Evonik Industries AG

Evonik Industries AG

Evonik Industries AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

To assess EI, Moody’s has applied its Global Chemical Industry Rating Methodology, published in<br />

December 2009. The methodology contains five key rating factors (Business Profile, Size and Stability,<br />

Cost Position, Management Strategy and Financial Strength), incorporating several sub-factors or<br />

metrics, against which we assign a score to the company. EI’s performance against these factors and<br />

sub-factors is detailed under “Business Risk Factors” and “Financial Risk Factors”, as follows:<br />

Business Risk Factors<br />

The strong business profile of EI is largely supported by its world-leading chemicals franchise<br />

EI’s chemicals business segment, which accounts for 76% of group revenues and 79% of group<br />

EBITDA, is one of the largest and most profitable European specialty chemicals companies, with<br />

around 100 production sites in 28 countries. The products of the chemicals franchise hold marketleading<br />

positions, including in silicas, polyamide 12, super absorbants, Dl-methionine to name a few.<br />

EI is active across the entire value chain of the chemicals industry, with some exposure to commodity<br />

type chemicals (mainly centred around the group’s C4 chemistry expertise), but mainly to specialty<br />

chemicals applications in its consumer specialties and health & nutrition business units (conditioners,<br />

super absorbants, skin cleanser), which carry higher margins. Importantly, EI benefits from Verbund<br />

structures in several of its chemicals product lines (silicon, C4, isophorone and MMA), which enables<br />

the group to control the entire value chain, a key competitive advantage over non-integrated players.<br />

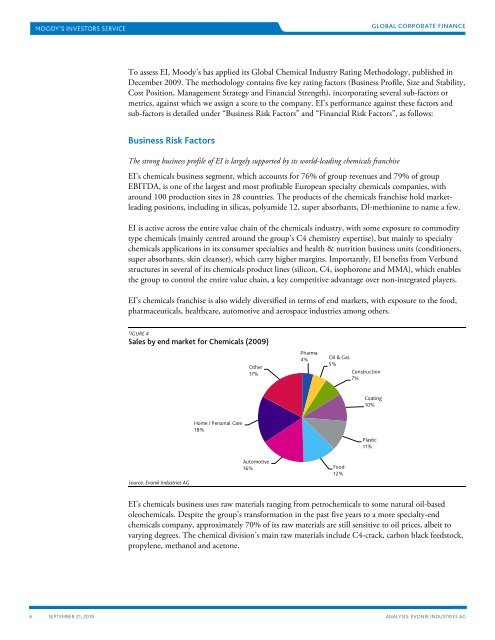

EI’s chemicals franchise is also widely diversified in terms of end markets, with exposure to the food,<br />

pharmaceuticals, healthcare, automotive and aerospace industries among others.<br />

FIGURE 4<br />

Sales by end market for Chemicals (2009)<br />

Source: <strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong><br />

Home / Personal Care<br />

18%<br />

Other<br />

17%<br />

Automotive<br />

16%<br />

Pharma<br />

4%<br />

Oil & Gas<br />

5%<br />

Construction<br />

7%<br />

Coating<br />

10%<br />

EI’s chemicals business uses raw materials ranging from petrochemicals to some natural oil-based<br />

oleochemicals. Despite the group’s transformation in the past five years to a more specialty-end<br />

chemicals company, approximately 70% of its raw materials are still sensitive to oil prices, albeit to<br />

varying degrees. The chemical division’s main raw materials include C4-crack, carbon black feedstock,<br />

propylene, methanol and acetone.<br />

Food<br />

12%<br />

Plastic<br />

11%<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>