Evonik Industries AG

Evonik Industries AG

Evonik Industries AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SEPTEMBER 21, 2010<br />

ANALYSIS<br />

Table of Contents:<br />

CORPORATE PROFILE 1<br />

SHAREHOLDER STRUCTURE AND<br />

MAN<strong>AG</strong>EMENT STRATEGY 2<br />

KEY RATING CONSIDERATIONS 4<br />

BUSINESS RISK FACTORS 6<br />

FINANCIAL RISK FACTORS 8<br />

DEBT STRUCTURE AND GROUP<br />

FINANCING 12<br />

LIQUIDITY 12<br />

MOODY’S RELATED RESEARCH 12<br />

Analyst Contacts:<br />

FRANKFURT 49.69.70730.700<br />

Stanislas Duquesnoy 49.69.70730.781<br />

Assistant Vice President-Analyst<br />

Stanislas.Duquesnoy@moodys.com<br />

Max Huefner 49.69.70730.783<br />

Associate Analyst<br />

Max.Huefner@moodys.com<br />

LONDON 44.20.7772.5454<br />

David G. Staples 44.20.7772.5593<br />

Managing Director-Corporate Finance<br />

David.Staples@moodys.com<br />

This Analysis provides an in-depth discussion<br />

of credit rating(s) for <strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong><br />

and should be read in conjunction with<br />

Moody’s most recent Credit Opinion and<br />

rating information available on Moody's<br />

website.<br />

<strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong><br />

Essen, Germany<br />

Corporate Profile<br />

GLOBAL CORPORATE FINANCE<br />

<strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong>, headquartered in Essen, Germany (Ba1, Stable outlook), is the<br />

holding company of the <strong>Evonik</strong> Group (EI, <strong>Evonik</strong> or the group), an industrial<br />

conglomerate encompassing chemicals, energy and real estate businesses. While the roots of<br />

EI date back to 1843, the group in its current legal form was established in 2007, when the<br />

so-called “white division” of R<strong>AG</strong> <strong>AG</strong> was separated from the mining activities of the group<br />

and incorporated under EI. <strong>Evonik</strong> is majority-owned by R<strong>AG</strong>-Stiftung, which was set up to<br />

fund liabilities relating to the termination of R<strong>AG</strong>’s mining activities until 2018. Funds of<br />

the financial investor CVC Capital Partners acquired a 25.01% stake in EI in 2008.<br />

EI reported revenues of €13.1 billion and EBITDA of €2 billion for the fiscal year-ended<br />

(FYE) 31 December 2009. The group employed 38,681 people at FYE 2009.<br />

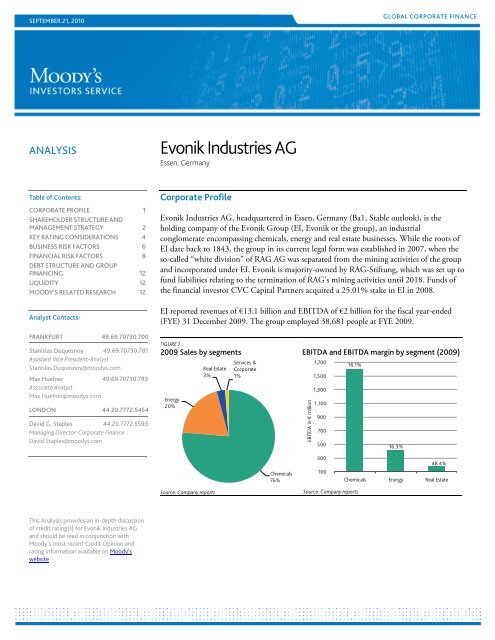

FIGURE 1<br />

2009 Sales by segments<br />

Energy<br />

20%<br />

Real Estate<br />

3%<br />

Source: Company reports<br />

Services &<br />

Corporate<br />

1%<br />

Chemicals<br />

76%<br />

EBITDA and EBITDA margin by segment (2009)<br />

EBITDA in € million<br />

1,700<br />

1,500<br />

1,300<br />

1,100<br />

900<br />

700<br />

500<br />

300<br />

100<br />

16.1%<br />

Source: Company reports<br />

16.3%<br />

48.4%<br />

Chemicals Energy Real Estate

2 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

Chemicals: <strong>Evonik</strong>’s chemicals business is one of the world’s leading specialty chemicals enterprises,<br />

with approx. 80% of revenues generated from products that hold top three market positions globally.<br />

The group’s chemicals portfolio is widespread, ranging from commoditised chemical applications in its<br />

industrial chemicals business to more stable and higher-margin applications in its health & nutrition<br />

sub-segment. EI also benefits from “Verbund” structures in silicon, its C4 chemistry business,<br />

isophorone and Methylmetacrylates (MMA), which offers better control over supplies and higher<br />

margins. EI’s chemicals portfolio is geared towards a wide array of end industries, including<br />

automotive, construction, food, pharmaceuticals, home & personal care, and oil & gas.<br />

Energy: EI’s energy business is the fifth-largest power producer on a basis of long-term contracts in<br />

Germany, with 10,201 MW of installed capacity in 2009, albeit with limited market share compared<br />

with the four largest players (RWE, Eon, Vattenfall and EnBW). EI primarily operates coal-powered<br />

power plants and its installed power generation capacity is split approximately 80%/20% between its<br />

domestic market and international locations (Turkey, Colombia and the Philippines). Besides its<br />

generation activities, <strong>Evonik</strong> also provides engineering expertise in the construction of power plants.<br />

The group is currently seeking to divest a stake in its energy business.<br />

Real Estate: With around 60,000 units (as per end of 2009) in the largest German state, North Rhine-<br />

Westphalia (NRW), EI’s real estate business is one of Germany’s largest residential real estate<br />

companies. EI also holds a 50% stake in THS, which owns approx. 73,000 residential units. In the<br />

medium term, EI is seeking to spin off its real estate business.<br />

Shareholder Structure and Management Strategy<br />

On 8 November 2007, Germany’s lower house of parliament approved the proposed coal mining<br />

financing legislation. This constituted a key milestone in a process that would ultimately lead to the<br />

complete discontinuation of the country’s hard-coal mining activities by the end of 2018, in line with<br />

the agreement made in February 2008 on a compromise between the German federal government, the<br />

states of NRW and Saarland, R<strong>AG</strong> <strong>AG</strong> and the IG BCE trade union. As part of the reorganisation<br />

process necessary to implement the compromise, the R<strong>AG</strong> group was sold to R<strong>AG</strong>-Stiftung, a<br />

foundation set up under German civil law. Subsequently, all of its non-coal businesses, which are held<br />

by EI, were separated from the subsidised hard-coal mining operations conducted by Deutsche<br />

Steinkohle <strong>AG</strong> (DSK). In July 2010, the European Commission approved a proposal for a regulation<br />

to allow state subsidies for loss-making coal mines only if plans for a closure by October 2014 are<br />

presented. In order to align the different time schedules negotiations between the involved parties will<br />

follow.If executed as proposed, the decision by the European Commission could increase pressure on<br />

R<strong>AG</strong>-Stiftung to fund mining liabilities four years earlier than initially anticipated.<br />

R<strong>AG</strong>-Stiftung owns 74.99% of EI, with the remaining stake owned by CVC. In order to raise the<br />

necessary funds to wind down the hard-coal mining activities, R<strong>AG</strong> Stiftung accumulates cash from<br />

dividends. Moody’s understands that it is the shareholders’ intention to sell their stakes through an<br />

initial public offering (IPO), notwithstanding that R<strong>AG</strong>-Stiftung would most likely keep a minority<br />

stake in EI post-IPO.<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

3 SEPTEMBER 21, 2010<br />

FIGURE 2<br />

Shareholder structure of <strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong><br />

¹ domination and profit-and-loss transfer agreement<br />

Source: <strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong><br />

Stronger focus on EI’s chemicals operations ...<br />

GLOBAL CORPORATE FINANCE<br />

Following a strategic review of the group’s operations and market opportunities at the end of fiscal<br />

year (FY) 2009, EI is currently in the transition from its conglomerate structure to becoming a focused<br />

chemicals company, paying specific attention to trends such as resource efficiency, health & nutrition<br />

and globalisation of technologies. In order to improve the breadth and strength of the group’s<br />

chemicals portfolio, EI will aim to reduce its exposure to energy and real estate.<br />

The group is well advanced in the process to sell a stake in its energy business, with potential bidders<br />

having submitted non-binding offers in a second round of bidding. Proceeds from a sale are likely to<br />

be kept in the group and used both to reduce leverage and to fund development projects at the<br />

chemicals division through a combination of organic and external growth initiatives.<br />

EI is considering a possible listing for the real estate business or the sale of a minority stake in the<br />

business in order to reduce its exposure to real estate. However, in the meantime, EI is likely to merge<br />

its real estate operations with THS. This entity owns around 73,000 units in NRW and is 50%<br />

controlled by EI and 50% by labour union (Vermögensverwaltungs- und Treuhandgesellschaft der<br />

Industriegewerkschaft Bergbau und Energie mbh (IGBCE), Hannover).<br />

... and continued attention to cost optimisation ...<br />

CVC Funds R<strong>AG</strong>-Stiftung<br />

100% 1<br />

25.01%<br />

<strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong><br />

<strong>Evonik</strong> Degussa GmbH<br />

<strong>Evonik</strong> Steag GmbH<br />

<strong>Evonik</strong> Immobilien<br />

GmbH<br />

<strong>Evonik</strong> Services GmbH<br />

Directly and<br />

indirectly 74.99%<br />

In early 2009, EI launched a cost optimisation programme, “On Track”, with the aim of reducing<br />

annual costs sustainable by €500 million by FY 2012. This programme is broad-based and focuses on<br />

operational improvements, administrative and corporate centre costs, shared services costs, and<br />

sourcing. EI is progressing well with the implementation of the programme, with more than one<br />

quarter of sustainable savings achieved at the end of FY 2009. It is also likely that EI will achieve<br />

savings slightly exceeding €550 million, which is higher than initially anticipated.<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

4 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

... should pave the way for a successful IPO in the medium term<br />

The ultimate target of EI is to float the business in an IPO, as this option would allow both<br />

shareholders to fulfil their strategic objectives. CVC could exit its investment in the medium term and<br />

R<strong>AG</strong>-Stiftung could raise proceeds necessary to fund liabilities arising from the discontinuation of<br />

Germany’s hard-coal mining operations. Moody’s believes that the successful implementation of EI’s<br />

strategy focused on the development of its chemicals franchise will support a successful IPO.<br />

All in all, EI’s corporate strategy is sensible and should be supportive of the group’s credit profile, in<br />

Moody’s view. The divestment proceeds from the sale of a stake in the energy business will be used to<br />

reduce EI’s leverage and should enable the group to strengthen its chemicals franchise. Moody’s<br />

considers EI’s focus on its chemicals franchise to be positive, as the group lacks critical mass in energy<br />

and already has an excellent platform for growth in chemicals, with leading market positions in most<br />

of its chemicals end markets. Moody’s also notes that a more focused group with a strong chemicals<br />

franchise should be easier to float on the stock exchange.<br />

Key Rating Considerations<br />

On September 21, 2010 Moody’s Investors Services has assigned a Ba1 Corporate Family Rating<br />

(CFR) for the group and Probability of Default Rating (PDR) to <strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong>, the holding<br />

company of a German-based conglomerate encompassing chemicals, energy and real estate businesses.<br />

At the same time, Moody’s has assigned a Ba1 rating to EUR750 million of Senior Unsecured Notes<br />

issued by <strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong>. The outlook on all ratings is stable. This was the first time that<br />

Moody’s has rated <strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong>.<br />

Moody’s Ba1 Corporate Family Rating for <strong>Evonik</strong> reflects the group’s (i) strong business profile in<br />

chemicals with leading market positions, large scale, wide end-product and end-market diversity with a<br />

good mix between more cyclical upstream activities and stable specialty applications, (ii) above average<br />

operating margins at the chemicals business supported by the quality and technology content of its<br />

products as well as through a good level of vertical integration through selective ‘Verbund’ structures,<br />

(iii) clear strategic path to focus on the group’s strong chemical division by partial divestments of the<br />

energy and real estate business notwithstanding that the successful implementation of this strategy<br />

bears execution risk, (iv) focus on optimizing its cost structure through the implementation of various<br />

cost initiatives across the businesses to further enhance margin levels notwithstanding that <strong>Evonik</strong><br />

already generates operating margins in excess of most of its European chemicals peers, (v) strong<br />

technology- as well as R&D platform (more than 20% of sales generated from products not older than<br />

five years) allowing for a timely response to customer needs and to new market trends, and (vi) strong<br />

liquidity profile with currently over EUR1.359 billion in cash on balance sheet as well as access to an<br />

undrawn EUR1.5 billion unsecured revolving credit facility.<br />

The rating remains constrained by <strong>Evonik</strong>’s (i) leveraged capital structure if compared to investment<br />

grade chemicals peers, (ii) aggressive dividend policy (payout ratios was around 100% of net income in<br />

FY 2009) which is expected to exert negative pressure on free cash flow generation going forward, (iii)<br />

limited exposure to cyclical customer industries such as automotive and construction notwithstanding<br />

that the group has no specific concentration on any specific industries, customers or products, (iv)<br />

shareholder structure with the cohabitation of a financial investor with a minority stake and a<br />

foundation set up in 2007 to wind down the subsidized coal activities of former R<strong>AG</strong> by 2018, which<br />

might have different strategic interests although the execution of the group’s strategy since the change<br />

in the ownership structure has been smooth and focused.<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

5 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

The stable outlook assigned to the rating reflects Moody’s expectation that <strong>Evonik</strong> will continue to<br />

focus on deleveraging and will apply discretion in the implementation of its organic growth strategy.<br />

The agency’s expectation is predicated upon a gradual recovery in chemicals demand across all regions<br />

with continued stronger growth patterns anticipated in emerging economies. The strong recovery in<br />

emerging market economies have been the main driver of the recovery in the European Chemicals<br />

industry. The derailing of emerging economies growth and / or a reversal in the recovery of developed<br />

economies, which are concurrently considered as tail risks could invalidate our assumption underlying<br />

the assignment of a stable outlook to <strong>Evonik</strong>.<br />

Continued strong operating performance coupled with prudent balance sheet management and / or<br />

proceeds from asset disposals applied to debt reduction leading to Adjusted Net Debt / EBITDA of<br />

below 3.5x and RCF / Net Debt of above 15% on a sustainable basis would exert positive pressure on<br />

the ratings.<br />

A sharp deterioration in the operating environment and / or shift in the group’s organic and external<br />

growth strategy leading to sustained negative free cash flow generation and / or a deterioration in<br />

Adjusted Net Debt / EBITDA to sustainably above 4.5x would lead to negative pressure on the<br />

ratings. The agency would also expect <strong>Evonik</strong> to maintain RCF / Net Debt in the low double digit to<br />

avert negative pressure on the ratings.<br />

FIGURE 3<br />

Rating factors table as per Moody’s Global Chemical Industry Rating Methodology<br />

EVONIK INDUSTRIES <strong>AG</strong><br />

CHEMICAL INDUSTRY<br />

Factor 1: Business Profile<br />

Aaa Aa A Baa Ba B Caa Ca<br />

a) Business Position Assessment X<br />

Factor 2: Size & Stability<br />

a) Revenue (Billions of US$) X<br />

b) # of Divisions of Equal Size X<br />

c) Stability of EBITDA X<br />

Factor 3: Cost Position<br />

a) EBITDA Margin (3 Yr. Avg.) X<br />

b) ROA - EBIT / Assets (3 Yr. Avg.) X<br />

Factor 4: Leverage / Financial policies<br />

a) Current Debt / Capital X<br />

b) Debt / EBITDA (3 Yr. Avg.) X<br />

Factor 5: Financial Strength<br />

a) EBITDA / Total Interest Expense (3 Yr. Avg.) X<br />

b) Retained Cash Flow / Debt (3 Yr. Avg.) X<br />

c) Free Cash Flow / Debt (3 Yr. Avg.)<br />

Rating:<br />

a) Indicated Rating from Grid X<br />

b) Actual Rating Assigned Ba1<br />

X<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

6 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

To assess EI, Moody’s has applied its Global Chemical Industry Rating Methodology, published in<br />

December 2009. The methodology contains five key rating factors (Business Profile, Size and Stability,<br />

Cost Position, Management Strategy and Financial Strength), incorporating several sub-factors or<br />

metrics, against which we assign a score to the company. EI’s performance against these factors and<br />

sub-factors is detailed under “Business Risk Factors” and “Financial Risk Factors”, as follows:<br />

Business Risk Factors<br />

The strong business profile of EI is largely supported by its world-leading chemicals franchise<br />

EI’s chemicals business segment, which accounts for 76% of group revenues and 79% of group<br />

EBITDA, is one of the largest and most profitable European specialty chemicals companies, with<br />

around 100 production sites in 28 countries. The products of the chemicals franchise hold marketleading<br />

positions, including in silicas, polyamide 12, super absorbants, Dl-methionine to name a few.<br />

EI is active across the entire value chain of the chemicals industry, with some exposure to commodity<br />

type chemicals (mainly centred around the group’s C4 chemistry expertise), but mainly to specialty<br />

chemicals applications in its consumer specialties and health & nutrition business units (conditioners,<br />

super absorbants, skin cleanser), which carry higher margins. Importantly, EI benefits from Verbund<br />

structures in several of its chemicals product lines (silicon, C4, isophorone and MMA), which enables<br />

the group to control the entire value chain, a key competitive advantage over non-integrated players.<br />

EI’s chemicals franchise is also widely diversified in terms of end markets, with exposure to the food,<br />

pharmaceuticals, healthcare, automotive and aerospace industries among others.<br />

FIGURE 4<br />

Sales by end market for Chemicals (2009)<br />

Source: <strong>Evonik</strong> <strong>Industries</strong> <strong>AG</strong><br />

Home / Personal Care<br />

18%<br />

Other<br />

17%<br />

Automotive<br />

16%<br />

Pharma<br />

4%<br />

Oil & Gas<br />

5%<br />

Construction<br />

7%<br />

Coating<br />

10%<br />

EI’s chemicals business uses raw materials ranging from petrochemicals to some natural oil-based<br />

oleochemicals. Despite the group’s transformation in the past five years to a more specialty-end<br />

chemicals company, approximately 70% of its raw materials are still sensitive to oil prices, albeit to<br />

varying degrees. The chemical division’s main raw materials include C4-crack, carbon black feedstock,<br />

propylene, methanol and acetone.<br />

Food<br />

12%<br />

Plastic<br />

11%<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

7 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

Raw material costs represent more than 40% of the division’s sales. In 2009, EI benefitted from the<br />

significant decrease in raw material costs which only partly had to be passed on to the customers (sales<br />

price -6%); During H1, the increase in raw material costs (compared to H1 2009) could be<br />

successfully passed on to the customers (sales price +7%)<br />

Energy and real estate businesses offer some level of earnings diversification but have lower, or more volatile,<br />

returns on capital employed<br />

The earnings diversification stemming from EI’s energy and real estate businesses, accounting for 20%<br />

and 3% of group revenues, respectively, is only valid to a certain extent. The group’s energy division is<br />

focused on power generation and has no retail integration. Moody’s notes that most of EI’s power<br />

generation is sold under long-term contracts to other utilities or industrial customers, which means<br />

that it is a more stable business and is relatively less exposed to normal economic cycles. The real estate<br />

business offers very stable earnings and operating cash flows but its contribution to the group’s overall<br />

earnings is relatively limited, with only 9% of group EBITDA generated from this business.<br />

Given the above, EI’s strategy to focus its efforts and resources on its chemicals franchise in future is<br />

sensible, in Moody’s view. This view is supported by our analysis of the group’s returns on capital<br />

employed (ROCE). As illustrated in Figure 5, below, the chemicals division generated ROCE well in<br />

excess of that of the real estate business over the past four years. In addition, ROCE at the group’s<br />

energy business has proven much more volatile than that at the chemicals division.<br />

FIGURE 5<br />

Return on Capital employed by division<br />

ROCE 2006 2007 2008 2009<br />

Chemicals 8.5% 10.1% 9.9% 10.3%<br />

Energy 13.8% 15.3% 13.2% 9.7%<br />

Real Estate 6.6% 8.3% 9.2% 7.3%<br />

The group generates around 61% of sales and has more than 80% of its assets (see Figure 6) in its<br />

traditional European markets. EI’s overweight position in the high-cost regions of Europe and North<br />

America is a disadvantage, particularly in certain sub-sectors of the chemicals industry, in which lowcost<br />

players based in China and India have exacerbated the competitiveness.<br />

FIGURE 6<br />

Geographical breakdown of sales and assets (FYE 2009)<br />

Sales<br />

Segment<br />

Assets<br />

Germany Europe excl. Germany North America Asia Central & South America Other<br />

0%<br />

Source: Company reports<br />

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

8 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

Score of A for the “Size and Stability” rating factor reflects the group’s scale and breadth ...<br />

With annual revenues of €13.1 billion (€10.0 billion for its chemicals division), EI is among the largest<br />

European chemical issuers rated by Moody’s. On a more negative note, the group’s energy business<br />

clearly lacks scale and breadth compared with other European multi-utilities. Moody’s expects the size<br />

of the group to remain relatively stable in the short to medium term, given that parts of the proceeds<br />

from a potential sale of a stake in the group’s energy business would be reinvested in the chemicals<br />

franchise while the other part will be applied to debt reduction. We do not expect EI to embark on an<br />

aggressive external expansion strategy as the group’s focus will be on maximising its enterprise value<br />

through organic projects and bolt-on acquisitions ahead of a potential IPO.<br />

... and the stability of its operating margins through the cycle<br />

As referred to above, EI’s diversified chemicals portfolio has proven very stable through the downturn,<br />

with EBITDA margins in FY 2009 exceeding those in the previous year. The group’s real estate<br />

business, albeit dilutive in terms of ROCE, offers earnings and operating cash flow stability through<br />

the cycle. As illustrated in Figure 7, below, EI has been able to sustain healthy and stable operating<br />

margins through the cycle and has outperformed its peers.<br />

FIGURE 7<br />

EBITDA margins of EI in comparison to peers<br />

ADJUSTED EBITDA MARGINS 2007 2008 2009<br />

<strong>Evonik</strong> <strong>Industries</strong> 14.42% 11.93% 13.87%<br />

Lanxess 9.87% 8.53% 7.81%<br />

Akzo Nobel 13.65% 13.77% 13.84%<br />

Clariant 8.79% 8.64% 4.75%<br />

Low Baa score for the “Cost Position” rating factor offers improvement potential in line with the implementation<br />

of EI’s “On Track” programme<br />

While EI already exhibits relatively high margins compared with most of its peers, Moody’s believes<br />

that the strength of the group’s chemicals operations should allow the group to increase its operating<br />

margins going forward. In addition, EI’s implementation of its broad-based cost optimisation<br />

programme, “On Track”, should help EI to retain industry-leading margins in the medium term, in<br />

Moody’s view. As a consequence of EI’s implementation of this cost optimisation programme and a<br />

higher focus on its chemicals operations, the group’s margins could be lifted into the high Baa – low A<br />

range (i.e. around 15% EBITDA margin) through the cycle.<br />

Financial Risk Factors<br />

High pension liabilities and reported financial debt ...<br />

EI’s overall weak Ba positioning for debt leverage rating factors reflects the group’s relatively high<br />

leverage on an adjusted basis. Adjustments for pension liabilities and operating leases accounted for<br />

almost 60% of EI’s adjusted net indebtedness at FYE 2009. While EI has largely focused on reducing<br />

its financial indebtedness over the past 12-18 months (its net reported indebtedness was reduced by<br />

€1.1 billion to €3.4 billion over the past 18 months to 30 June 2010), the group’s debt metrics remain<br />

weaker than those of its direct peers in high non-investment-grade and low-investment-grade territory.<br />

In Moody’s view, EI’s efforts to further reduce its leverage through asset disposals (the group is<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

9 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

currently in the process of selling a stake in the energy business), with the proceeds to be partly applied<br />

to debt reduction, should help to position the group’s debt metrics in line with an investment-grade<br />

rating over time. Moody’s notes that while pension liabilities are included in its debt adjustments, they<br />

exert less pressure on the capital structure of EI than financial indebtedness, given the absence of<br />

maturities and the lower level of net interest cost carried on these liabilities.<br />

... as well as a relatively aggressive dividend policy result in elevated debt metrics<br />

Moody’s notes that EI has historically returned material amounts of cash to its shareholders through<br />

the payment of sizeable dividends. Payout ratios have averaged more than 100% of the group’s net<br />

income over the past two years. Looking ahead, we expect EI to continue to pay large dividends.<br />

FIGURE 8<br />

EI has weaker credit metrics than its peers [1]<br />

EBITDA/ NET DEBT/<br />

RCF/<br />

FCF/<br />

RATING INTEREST EXP<br />

EBITDA NET DEBT NET DEBT<br />

<strong>Evonik</strong> <strong>Industries</strong> Ba1/sta 3.1x 4.8x 8.8% 10.9%<br />

Lanxess Baa2/sta 3.7x 2.9x 18.4% 19.8%<br />

Clariant Ba1/sta 3.0x 3.4x 26.2% 54.4%<br />

Akzo Nobel Baa1/sta 5.4x 2.1x 20.9% 22.2%<br />

[1] These figures are based on standard adjustments that Moody’s makes to enable global consistency for issuers reporting under IFRS. For details on<br />

these adjustments please refer to our rating methodology document “Moody’s Approach to Global Standard Adjustments in the Analysis of Financial<br />

Statements of Non-Financial Corporations - Part II”, published in February 2006.<br />

Ba score for “Financial Strength” rating factor reflects EI’s solid operating performance despite difficult market<br />

conditions ...<br />

Despite challenging market conditions especially during the first half of fiscal year 2009 with continued<br />

destocking patterns across the chemicals value chain and pressure on prices whilst most chemicals<br />

companies were still absorbing high raw material costs through their P&Ls, EI posted a robust<br />

operating performance. EI’s performance was supported by the strength of its chemicals franchise and<br />

the overall diversity of its business profile with exposure to chemicals, energy and real estate.<br />

In 2009, EI reported a decline in sales of 18% year-on-year to €13.1 billion. Both the group’s<br />

chemicals and energy businesses posted a sharp fall in sales (-15% and -25%, respectively), mainly on<br />

the back of lower volumes (-10% for the chemicals business), but also as a result of lower prices for<br />

the chemicals business (-6% year-on year). The real estate business fared well, with a 1% increase in<br />

revenues year-on-year.<br />

In the same period, EBITDA at the group level was down 6%, to €2.0 billion, lifting the EBITDA<br />

margin by 1.9 percentage points, to 15.5%, thanks to an over-proportional reduction in cost of goods<br />

sold (COGS, -20%) and the group’s implementation of cost-cutting measures including short working<br />

hours, optimised maintenance expenses, reduced external services and the streamlining of<br />

administrative functions. Selling, general and administrative expenses (SG&A) fell by 14%, as EI<br />

maintained a high level of R&D (€300 million) in order not to jeopardise its future developments in<br />

an industry that is evolving rapidly. In terms of divisional EBITDA performance, the chemicals<br />

business proved to be the most resilient through the downturn. This division posted a 1% decline in<br />

EBITDA, lifting its margin by 2.3 percentage points to 16.1%, mainly as a result of cost-cutting<br />

measures in H1 2009 (3,500 employees, or almost 12% of the division’s workforce, were working<br />

short hours) and high operating leverage when volumes improved in H2 2009. Meanwhile, the energy<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

10 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

and real estate divisions posted a decline in EBITDA of 19% and 16%, respectively, notwithstanding<br />

that the real estate business benefited from a one-off gain on disposals in FY 2008.<br />

For H1 2010, EI reported a 24% year-on-year increase in sales to €7.8 billion, supported by a sharp<br />

improvement in the performance of the group’s chemicals business. The chemicals division posted a<br />

34% increase in revenues, to €6.3 billion, driven by higher volumes (+25%) and prices (+7%).<br />

Currency effects and changes in the scope of consolidation were more or less neutral (+1%<br />

respectively), while the revenues of the energy and real estate businesses were flat to slightly down (-1%<br />

and -3%, respectively). EBITDA was sharply up (+83% to €1.5 billion), again mainly supported by<br />

the chemicals business (+91% to €1.2 billion).<br />

FIGURE 9<br />

Revenues and profitability [1]<br />

€ MILLION 2009 2008 2007<br />

Turnover 13,076 15,873 14,444<br />

Operating Profit 791 898 994<br />

Operating Profit Margin 6.0% 5.7% 6.9%<br />

EBITDA [2] 1,814 1,893 2,083<br />

EBITDA Margin [2] 13.9% 11.9% 14.4%<br />

EBITA/ Average Assets excl. cash [2] 5.4% 5.6% 6.6%<br />

[1] These figures are based on standard adjustments that Moody’s makes to enable global consistency for issuers reporting under IFRS. For details on<br />

these adjustments, please refer to our rating methodology document “Moody’s Approach to Global Standard Adjustments in the Analysis of Financial<br />

Statements of Non-Financial Corporations – Part II”, published in February 2006.<br />

[2] EBITDA/EBITA computed as defined in Moody’s Global Chemical Industry Rating Methodology, published in February 2006.<br />

... and the management’s efforts to improve the group’s cost structure and cash flow generation<br />

EI rapidly adjusted to deteriorating market conditions at the end of FY 2008, as evidenced by the costcutting<br />

initiatives that the group launched to protects its earnings. The measures implemented were<br />

mainly centred on shortened working hours, reduced variable salary payments, reduction in external<br />

services and on the streamlining of administrative functions. EI achieved costs savings of more than<br />

€500 million during the course of 2009, of which more than one quarter was of a sustainable nature<br />

and will be retained. In addition to temporary measures to adjust to depressed market conditions EI<br />

has also launched a cost optimisation programme, “On Track” which aims to achieve annual<br />

sustainable cost savings of €500 million per annum by 2012. As referred to in the “Management<br />

Strategy” section, this programme will be focused on the entire value chain, with savings targeted in<br />

operations, corporate centre, administration, shared services, insurance and sourcing. The group’s<br />

various restructuring and cost-cutting measures led to a P&L charge of €103 million in 2009.<br />

Besides implementing short-term and sustainable cost-savings measures, EI has been focusing on<br />

protecting its cash flows through the increased control of working capital and capital expenditures<br />

(capex). EI managed to reduce its net working capital from €3.2 billion in December 2008 to around<br />

€2.3 billion in December 2009, and reduced its NWC/sales ratio, respectively the days of net working<br />

capital, significantly. The group has also reduced capex by 33%, to €834 million.<br />

In 2009, EI exhibited mixed results with regard to cash flow generation. EI’s funds from operations<br />

(FFO) and retained cash flow (RCF) were under pressure due to the group’s weaker operating<br />

performance, falling by 18% to €1.1 billion and by 21% to €760 million, respectively. The group’s<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

11 SEPTEMBER 21, 2010<br />

GLOBAL CORPORATE FINANCE<br />

cash flow from operations (CFO) and FCF improved year-on-year, reflecting both company-specific<br />

measures to reduce capex, working capital days and volumes, which resulted in material working<br />

capital inflows (€1,230 net working capital inflow in 2009). As a result, EI’s FCF/net debt ratio<br />

(10.9%) exceeded its RCF/net debt ratio (8.8%).<br />

Going forward, Moody’s expects EI’s debt and cash flow metrics to improve as a result of: (i) moderate<br />

organic de-leveraging (FCF is expected to be slightly positive in 2010); (ii) asset disposals (EI is in advanced<br />

negotiations on the sale of a stake in its energy business); and (iii) improved operating performance and cash<br />

flow generation (before working capital movements). While Moody’s anticipates some of the proceeds from<br />

assets disposals being reinvested in the business, we believe that the management of the group will apply<br />

discretion in the reallocation of proceeds to ensure that it further improves its balance sheet structure and<br />

achieves an investment-grade financial profile in the medium term.<br />

FIGURE 10<br />

Cash flow and coverage ratios [1]<br />

€ MILLION 2009 2008 2007<br />

Funds from Operations (FFO) 1,101 1,338 1,369<br />

Cash Flow from Operations 2,191 471 1,277<br />

(FFO + Interest expense)/ Interest Expense 2.9x 2.5x 3.0x<br />

Retained Cash Flow (pre-WC) 760 958 1,073<br />

Free Cash Flow 944 -1,157 -149<br />

[1] These figures are based on standard adjustments that Moody’s makes to enable global consistency for issuers reporting under IFRS. For details on<br />

these adjustments, please refer to our rating methodology document “Moody’s Approach to Global Standard Adjustments in the Analysis of Financial<br />

Statements of Non-Financial Corporations – Part II”, published in February 2006.<br />

FIGURE 11<br />

Leverage and liquidity [1]<br />

€ MILLION 2009 2008 2007<br />

Short-Term Debt 455 1,008 942<br />

Long-Term Debt 4,040 4,394 3,752<br />

Total Debt 4,495 5,402 4,694<br />

Cash & Marketable Securities 885 542 349<br />

Net Debt 3,610 4,860 4,345<br />

Net Debt Adjustments:<br />

Underfunded Pensions 4,193 3,864 3,968<br />

Operating leases 876 750 558<br />

Contingent Liabilities/Other -26 -177 -181<br />

Net Adjusted Debt 8,653 9,297 8,690<br />

RCF 760 958 1,073<br />

FCF 944 -1,157 -149<br />

RCF/Net Adj. Debt 8.8% 10.3% 12.3%<br />

FCF/Net Adjusted Debt 10.9% -12.4% -1.7%<br />

[1] These figures are based on standard adjustments that Moody’s makes to enable global consistency for issuers reporting under IFRS. For details on<br />

these adjustments, please refer to the rating methodology document “Moody’s Approach to Global Standard Adjustments in the Analysis of Financial<br />

Statements of Non-Financial Corporations – Part II”, published in February 2006.<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

12 SEPTEMBER 21, 2010<br />

Debt Structure and Group Financing<br />

GLOBAL CORPORATE FINANCE<br />

The debt structure of EI reflects the group’s relatively short history as well as its conglomerate<br />

structure, encompassing the previously independent operating companies. Therefore, the group’s<br />

financing comprises a mixture of debt instruments raised at the parent company level (a €1.5 billion<br />

unsecured syndicated revolving credit facility signed in June 2010 and a €750 million senior unsecured<br />

bond) and at operating subsidiary level (a €1.25 billion senior unsecured bond issued by <strong>Evonik</strong><br />

Degussa GmbH, ca. €1.2 billion worth of non-recourse project financing in the energy business and<br />

ca. €500 million worth of mortgage-backed real estate loans in the real estate business). The absence of<br />

notching of the €750 million senior unsecured bond from the CFR reflects Moody’s expectation that:<br />

(i) EI will increasingly act as the central funding entity for the group, providing liquidity to operating<br />

subsidiaries through intra-group cash pooling arrangements; and (ii) new debt will be mainly raised at<br />

the parent company level, thereby reducing the structural subordination from legacy debt located at<br />

the operating subsidiary level.<br />

EI has access to a €1.5 billion undrawn unsecured revolver signed in June 2010 with three tranches<br />

maturing in 2012, 2013 and 2015. The facility contains financial covenants with ample headroom.<br />

EI benefits from a comfortable maturity profile with no major maturities before FY 2013, when the<br />

€1.25 billion senior unsecured bond at <strong>Evonik</strong> Degussa GmbH matures.<br />

Liquidity<br />

EI’s liquidity position is strong. The group’s liquidity is supported by large cash balances (EUR1,359<br />

million at 30 th June 2010) and access to a EUR1.5 billion unsecured syndicated revolving credit<br />

facility (undrawn at 30 th June 2010). Operating cash outlays for the coming twelve months, which<br />

comprise mainly capital expenditures, working capital, dividends are expected to be largely covered by<br />

operating cash flows.<br />

Moody’s Related Research<br />

Industry Outlook:<br />

» North American and EMEA Chemicals Stable as Industrial Demand Strengthens, May 2010<br />

(125347)<br />

Rating Methodologies:<br />

» Moody’s Approach to Global Standard Adjustments in the Analysis of Financial Statements of<br />

Non-Financial Corporations – Part II”, February 2006 (96729)<br />

» Global Chemical Industry, December 2009 (121271)<br />

To access any of these reports, click on the entry above. Note that these references are current as of the date of publication of<br />

this report and that more recent reports may be available. All research may not be available to all clients.<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>

13 SEPTEMBER 21, 2010<br />

Report Number: 127540<br />

Authors<br />

Stanislas Duquesnoy<br />

Max Huefner<br />

Senior Production Associate<br />

Wendy Kroeker<br />

GLOBAL CORPORATE FINANCE<br />

© 2010 Moody’s Investors Service, Inc. and/or its licensors and affiliates (collectively, “MOODY’S”). All rights reserved.<br />

CREDIT RATINGS ARE MOODY'S INVESTORS SERVICE, INC.'S (“MIS”) CURRENT OPINIONS OF THE RELATIVE FUTURE<br />

CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES. MIS DEFINES CREDIT RISK AS<br />

THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY<br />

ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK,<br />

INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS ARE<br />

NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. CREDIT RATINGS DO NOT CONSTITUTE INVESTMENT OR<br />

FINANCIAL ADVICE, AND CREDIT RATINGS ARE NOT RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR<br />

SECURITIES. CREDIT RATINGS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR<br />

INVESTOR. MIS ISSUES ITS CREDIT RATINGS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR<br />

WILL MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE,<br />

HOLDING, OR SALE.<br />

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND<br />

NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACK<strong>AG</strong>ED, FURTHER TRANSMITTED,<br />

TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN<br />

WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S<br />

PRIOR WRITTEN CONSENT. All information contained herein is obtained by MOODY’S from sources believed by it to be accurate<br />

and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained<br />

herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in<br />

assigning a credit rating is of sufficient quality and from sources Moody’s considers to be reliable, including, when appropriate,<br />

independent third-party sources. However, MOODY’S is not an auditor and cannot in every instance independently verify or<br />

validate information received in the rating process. Under no circumstances shall MOODY’S have any liability to any person or entity<br />

for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error (negligent or otherwise) or other<br />

circumstance or contingency within or outside the control of MOODY’S or any of its directors, officers, employees or agents in<br />

connection with the procurement, collection, compilation, analysis, interpretation, communication, publication or delivery of any<br />

such information, or (b) any direct, indirect, special, consequential, compensatory or incidental damages whatsoever (including<br />

without limitation, lost profits), even if MOODY’S is advised in advance of the possibility of such damages, resulting from the use of<br />

or inability to use, any such information. The ratings, financial reporting analysis, projections, and other observations, if any,<br />

constituting part of the information contained herein are, and must be construed solely as, statements of opinion and not<br />

statements of fact or recommendations to purchase, sell or hold any securities. Each user of the information contained herein must<br />

make its own study and evaluation of each security it may consider purchasing, holding or selling. NO WARRANTY, EXPRESS OR<br />

IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE<br />

OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER<br />

WHATSOEVER.<br />

MIS, a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt<br />

securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by MIS<br />

have, prior to assignment of any rating, agreed to pay to MIS for appraisal and rating services rendered by it fees ranging from $1,500<br />

to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MIS’s ratings and<br />

rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between<br />

entities who hold ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is<br />

posted annually at www.moodys.com under the heading “Shareholder Relations — Corporate Governance — Director and<br />

Shareholder Affiliation Policy.”<br />

Any publication into Australia of this document is by MOODY’S affiliate, Moody’s Investors Service Pty Limited ABN 61 003 399<br />

657, which holds Australian Financial Services License no. 336969. This document is intended to be provided only to “wholesale<br />

clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within<br />

Australia, you represent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and<br />

that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to “retail clients”<br />

within the meaning of section 761G of the Corporations Act 2001.<br />

ANALYSIS: EVONIK INDUSTRIES <strong>AG</strong>