ke staženà - Pojistný obzor

ke staženà - Pojistný obzor

ke staženà - Pojistný obzor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

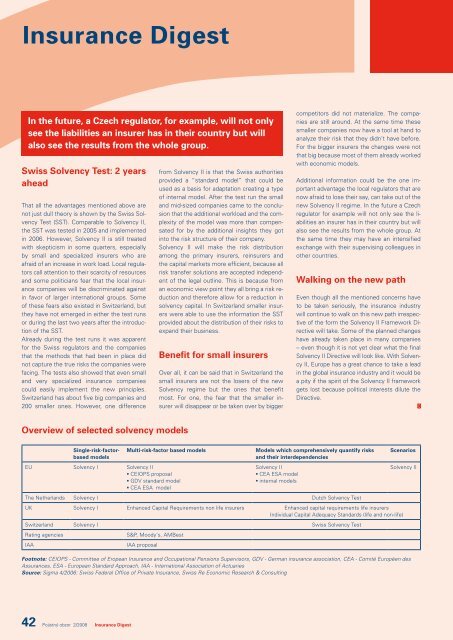

Insurance DigestIn the future, a Czech regulator, for example, will not onlysee the liabilities an insurer has in their country but willalso see the results from the whole group.Swiss Solvency Test: 2 yearsaheadThat all the advantages mentioned above arenot just dull theory is shown by the Swiss SolvencyTest (SST). Comparable to Solvency II,the SST was tested in 2005 and implementedin 2006. However, Solvency II is still treatedwith s<strong>ke</strong>pticism in some quarters, especiallyby small and specialized insurers who areafraid of an increase in work load. Local regulatorscall attention to their scarcity of resourcesand some politicians fear that the local insurancecompanies will be discriminated againstin favor of larger international groups. Someof these fears also existed in Switzerland, butthey have not emerged in either the test runsor during the last two years after the introductionof the SST.Already during the test runs it was apparentfor the Swiss regulators and the companiesthat the methods that had been in place didnot capture the true risks the companies werefacing. The tests also showed that even smalland very specialized insurance companiescould easily implement the new principles.Switzerland has about five big companies and200 smaller ones. However, one differencefrom Solvency II is that the Swiss authoritiesprovided a “standard model” that could beused as a basis for adaptation creating a typeof internal model. After the test run the smalland mid-sized companies came to the conclusionthat the additional workload and the complexityof the model was more than compensatedfor by the additional insights they gotinto the risk structure of their company.Solvency II will ma<strong>ke</strong> the risk distributionamong the primary insurers, reinsurers andthe capital mar<strong>ke</strong>ts more efficient, because allrisk transfer solutions are accepted independentof the legal outline. This is because froman economic view point they all bring a risk reductionand therefore allow for a reduction insolvency capital. In Switzerland smaller insurerswere able to use the information the SSTprovided about the distribution of their risks toexpand their business.Benefit for small insurersOver all, it can be said that in Switzerland thesmall insurers are not the losers of the newSolvency regime but the ones that benefitmost. For one, the fear that the smaller insurerwill disappear or be ta<strong>ke</strong>n over by biggercompetitors did not materialize. The companiesare still around. At the same time thesesmaller companies now have a tool at hand toanalyze their risk that they didn’t have before.For the bigger insurers the changes were notthat big because most of them already wor<strong>ke</strong>dwith economic models.Additional information could be the one importantadvantage the local regulators that arenow afraid to lose their say, can ta<strong>ke</strong> out of thenew Solvency II regime. In the future a Czechregulator for example will not only see the liabilitiesan insurer has in their country but willalso see the results from the whole group. Atthe same time they may have an intensifiedexchange with their supervising colleagues inother countries.Walking on the new pathEven though all the mentioned concerns haveto be ta<strong>ke</strong>n seriously, the insurance industrywill continue to walk on this new path irrespectiveof the form the Solvency II Framework Directivewill ta<strong>ke</strong>. Some of the planned changeshave already ta<strong>ke</strong>n place in many companies– even though it is not yet clear what the finalSolvency II Directive will look li<strong>ke</strong>. With SolvencyII, Europe has a great chance to ta<strong>ke</strong> a leadin the global insurance industry and it would bea pity if the spirit of the Solvency II frameworkgets lost because political interests dilute theDirective.Overview of selected solvency modelsSingle-risk-factorbasedmodelsMulti-risk-factor based modelsEU Solvency I Solvency II• CEIOPS proposal• GDV standard model• CEA ESA modelModels which comprehensively quantify risksand their interdependenciesSolvency II• CEA ESA model• internal modelsThe Netherlands Solvency I Dutch Solvency TestUK Solvency I Enhanced Capital Requirements non life insurers Enhanced capital requirements life insurersIndividual Capital Adequacy Standards (life and non-life)Switzerland Solvency I Swiss Solvency TestRating agenciesIAAS&P, Moody‘s, AMBestIAA proposalScenariosSolvency IIFootnote: CEIOPS - Committee of Eropean Insurance and Occupational Pensions Supervisors, GDV - German insurance association, CEA - Comité Européen desAssurances, ESA - European Standard Approach, IAA - International Association of ActuariesSource: Sigma 4/2006: Swiss Federal Office of Private Insurance, Swiss Re Economic Research & Consulting42 Pojistný <strong>obzor</strong> 2/2008 Insurance Digest