continued - The Lion Group

continued - The Lion Group

continued - The Lion Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

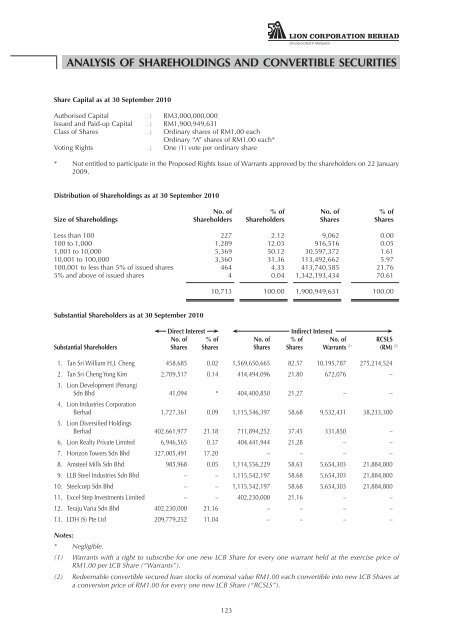

ANALYSIS OF SHAREHOLDINGS AND CONVERTIBLE SECURITIES<br />

Share Capital as at 30 September 2010<br />

Authorised Capital : RM3,000,000,000<br />

Issued and Paid-up Capital : RM1,900,949,631<br />

Class of Shares : Ordinary shares of RM1.00 each<br />

Ordinary “A” shares of RM1.00 each*<br />

Voting Rights : One (1) vote per ordinary share<br />

* Not entitled to participate in the Proposed Rights Issue of Warrants approved by the shareholders on 22 January<br />

2009.<br />

Distribution of Shareholdings as at 30 September 2010<br />

No. of % of No. of % of<br />

Size of Shareholdings Shareholders Shareholders Shares Shares<br />

Less than 100 227 2.12 9,062 0.00<br />

100 to 1,000 1,289 12.03 916,516 0.05<br />

1,001 to 10,000 5,369 50.12 30,597,372 1.61<br />

10,001 to 100,000 3,360 31.36 113,492,662 5.97<br />

100,001 to less than 5% of issued shares 464 4.33 413,740,585 21.76<br />

5% and above of issued shares 4 0.04 1,342,193,434 70.61<br />

Substantial Shareholders as at 30 September 2010<br />

10,713 100.00 1,900,949,631 100.00<br />

Direct Interest Indirect Interest<br />

No. of % of No. of % of No. of RCSLS<br />

Substantial Shareholders Shares Shares Shares Shares Warrants (1) (RM) (2)<br />

1. Tan Sri William H.J. Cheng 458,685 0.02 1,569,650,665 82.57 10,195,787 275,214,524<br />

2. Tan Sri Cheng Yong Kim<br />

3. <strong>Lion</strong> Development (Penang)<br />

2,709,517 0.14 414,494,096 21.80 672,076 –<br />

Sdn Bhd<br />

4. <strong>Lion</strong> Industries Corporation<br />

41,094 * 404,400,850 21.27 – –<br />

Berhad<br />

5. <strong>Lion</strong> Diversified Holdings<br />

1,727,361 0.09 1,115,546,397 58.68 9,532,431 38,233,300<br />

Berhad 402,661,977 21.18 711,894,252 37.45 331,850 –<br />

6. <strong>Lion</strong> Realty Private Limited 6,946,565 0.37 404,441,944 21.28 – –<br />

7. Horizon Towers Sdn Bhd 327,005,491 17.20 – – – –<br />

8. Amsteel Mills Sdn Bhd 985,968 0.05 1,114,556,229 58.63 5,654,303 21,884,800<br />

9. LLB Steel Industries Sdn Bhd – – 1,115,542,197 58.68 5,654,303 21,884,800<br />

10. Steelcorp Sdn Bhd – – 1,115,542,197 58.68 5,654,303 21,884,800<br />

11. Excel Step Investments Limited – – 402,230,000 21.16 – –<br />

12. Teraju Varia Sdn Bhd 402,230,000 21.16 – – – –<br />

13. LDH (S) Pte Ltd 209,779,252 11.04 – – – –<br />

Notes:<br />

* Negligible.<br />

(1) Warrants with a right to subscribe for one new LCB Share for every one warrant held at the exercise price of<br />

RM1.00 per LCB Share (“Warrants”).<br />

(2) Redeemable convertible secured loan stocks of nominal value RM1.00 each convertible into new LCB Shares at<br />

a conversion price of RM1.00 for every one new LCB Share (“RCSLS”).<br />

123