International Total Occupancy Cost Code - IPD

International Total Occupancy Cost Code - IPD

International Total Occupancy Cost Code - IPD

Erfolgreiche ePaper selbst erstellen

Machen Sie aus Ihren PDF Publikationen ein blätterbares Flipbook mit unserer einzigartigen Google optimierten e-Paper Software.

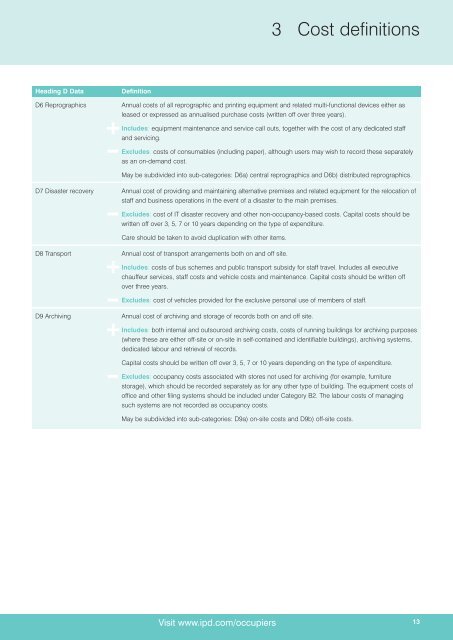

Heading D Data Definition<br />

Visit www.ipd.com/occupiers<br />

3 <strong>Cost</strong> definitions<br />

D6 Reprographics Annual costs of all reprographic and printing equipment and related multi-functional devices either as<br />

leased or expressed as annualised purchase costs (written off over three years).<br />

+<br />

–<br />

Includes: equipment maintenance and service call outs, together with the cost of any dedicated staff<br />

and servicing.<br />

Excludes: costs of consumables (including paper), although users may wish to record these separately<br />

as an on-demand cost.<br />

May be subdivided into sub-categories: D6a) central reprographics and D6b) distributed reprographics.<br />

D7 Disaster recovery Annual cost of providing and maintaining alternative premises and related equipment for the relocation of<br />

staff and business operations in the event of a disaster to the main premises.<br />

–<br />

Excludes: cost of IT disaster recovery and other non-occupancy-based costs. Capital costs should be<br />

written off over 3, 5, 7 or 10 years depending on the type of expenditure.<br />

Care should be taken to avoid duplication with other items.<br />

D8 Transport Annual cost of transport arrangements both on and off site.<br />

+<br />

–<br />

Includes: costs of bus schemes and public transport subsidy for staff travel. Includes all executive<br />

chauffeur services, staff costs and vehicle costs and maintenance. Capital costs should be written off<br />

over three years.<br />

Excludes: cost of vehicles provided for the exclusive personal use of members of staff.<br />

D9 Archiving Annual cost of archiving and storage of records both on and off site.<br />

+<br />

–<br />

Includes: both internal and outsourced archiving costs, costs of running buildings for archiving purposes<br />

(where these are either off-site or on-site in self-contained and identifiable buildings), archiving systems,<br />

dedicated labour and retrieval of records.<br />

Capital costs should be written off over 3, 5, 7 or 10 years depending on the type of expenditure.<br />

Excludes: occupancy costs associated with stores not used for archiving (for example, furniture<br />

storage), which should be recorded separately as for any other type of building. The equipment costs of<br />

office and other filing systems should be included under Category B2. The labour costs of managing<br />

such systems are not recorded as occupancy costs.<br />

May be subdivided into sub-categories: D9a) on-site costs and D9b) off-site costs.<br />

13