valuacion de general motors usando un modelo de opciones reales

valuacion de general motors usando un modelo de opciones reales

valuacion de general motors usando un modelo de opciones reales

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Valuación GM<br />

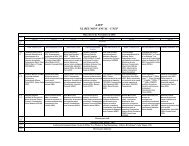

Analyst Estimates<br />

Earnings Est<br />

Current Qtr Next Qtr Current Year Next Year<br />

Dec-08 Mar-09 Dec-08 Dec-09<br />

Avg. Estimate -7.39 -3.75 -26.02 -19.69<br />

No. of<br />

Analysts<br />

10 3 11 12<br />

Low Estimate -11.33 -8.47 -30.50 -35.00<br />

High Estimate -5.32 -0.41 -19.19 -1.29<br />

Year Ago EPS 0.08 -0.62 -0.33 -26.02<br />

Revenue Est<br />

Current Qtr Next Qtr Current Year Next Year<br />

Dec-08 Mar-09 Dec-08 Dec-09<br />

Avg. Estimate 35.14B 29.23B 152.61B 135.68B<br />

No. of<br />

Analysts<br />

9 3 6 9<br />

Low Estimate 30.63B 24.54B 147.93B 112.97B<br />

High Estimate 39.93B 37.25B 158.70B 162.00B<br />

Year Ago<br />

Sales<br />

42.16B 42.13B 173.59B 152.61B<br />

Sales Growth<br />

(year/est)<br />

-16.6% -30.6% -12.1% -11.1%<br />

Earnings<br />

History<br />

Dec-07 Mar-08 J<strong>un</strong>-08 Sep-08<br />

EPS Est -0.59 -1.60 -2.62 -3.70<br />

EPS Actual 0.08 -0.62 -11.21 -7.35<br />

Difference 0.67 0.98 -8.59 -3.65<br />

Surprise % 113.6% 61.3% -327.9% -98.6%<br />

Growth Est GM Industry Sector S&P 500<br />

Current Qtr. -9337.5% -495.9% -35.4% -30.1%<br />

Next Qtr. -504.8% N/A 30.9% 28.1%<br />

Javier Herrou Febrero 2009 Página 51 <strong>de</strong> 54