Master's Program 2004/2005 Technical and Fiscal Barriers ... - Lexnet

Master's Program 2004/2005 Technical and Fiscal Barriers ... - Lexnet

Master's Program 2004/2005 Technical and Fiscal Barriers ... - Lexnet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

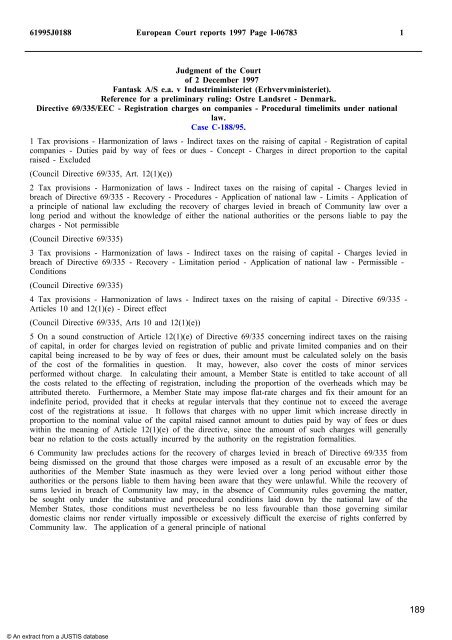

61995J0188 European Court reports 1997 Page I-06783 1<br />

Judgment of the Court<br />

of 2 December 1997<br />

Fantask A/S e.a. v Industriministeriet (Erhvervministeriet).<br />

Reference for a preliminary ruling: Ostre L<strong>and</strong>sret - Denmark.<br />

Directive 69/335/EEC - Registration charges on companies - Procedural timelimits under national<br />

law.<br />

Case C-188/95.<br />

1 Tax provisions - Harmonization of laws - Indirect taxes on the raising of capital - Registration of capital<br />

companies - Duties paid by way of fees or dues - Concept - Charges in direct proportion to the capital<br />

raised - Excluded<br />

(Council Directive 69/335, Art. 12(1)(e))<br />

2 Tax provisions - Harmonization of laws - Indirect taxes on the raising of capital - Charges levied in<br />

breach of Directive 69/335 - Recovery - Procedures - Application of national law - Limits - Application of<br />

a principle of national law excluding the recovery of charges levied in breach of Community law over a<br />

long period <strong>and</strong> without the knowledge of either the national authorities or the persons liable to pay the<br />

charges - Not permissible<br />

(Council Directive 69/335)<br />

3 Tax provisions - Harmonization of laws - Indirect taxes on the raising of capital - Charges levied in<br />

breach of Directive 69/335 - Recovery - Limitation period - Application of national law - Permissible -<br />

Conditions<br />

(Council Directive 69/335)<br />

4 Tax provisions - Harmonization of laws - Indirect taxes on the raising of capital - Directive 69/335 -<br />

Articles 10 <strong>and</strong> 12(1)(e) - Direct effect<br />

(Council Directive 69/335, Arts 10 <strong>and</strong> 12(1)(e))<br />

5 On a sound construction of Article 12(1)(e) of Directive 69/335 concerning indirect taxes on the raising<br />

of capital, in order for charges levied on registration of public <strong>and</strong> private limited companies <strong>and</strong> on their<br />

capital being increased to be by way of fees or dues, their amount must be calculated solely on the basis<br />

of the cost of the formalities in question. It may, however, also cover the costs of minor services<br />

performed without charge. In calculating their amount, a Member State is entitled to take account of all<br />

the costs related to the effecting of registration, including the proportion of the overheads which may be<br />

attributed thereto. Furthermore, a Member State may impose flat-rate charges <strong>and</strong> fix their amount for an<br />

indefinite period, provided that it checks at regular intervals that they continue not to exceed the average<br />

cost of the registrations at issue. It follows that charges with no upper limit which increase directly in<br />

proportion to the nominal value of the capital raised cannot amount to duties paid by way of fees or dues<br />

within the meaning of Article 12(1)(e) of the directive, since the amount of such charges will generally<br />

bear no relation to the costs actually incurred by the authority on the registration formalities.<br />

6 Community law precludes actions for the recovery of charges levied in breach of Directive 69/335 from<br />

being dismissed on the ground that those charges were imposed as a result of an excusable error by the<br />

authorities of the Member State inasmuch as they were levied over a long period without either those<br />

authorities or the persons liable to them having been aware that they were unlawful. While the recovery of<br />

sums levied in breach of Community law may, in the absence of Community rules governing the matter,<br />

be sought only under the substantive <strong>and</strong> procedural conditions laid down by the national law of the<br />

Member States, those conditions must nevertheless be no less favourable than those governing similar<br />

domestic claims nor render virtually impossible or excessively difficult the exercise of rights conferred by<br />

Community law. The application of a general principle of national<br />

© An extract from a JUSTIS database<br />

189