Aeropuertos Españoles y Navegación Aérea - Aena.es

Aeropuertos Españoles y Navegación Aérea - Aena.es

Aeropuertos Españoles y Navegación Aérea - Aena.es

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

of which EUR 1,942.4 million relate to property, plant<br />

and equipment and EUR 17.6 million relate to intangible<br />

assets.<br />

Limitations<br />

The assets assigned to the consolidated Group relating<br />

to the Company <strong>Aeropuertos</strong> <strong>Español<strong>es</strong></strong> y <strong>Navegación</strong><br />

<strong>Aérea</strong>, are public domain assets with r<strong>es</strong>pect to which<br />

<strong>Aeropuertos</strong> <strong>Español<strong>es</strong></strong> y <strong>Navegación</strong> <strong>Aérea</strong> do<strong>es</strong> not<br />

have title or powers of disposal or encumbrance.<br />

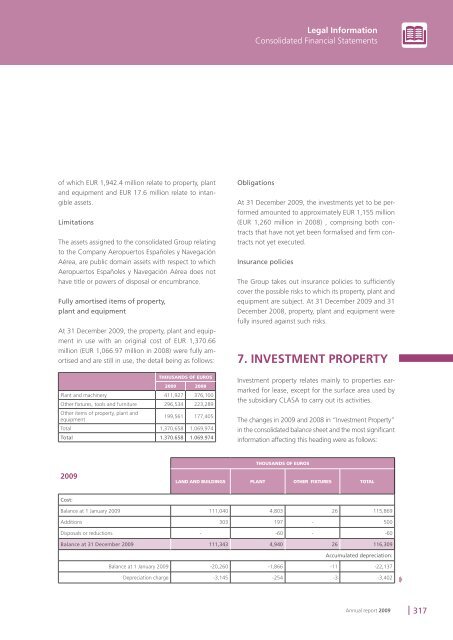

Fully amortised items of property,<br />

plant and equipment<br />

At 31 December 2009, the property, plant and equipment<br />

in use with an original cost of EUR 1,370.66<br />

million (EUR 1,066.97 million in 2008) were fully amortised<br />

and are still in use, the detail being as follows:<br />

THOUSANDS OF EUROS<br />

2009 2008<br />

Plant and machinery 411,927 376,100<br />

Other fi xtur<strong>es</strong>, tools and furniture 296,534 223,289<br />

Other items of property, plant and<br />

equipment<br />

199,561 177,405<br />

Total 1,370,658 1,069,974<br />

Total 1.370.658 1.069.974<br />

2009<br />

Cost:<br />

Legal Information<br />

Consolidated Financial Statements<br />

Obligations<br />

At 31 December 2009, the inv<strong>es</strong>tments yet to be performed<br />

amounted to approximately EUR 1,155 million<br />

(EUR 1,260 million in 2008) , comprising both contracts<br />

that have not yet been formalised and fi rm contracts<br />

not yet executed.<br />

Insurance polici<strong>es</strong><br />

The Group tak<strong>es</strong> out insurance polici<strong>es</strong> to suffi ciently<br />

cover the possible risks to which its property, plant and<br />

equipment are subject. At 31 December 2009 and 31<br />

December 2008, property, plant and equipment were<br />

fully insured against such risks.<br />

7. INVESTMENT PROPERTY<br />

Inv<strong>es</strong>tment property relat<strong>es</strong> mainly to properti<strong>es</strong> earmarked<br />

for lease, except for the surface area used by<br />

the subsidiary CLASA to carry out its activiti<strong>es</strong>.<br />

The chang<strong>es</strong> in 2009 and 2008 in “Inv<strong>es</strong>tment Property”<br />

in the consolidated balance sheet and the most signifi cant<br />

information affecting this heading were as follows:<br />

THOUSANDS OF EUROS<br />

LAND AND BUILDINGS PLANT OTHER FIXTURES TOTAL<br />

Balance at 1 January 2009 111,040 4,803 26 115,869<br />

Additions 303 197 - 500<br />

Disposals or reductions - -60 - -60<br />

Balance at 31 December 2009 111,343 4,940 26 116,309<br />

Accumulated depreciation:<br />

Balance at 1 January 2009 -20,260 -1,866 -11 -22,137<br />

Depreciation charge -3,145 -254 -3 -3,402<br />

Annual report 2009 317