Recent Developments in Indiana Taxation - I.U. School of Law ...

Recent Developments in Indiana Taxation - I.U. School of Law ...

Recent Developments in Indiana Taxation - I.U. School of Law ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2007] TAX LAW 1105<br />

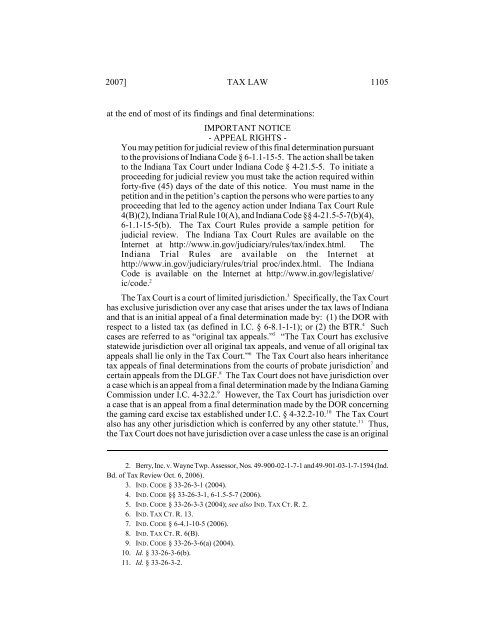

at the end <strong>of</strong> most <strong>of</strong> its f<strong>in</strong>d<strong>in</strong>gs and f<strong>in</strong>al determ<strong>in</strong>ations:<br />

IMPORTANT NOTICE<br />

- APPEAL RIGHTS -<br />

You may petition for judicial review <strong>of</strong> this f<strong>in</strong>al determ<strong>in</strong>ation pursuant<br />

to the provisions <strong>of</strong> <strong>Indiana</strong> Code § 6-1.1-15-5. The action shall be taken<br />

to the <strong>Indiana</strong> Tax Court under <strong>Indiana</strong> Code § 4-21.5-5. To <strong>in</strong>itiate a<br />

proceed<strong>in</strong>g for judicial review you must take the action required with<strong>in</strong><br />

forty-five (45) days <strong>of</strong> the date <strong>of</strong> this notice. You must name <strong>in</strong> the<br />

petition and <strong>in</strong> the petition’s caption the persons who were parties to any<br />

proceed<strong>in</strong>g that led to the agency action under <strong>Indiana</strong> Tax Court Rule<br />

4(B)(2), <strong>Indiana</strong> Trial Rule 10(A), and <strong>Indiana</strong> Code §§ 4-21.5-5-7(b)(4),<br />

6-1.1-15-5(b). The Tax Court Rules provide a sample petition for<br />

judicial review. The <strong>Indiana</strong> Tax Court Rules are available on the<br />

Internet at http://www.<strong>in</strong>.gov/judiciary/rules/tax/<strong>in</strong>dex.html. The<br />

<strong>Indiana</strong> Trial Rules are available on the Internet at<br />

http://www.<strong>in</strong>.gov/judiciary/rules/trial proc/<strong>in</strong>dex.html. The <strong>Indiana</strong><br />

Code is available on the Internet at http://www.<strong>in</strong>.gov/legislative/<br />

ic/code. 2<br />

3<br />

The Tax Court is a court <strong>of</strong> limited jurisdiction. Specifically, the Tax Court<br />

has exclusive jurisdiction over any case that arises under the tax laws <strong>of</strong> <strong>Indiana</strong><br />

and that is an <strong>in</strong>itial appeal <strong>of</strong> a f<strong>in</strong>al determ<strong>in</strong>ation made by: (1) the DOR with<br />

4<br />

respect to a listed tax (as def<strong>in</strong>ed <strong>in</strong> I.C. § 6-8.1-1-1); or (2) the BTR. Such<br />

5<br />

cases are referred to as “orig<strong>in</strong>al tax appeals.” “The Tax Court has exclusive<br />

statewide jurisdiction over all orig<strong>in</strong>al tax appeals, and venue <strong>of</strong> all orig<strong>in</strong>al tax<br />

6<br />

appeals shall lie only <strong>in</strong> the Tax Court.” The Tax Court also hears <strong>in</strong>heritance<br />

7<br />

tax appeals <strong>of</strong> f<strong>in</strong>al determ<strong>in</strong>ations from the courts <strong>of</strong> probate jurisdiction and<br />

8<br />

certa<strong>in</strong> appeals from the DLGF. The Tax Court does not have jurisdiction over<br />

a case which is an appeal from a f<strong>in</strong>al determ<strong>in</strong>ation made by the <strong>Indiana</strong> Gam<strong>in</strong>g<br />

9<br />

Commission under I.C. 4-32.2. However, the Tax Court has jurisdiction over<br />

a case that is an appeal from a f<strong>in</strong>al determ<strong>in</strong>ation made by the DOR concern<strong>in</strong>g<br />

10<br />

the gam<strong>in</strong>g card excise tax established under I.C. § 4-32.2-10. The Tax Court<br />

11<br />

also has any other jurisdiction which is conferred by any other statute. Thus,<br />

the Tax Court does not have jurisdiction over a case unless the case is an orig<strong>in</strong>al<br />

2. Berry, Inc. v. Wayne Twp. Assessor, Nos. 49-900-02-1-7-1 and 49-901-03-1-7-1594 (Ind.<br />

Bd. <strong>of</strong> Tax Review Oct. 6, 2006).<br />

3. IND. CODE § 33-26-3-1 (2004).<br />

4. IND. CODE §§ 33-26-3-1, 6-1.5-5-7 (2006).<br />

5. IND. CODE § 33-26-3-3 (2004); see also IND. TAX CT. R. 2.<br />

6. IND. TAX CT. R. 13.<br />

7. IND. CODE § 6-4.1-10-5 (2006).<br />

8. IND. TAX CT. R. 6(B).<br />

9. IND. CODE § 33-26-3-6(a) (2004).<br />

10. Id. § 33-26-3-6(b).<br />

11. Id. § 33-26-3-2.