here - Rotterdam School of Management

here - Rotterdam School of Management

here - Rotterdam School of Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

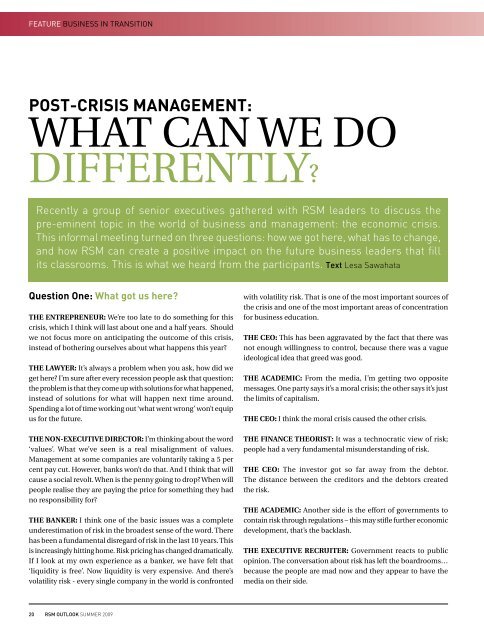

FEATURE BUSINESS IN TRANSITION<br />

POST-CRISIS MANAGEMENT:<br />

WHAT CAN WE DO<br />

DIFFERENTLY?<br />

Recently a group <strong>of</strong> senior executives gat<strong>here</strong>d with RSM leaders to discuss the<br />

pre-eminent topic in the world <strong>of</strong> business and management: the economic crisis.<br />

This informal meeting turned on three questions: how we got <strong>here</strong>, what has to change,<br />

and how RSM can create a positive impact on the future business leaders that fill<br />

its classrooms. This is what we heard from the participants. Text Lesa Sawahata<br />

Question One: What got us <strong>here</strong>?<br />

THE ENTREPRENEUR: We’re too late to do something for this<br />

crisis, which I think will last about one and a half years. Should<br />

we not focus more on anticipating the outcome <strong>of</strong> this crisis,<br />

instead <strong>of</strong> bothering ourselves about what happens this year?<br />

THE LAWYER: It’s always a problem when you ask, how did we<br />

get <strong>here</strong>? I’m sure after every recession people ask that question;<br />

the problem is that they come up with solutions for what happened,<br />

instead <strong>of</strong> solutions for what will happen next time around.<br />

Spending a lot <strong>of</strong> time working out ‘what went wrong’ won’t equip<br />

us for the future.<br />

THE NON-EXECUTIVE DIRECTOR: I’m thinking about the word<br />

‘values’. What we’ve seen is a real misalignment <strong>of</strong> values.<br />

<strong>Management</strong> at some companies are voluntarily taking a 5 per<br />

cent pay cut. However, banks won’t do that. And I think that will<br />

cause a social revolt. When is the penny going to drop? When will<br />

people realise they are paying the price for something they had<br />

no responsibility for?<br />

THE BANKER: I think one <strong>of</strong> the basic issues was a complete<br />

underestimation <strong>of</strong> risk in the broadest sense <strong>of</strong> the word. T<strong>here</strong><br />

has been a fundamental disregard <strong>of</strong> risk in the last 10 years. This<br />

is increasingly hitting home. Risk pricing has changed dramatically.<br />

If I look at my own experience as a banker, we have felt that<br />

‘liquidity is free’. Now liquidity is very expensive. And t<strong>here</strong>’s<br />

volatility risk - every single company in the world is confronted<br />

20 RSM OUTLOOK SUMMER 2009<br />

with volatility risk. That is one <strong>of</strong> the most important sources <strong>of</strong><br />

the crisis and one <strong>of</strong> the most important areas <strong>of</strong> concentration<br />

for business education.<br />

THE CEO: This has been aggravated by the fact that t<strong>here</strong> was<br />

not enough willingness to control, because t<strong>here</strong> was a vague<br />

ideological idea that greed was good.<br />

THE ACADEMIC: From the media, I’m getting two opposite<br />

messages. One party says it’s a moral crisis; the other says it’s just<br />

the limits <strong>of</strong> capitalism.<br />

THE CEO: I think the moral crisis caused the other crisis.<br />

THE FINANCE THEORIST: It was a technocratic view <strong>of</strong> risk;<br />

people had a very fundamental misunderstanding <strong>of</strong> risk.<br />

THE CEO: The investor got so far away from the debtor.<br />

The distance between the creditors and the debtors created<br />

the risk.<br />

THE ACADEMIC: Another side is the effort <strong>of</strong> governments to<br />

contain risk through regulations – this may stifle further economic<br />

development, that’s the backlash.<br />

THE EXECUTIVE RECRUITER: Government reacts to public<br />

opinion. The conversation about risk has left the boardrooms…<br />

because the people are mad now and they appear to have the<br />

media on their side.