rrL4Y7

rrL4Y7

rrL4Y7

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

48<br />

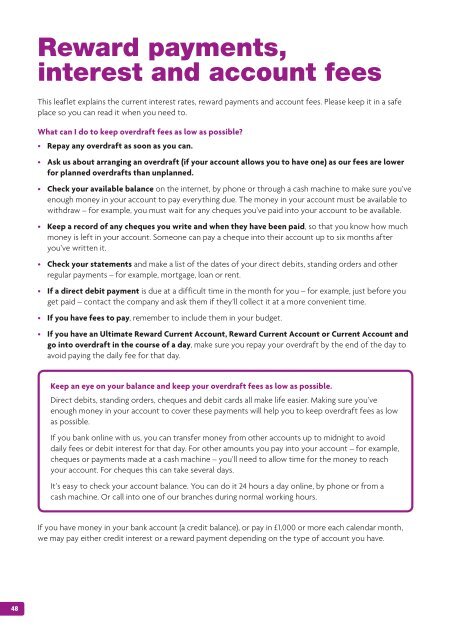

Reward payments,<br />

interest and account fees<br />

This leaflet explains the current interest rates, reward payments and account fees. Please keep it in a safe<br />

place so you can read it when you need to.<br />

What can I do to keep overdraft fees as low as possible?<br />

• Repay any overdraft as soon as you can.<br />

• Ask us about arranging an overdraft (if your account allows you to have one) as our fees are lower<br />

for planned overdrafts than unplanned.<br />

• Check your available balance on the internet, by phone or through a cash machine to make sure you’ve<br />

enough money in your account to pay everything due. The money in your account must be available to<br />

withdraw – for example, you must wait for any cheques you’ve paid into your account to be available.<br />

• Keep a record of any cheques you write and when they have been paid, so that you know how much<br />

money is left in your account. Someone can pay a cheque into their account up to six months after<br />

you’ve written it.<br />

• Check your statements and make a list of the dates of your direct debits, standing orders and other<br />

regular payments – for example, mortgage, loan or rent.<br />

• If a direct debit payment is due at a difficult time in the month for you – for example, just before you<br />

get paid – contact the company and ask them if they’ll collect it at a more convenient time.<br />

• If you have fees to pay, remember to include them in your budget.<br />

• If you have an Ultimate Reward Current Account, Reward Current Account or Current Account and<br />

go into overdraft in the course of a day, make sure you repay your overdraft by the end of the day to<br />

avoid paying the daily fee for that day.<br />

Keep an eye on your balance and keep your overdraft fees as low as possible.<br />

Direct debits, standing orders, cheques and debit cards all make life easier. Making sure you’ve<br />

enough money in your account to cover these payments will help you to keep overdraft fees as low<br />

as possible.<br />

If you bank online with us, you can transfer money from other accounts up to midnight to avoid<br />

daily fees or debit interest for that day. For other amounts you pay into your account – for example,<br />

cheques or payments made at a cash machine – you’ll need to allow time for the money to reach<br />

your account. For cheques this can take several days.<br />

It’s easy to check your account balance. You can do it 24 hours a day online, by phone or from a<br />

cash machine. Or call into one of our branches during normal working hours.<br />

If you have money in your bank account (a credit balance), or pay in £1,000 or more each calendar month,<br />

we may pay either credit interest or a reward payment depending on the type of account you have.