continued - The Lion Group

continued - The Lion Group

continued - The Lion Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3. SIGNIFICANT ACCOUNTING POLICIES (<strong>continued</strong>)<br />

(e) Foreign Currencies (<strong>continued</strong>)<br />

(iii) Foreign Operations<br />

<strong>The</strong> results and financial position of foreign operations that have a functional currency different from<br />

the presentation currency (RM) of the consolidated financial statements are translated into RM as<br />

follows:<br />

- Assets and liabilities for each balance sheet presented are translated at the closing rate prevailing<br />

at the balance sheet date;<br />

- Income and expenses for each income statement are translated at average exchange rates for<br />

the year, which approximate the exchange rates at the dates of the transactions; and<br />

- All resulting exchange differences are taken to the foreign currency translation reserve within<br />

equity.<br />

Goodwill and fair value adjustments arising from the acquisition of foreign operations are treated<br />

as assets and liabilities of the foreign operations and are recorded in the Functional Currency of the<br />

foreign operations and translated at the closing rate at the balance sheet date.<br />

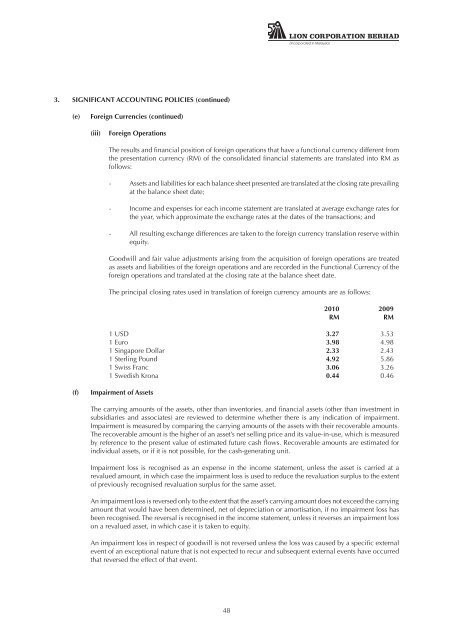

<strong>The</strong> principal closing rates used in translation of foreign currency amounts are as follows:<br />

48<br />

2010 2009<br />

RM RM<br />

1 USD 3.27 3.53<br />

1 Euro 3.98 4.98<br />

1 Singapore Dollar 2.33 2.43<br />

1 Sterling Pound 4.92 5.86<br />

1 Swiss Franc 3.06 3.26<br />

1 Swedish Krona 0.44 0.46<br />

(f) Impairment of Assets<br />

<strong>The</strong> carrying amounts of the assets, other than inventories, and financial assets (other than investment in<br />

subsidiaries and associates) are reviewed to determine whether there is any indication of impairment.<br />

Impairment is measured by comparing the carrying amounts of the assets with their recoverable amounts.<br />

<strong>The</strong> recoverable amount is the higher of an asset’s net selling price and its value-in-use, which is measured<br />

by reference to the present value of estimated future cash flows. Recoverable amounts are estimated for<br />

individual assets, or if it is not possible, for the cash-generating unit.<br />

Impairment loss is recognised as an expense in the income statement, unless the asset is carried at a<br />

revalued amount, in which case the impairment loss is used to reduce the revaluation surplus to the extent<br />

of previously recognised revaluation surplus for the same asset.<br />

An impairment loss is reversed only to the extent that the asset’s carrying amount does not exceed the carrying<br />

amount that would have been determined, net of depreciation or amortisation, if no impairment loss has<br />

been recognised. <strong>The</strong> reversal is recognised in the income statement, unless it reverses an impairment loss<br />

on a revalued asset, in which case it is taken to equity.<br />

An impairment loss in respect of goodwill is not reversed unless the loss was caused by a specific external<br />

event of an exceptional nature that is not expected to recur and subsequent external events have occurred<br />

that reversed the effect of that event.