rrL4Y7

rrL4Y7

rrL4Y7

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

50<br />

Monthly billing periods<br />

We calculate the amount you pay in overdraft fees (including any returned item fees) using monthly billing<br />

periods. This applies to all accounts and means we divide the year into monthly billing periods that differ<br />

from calendar months as they start on the day after the first working day of the month. The last day of a<br />

monthly billing period is the first working day of the following month.<br />

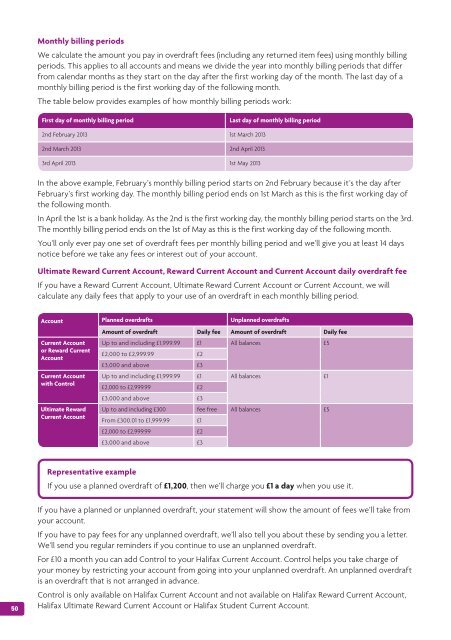

The table below provides examples of how monthly billing periods work:<br />

First day of monthly billing period Last day of monthly billing period<br />

2nd February 2013 1st March 2013<br />

2nd March 2013 2nd April 2013<br />

3rd April 2013 1st May 2013<br />

In the above example, February’s monthly billing period starts on 2nd February because it’s the day after<br />

February’s first working day. The monthly billing period ends on 1st March as this is the first working day of<br />

the following month.<br />

In April the 1st is a bank holiday. As the 2nd is the first working day, the monthly billing period starts on the 3rd.<br />

The monthly billing period ends on the 1st of May as this is the first working day of the following month.<br />

You’ll only ever pay one set of overdraft fees per monthly billing period and we’ll give you at least 14 days<br />

notice before we take any fees or interest out of your account.<br />

Ultimate Reward Current Account, Reward Current Account and Current Account daily overdraft fee<br />

If you have a Reward Current Account, Ultimate Reward Current Account or Current Account, we will<br />

calculate any daily fees that apply to your use of an overdraft in each monthly billing period.<br />

Account Planned overdrafts Unplanned overdrafts<br />

Amount of overdraft Daily fee Amount of overdraft Daily fee<br />

Current Account Up to and including £1,999.99 £1 All balances £5<br />

or Reward Current<br />

Account<br />

£2,000 to £2,999.99 £2<br />

£3,000 and above £3<br />

Current Account Up to and including £1,999.99 £1 All balances £1<br />

with Control<br />

£2,000 to £2,999.99 £2<br />

£3,000 and above £3<br />

Ultimate Reward Up to and including £300 fee free All balances £5<br />

Current Account<br />

From £300.01 to £1,999.99 £1<br />

£2,000 to £2,999.99 £2<br />

£3,000 and above £3<br />

Representative example<br />

If you use a planned overdraft of £1,200, then we’ll charge you £1 a day when you use it.<br />

If you have a planned or unplanned overdraft, your statement will show the amount of fees we’ll take from<br />

your account.<br />

If you have to pay fees for any unplanned overdraft, we’ll also tell you about these by sending you a letter.<br />

We’ll send you regular reminders if you continue to use an unplanned overdraft.<br />

For £10 a month you can add Control to your Halifax Current Account. Control helps you take charge of<br />

your money by restricting your account from going into your unplanned overdraft. An unplanned overdraft<br />

is an overdraft that is not arranged in advance.<br />

Control is only available on Halifax Current Account and not available on Halifax Reward Current Account,<br />

Halifax Ultimate Reward Current Account or Halifax Student Current Account.