valuacion de general motors usando un modelo de opciones reales

valuacion de general motors usando un modelo de opciones reales

valuacion de general motors usando un modelo de opciones reales

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

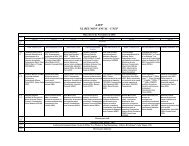

Valuación GM<br />

ENTERPRISE VALUE<br />

FQ3 2008 35.521,87<br />

FQ2 2008 30.393,87 -15,59%<br />

FQ1 2008 32.524,22 6,77%<br />

FQ4 2007 32.871,22 1,06%<br />

FQ3 2007 41.445,70 23,18%<br />

FQ2 2007 45.203,69 8,68%<br />

FQ1 2007 43.160,22 -4,63%<br />

FQ4 2006 42.289,39 -2,04%<br />

FQ3 2006 43.651,23 3,17%<br />

FQ2 2006 42.108,46 -3,60%<br />

FQ1 2006 237.563,40<br />

FQ4 2005 249.292,40 4,82%<br />

FQ3 2005 241.761,10 -3,07%<br />

FQ2 2005 246.913,10 2,11%<br />

FQ1 2005 253.775,20 2,74%<br />

FQ4 2004 263.523,20 3,77%<br />

FQ3 2004 254.118,90 -3,63%<br />

FQ2 2004 250.323,40 -1,50%<br />

FQ1 2004 253.439,40 1,24%<br />

FQ4 2003 247.303,70 -2,45%<br />

FQ3 2003 222.376,20 -10,62%<br />

FQ2 2003 203.540,70 -8,85%<br />

FQ1 2003 187.585,90 -8,16%<br />

FQ4 2002 183.960,10 -1,95%<br />

FQ3 2002 172.988,00 -6,15%<br />

FQ2 2002 175.874,50 1,65%<br />

FQ1 2002 169.414,20 -3,74%<br />

FQ4 2001 164.186,20 -3,13%<br />

FQ3 2001 151.539,40 -8,02%<br />

FQ2 2001 159.328,20 5,01%<br />

FQ1 2001 150.965,40 -5,39%<br />

FQ4 2000 152.382,30 0,93%<br />

FQ3 2000 157.673,80 3,41%<br />

FQ2 2000 150.698,40 -4,52%<br />

FQ1 2000 167.029,60 10,29%<br />

FQ4 1999 156.275,50 -6,66%<br />

FQ3 1999 142.180,00 -9,45%<br />

FQ2 1999 136.867,60 -3,81%<br />

FQ1 1999 149.046,90 8,52%<br />

FQ4 1998 144.605,90 -3,02%<br />

FQ3 1998 124.776,40 -14,75%<br />

Javier Herrou Febrero 2009 Página 19 <strong>de</strong> 54