- Page 2 and 3: FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 4: PROJECT TEAM Study Team Project Lea

- Page 7 and 8: linkages with the economy. The sect

- Page 10: Contents Executive Summary Chapter

- Page 13 and 14: Chapter 5: FDI: Linkages with the E

- Page 16 and 17: Executive Summary Foreign direct in

- Page 18 and 19: EXECUTIVE SUMMARY petroleum product

- Page 20 and 21: Chapter 1: Introduction 1.1 Backdro

- Page 22 and 23: section industry data. However, the

- Page 24 and 25: in India stood at $23 billion, show

- Page 26 and 27: viii) Backward and Forward Linkages

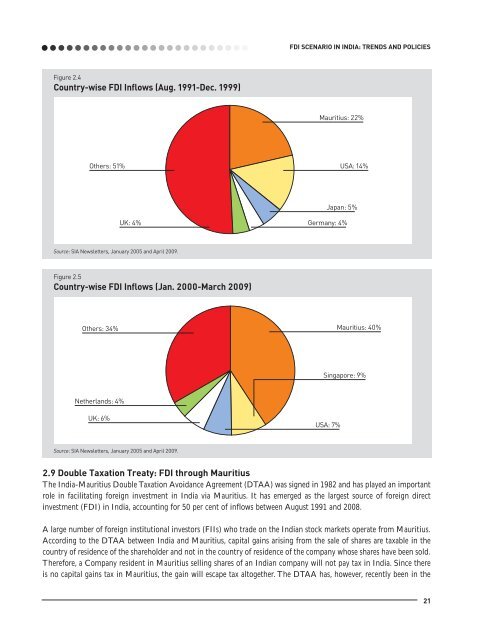

- Page 28 and 29: Chapter 2: FDI Scenario in India: T

- Page 30 and 31: Secretariat for Industrial Assistan

- Page 32 and 33: Table 2.2 shows that FDI outflows f

- Page 34 and 35: at about 2 per cent or less of the

- Page 36 and 37: Table 2.5 Sector-wise Break-up of F

- Page 38 and 39: Table 2.7 FDI in India in the Servi

- Page 42 and 43: 2.10 Foreign Technology Transfers A

- Page 44 and 45: Chapter 3: Mergers & Acquisitions a

- Page 46 and 47: Table 3.2 Short-term effects of FDI

- Page 48 and 49: proportion of foreign investment in

- Page 50 and 51: Chapter 4: Special Economic Zones (

- Page 52 and 53: 4.4 Management of SEZs SEZs are und

- Page 54 and 55: in the eight major SEZ’s exports

- Page 56 and 57: Foreign Direct Investment in SEZs S

- Page 58 and 59: In a span of a few years, there hav

- Page 60 and 61: SPECIAL ECONOMIC ZONES (SEZS) AND F

- Page 62 and 63: existing infrastructure, (b) exploi

- Page 64 and 65: SPECIAL ECONOMIC ZONES (SEZS) AND F

- Page 66 and 67: SPECIAL ECONOMIC ZONES (SEZS) AND F

- Page 68 and 69: Chapter 5: FDI: Linkages with the E

- Page 70 and 71: construction (4200); fuels, includi

- Page 72 and 73: FDI: LINKAGES WITH THE ECONOMY S. N

- Page 74: Table 5.5 Sector-wise FDI in India

- Page 77 and 78: FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 79 and 80: FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 81 and 82: FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 83 and 84: FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 85 and 86: FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 87 and 88: FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 89 and 90: FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 92 and 93:

Chapter 7: Primary Survey: Analysis

- Page 94 and 95:

the North and South zones, whereas

- Page 96 and 97:

PRIMARY SURVEY: ANALYSIS AND RESULT

- Page 98 and 99:

Table 7.1a Distribution of Surveyed

- Page 100 and 101:

Table 7.2b Zone-wise Distribution o

- Page 102 and 103:

Table 7.3b Zone-wise Distribution o

- Page 104 and 105:

Table 7.6a Number of Employees in S

- Page 106 and 107:

Table 7.7a Mode of Transport from F

- Page 108 and 109:

Table 7.8a Number of FDI-enabled Fi

- Page 110 and 111:

Chapter 8: FDI Data Reporting and C

- Page 112 and 113:

sector, non-profit institutions ser

- Page 114 and 115:

three categories, namely, (i) inves

- Page 116 and 117:

Table 8.1 Trends in FDI Inflows to

- Page 118 and 119:

FDI DATA REPORTING AND CLASSIFICATI

- Page 120 and 121:

Table 8.3 Trends in FDI Inflows by

- Page 122 and 123:

Table 8.5 DIPP Classification of FD

- Page 124 and 125:

SECTOR-WISE CODE 3700 DEFENCE INDUS

- Page 126 and 127:

FDI DATA REPORTING AND CLASSIFICATI

- Page 128 and 129:

S. No. DIPP DIPP Activity NIC 2-Dig

- Page 130 and 131:

S. No. DIPP DIPP Activity NIC 3-Dig

- Page 132 and 133:

S. No. DIPP DIPP Activity NIC 3-Dig

- Page 134:

FDI DATA REPORTING AND CLASSIFICATI

- Page 137 and 138:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 139 and 140:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 141 and 142:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 143 and 144:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 145 and 146:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 147 and 148:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 149 and 150:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 152 and 153:

Chapter 10: Key Findings and Salien

- Page 154 and 155:

Findings � About half the total o

- Page 156 and 157:

7. Forex Implications: To understan

- Page 158 and 159:

manufacturing firms taken together.

- Page 160 and 161:

References Australian Bureau of Sta

- Page 162 and 163:

for economic growth and poverty all

- Page 164:

Tables for Chapter 6

- Page 167 and 168:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 169 and 170:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 171 and 172:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 173 and 174:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 175 and 176:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 177 and 178:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 179 and 180:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 181 and 182:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 183 and 184:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 185 and 186:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 187 and 188:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 189 and 190:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 191 and 192:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 193 and 194:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 195 and 196:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 197 and 198:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 199 and 200:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 201 and 202:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 203 and 204:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 205 and 206:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 207 and 208:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 209 and 210:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 211 and 212:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 213 and 214:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 215 and 216:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 217 and 218:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 219 and 220:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 221 and 222:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 223 and 224:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 225 and 226:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 227 and 228:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 229 and 230:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 231 and 232:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 233 and 234:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 235 and 236:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 237 and 238:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 239 and 240:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 241 and 242:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 243 and 244:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 245 and 246:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 247 and 248:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 249 and 250:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 251 and 252:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 253 and 254:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 255 and 256:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 257 and 258:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 260:

Questionnaires

- Page 263 and 264:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 265 and 266:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 267 and 268:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 269 and 270:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 271 and 272:

FDI IN INDIA AND ITS GROWTH LINKAGE

- Page 274 and 275:

255

- Page 276 and 277:

QUESTIONNAIRE 257

- Page 278 and 279:

QUESTIONNAIRE 259

- Page 280 and 281:

QUESTIONNAIRE 261

- Page 282 and 283:

QUESTIONNAIRE 263