Februarie/Maart

Februarie/Maart

Februarie/Maart

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• at the end of the season, use the actual cash<br />

flow statement to estimate the projected cash<br />

flow statement for the next season.<br />

• Compile a projected cash flow statement by making<br />

use of references from your previous year’s<br />

actual entries on farm records, tax forms and<br />

cheque books.<br />

• Use reliable crop and livestock budgets to provide<br />

the necessary information for projecting future<br />

cash flows.<br />

• Consider farm business changes that are expected<br />

to take place the coming year, such as crop<br />

rotations, new livestock enterprises or sales and<br />

purchases of capital assets.<br />

even though your first cash flow projection may not<br />

be as accurate, it will provide important planning<br />

information and if the exercise is done regularly, projections<br />

will become more accurate in the future.<br />

hElPFul SuGGESTIonS To SolvE CASh<br />

FloW PRoBlEMS<br />

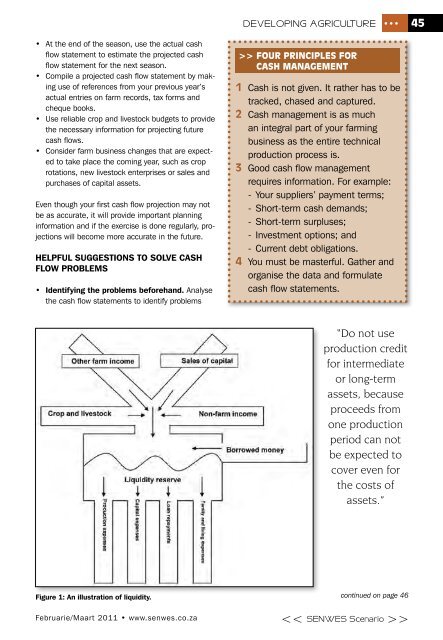

• Identifying the problems beforehand. analyse<br />

the cash flow statements to identify problems<br />

Figure 1: An illustration of liquidity.<br />

<strong>Februarie</strong>/<strong>Maart</strong> 2011 • www.senwes.co.za<br />

DEvElopiNG aGricUlTUrE •••<br />

>> Four prinCiples For<br />

Cash management<br />

1 Cash is not given. It rather has to be<br />

tracked, chased and captured.<br />

2 Cash management is as much<br />

an integral part of your farming<br />

business as the entire technical<br />

production process is.<br />

3 good cash flow management<br />

requires information. For example:<br />

- Your suppliers’ payment terms;<br />

- Short-term cash demands;<br />

- Short-term surpluses;<br />

- Investment options; and<br />

- Current debt obligations.<br />

4 You must be masterful. gather and<br />

organise the data and formulate<br />

cash flow statements.<br />

“Do not use<br />

production credit<br />

for intermediate<br />

or long-term<br />

assets, because<br />

proceeds from<br />

one production<br />

period can not<br />

be expected to<br />

cover even for<br />

the costs of<br />

assets.”<br />

continued on page 46<br />

><br />

45