Evonik Industries AG

Evonik Industries AG

Evonik Industries AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

Score of A for the “Size and Stability” rating factor reflects the group’s scale and breadth ...<br />

With annual revenues of €13.1 billion (€10.0 billion for its chemicals division), EI is among the largest<br />

European chemical issuers rated by Moody’s. On a more negative note, the group’s energy business<br />

clearly lacks scale and breadth compared with other European multi-utilities. Moody’s expects the size<br />

of the group to remain relatively stable in the short to medium term, given that parts of the proceeds<br />

from a potential sale of a stake in the group’s energy business would be reinvested in the chemicals<br />

franchise while the other part will be applied to debt reduction. We do not expect EI to embark on an<br />

aggressive external expansion strategy as the group’s focus will be on maximising its enterprise value<br />

through organic projects and bolt-on acquisitions ahead of a potential IPO.<br />

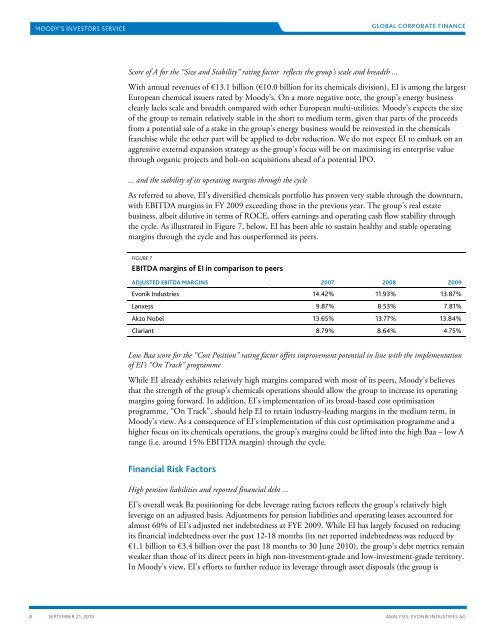

... and the stability of its operating margins through the cycle<br />

As referred to above, EI’s diversified chemicals portfolio has proven very stable through the downturn,<br />

with EBITDA margins in FY 2009 exceeding those in the previous year. The group’s real estate<br />

business, albeit dilutive in terms of ROCE, offers earnings and operating cash flow stability through<br />

the cycle. As illustrated in Figure 7, below, EI has been able to sustain healthy and stable operating<br />

margins through the cycle and has outperformed its peers.<br />

FIGURE 7<br />

EBITDA margins of EI in comparison to peers<br />

ADJUSTED EBITDA MARGINS 2007 2008 2009<br />

<strong>Evonik</strong> <strong>Industries</strong> 14.42% 11.93% 13.87%<br />

Lanxess 9.87% 8.53% 7.81%<br />

Akzo Nobel 13.65% 13.77% 13.84%<br />

Clariant 8.79% 8.64% 4.75%<br />

Low Baa score for the “Cost Position” rating factor offers improvement potential in line with the implementation<br />

of EI’s “On Track” programme<br />

While EI already exhibits relatively high margins compared with most of its peers, Moody’s believes<br />

that the strength of the group’s chemicals operations should allow the group to increase its operating<br />

margins going forward. In addition, EI’s implementation of its broad-based cost optimisation<br />

programme, “On Track”, should help EI to retain industry-leading margins in the medium term, in<br />

Moody’s view. As a consequence of EI’s implementation of this cost optimisation programme and a<br />

higher focus on its chemicals operations, the group’s margins could be lifted into the high Baa – low A<br />

range (i.e. around 15% EBITDA margin) through the cycle.<br />

Financial Risk Factors<br />

High pension liabilities and reported financial debt ...<br />

EI’s overall weak Ba positioning for debt leverage rating factors reflects the group’s relatively high<br />

leverage on an adjusted basis. Adjustments for pension liabilities and operating leases accounted for<br />

almost 60% of EI’s adjusted net indebtedness at FYE 2009. While EI has largely focused on reducing<br />

its financial indebtedness over the past 12-18 months (its net reported indebtedness was reduced by<br />

€1.1 billion to €3.4 billion over the past 18 months to 30 June 2010), the group’s debt metrics remain<br />

weaker than those of its direct peers in high non-investment-grade and low-investment-grade territory.<br />

In Moody’s view, EI’s efforts to further reduce its leverage through asset disposals (the group is<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>