not capital<strong>is</strong>ed.<br />

POLYTEC<br />

ANNUAL REPORT 2006