valuacion de general motors usando un modelo de opciones reales

valuacion de general motors usando un modelo de opciones reales

valuacion de general motors usando un modelo de opciones reales

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Valuación GM<br />

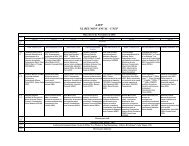

This Year -7784.8% N/A 19.8% -8.5%<br />

Next Year 24.3% N/A 50.4% 26.6%<br />

Past 5 Years<br />

(per annum)<br />

Next 5 Years<br />

(per annum)<br />

Price/Earnings<br />

(avg. for<br />

comparison<br />

categories)<br />

PEG Ratio<br />

(avg. for<br />

comparison<br />

categories)<br />

-32.13% N/A N/A N/A<br />

7.25% 12.79% 9.88% N/A<br />

N/A N/A 18.73 13.41<br />

N/A N/A 1.9 N/A<br />

Javier Herrou Febrero 2009 Página 52 <strong>de</strong> 54