fdi in india and its growth linkages - Department Of Industrial Policy ...

fdi in india and its growth linkages - Department Of Industrial Policy ...

fdi in india and its growth linkages - Department Of Industrial Policy ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FDI IN INDIA AND ITS GROWTH LINKAGES<br />

3.4 FDI <strong>in</strong> India<br />

In India any <strong>in</strong>flow of FDI is recorded with the RBI <strong>and</strong> is reported by the DIPP <strong>in</strong> the form of Fact sheets, newsletters<br />

or annual issues. However, there is a complete absence of government report<strong>in</strong>g of the FDI statistics with comparable<br />

<strong>in</strong>formation on greenfield vis-à-vis M&A <strong>in</strong>vestments <strong>in</strong> numbers or <strong>in</strong> values. Information is available from OCO<br />

Consult<strong>in</strong>g Ltd. <strong>in</strong> <strong>its</strong> LOCO-Monitor FDI Database that reports the greenfield <strong>in</strong>vestments <strong>in</strong> India, <strong>and</strong> <strong>in</strong>formation<br />

on M&As is available from Bureau van Dijk <strong>in</strong> <strong>its</strong> Zephyr Mergers <strong>and</strong> Acquisition database. While these nongovernment<br />

sources provide a profile of FDI <strong>in</strong>flows, their reported figures are not comparable with those furnished <strong>in</strong><br />

the official records. The <strong>in</strong>consistencies can be due to a number of reasons such as the <strong>in</strong>clusion of approved FDI along<br />

with actual FDI; the <strong>in</strong>ability to track FDI that reaches India piecemeal as aga<strong>in</strong>st be<strong>in</strong>g approved as a whole; the failure<br />

to separate the Indian partner’s stake from that of a foreign <strong>in</strong>vestor result<strong>in</strong>g <strong>in</strong> an <strong>in</strong>flated FDI figure; <strong>and</strong> that some<br />

transactions may not even have reported values.<br />

Accord<strong>in</strong>g to the available detailed route-wise FDI compiled by the DIPP, equity <strong>in</strong>vestment exclud<strong>in</strong>g acquisition of<br />

shares may be considered as greenfield <strong>in</strong>vestment <strong>in</strong> India. Thus, foreign equity <strong>in</strong>flows under the SIA/FIPB <strong>and</strong> RBI<br />

route, along with the equity capital of un<strong>in</strong>corporated bodies, represent the fresh arrival of FDI <strong>in</strong>to India. The DIPP<br />

reports a separate category of FDI under <strong>in</strong>flows through acquisition of exist<strong>in</strong>g shares.<br />

While <strong>in</strong>formation on acquisition of shares is compiled <strong>and</strong> provided by the DIPP, there is no explicit <strong>in</strong>formation on<br />

cross-border mergers occurr<strong>in</strong>g <strong>in</strong> India; however, cross-border mergers effected by swapp<strong>in</strong>g of stocks may be <strong>in</strong>cluded<br />

<strong>in</strong> the stock swaps provided by the DIPP. But another component of the stock swap, which is simply equity swaps<br />

between an Indian <strong>and</strong> a foreign company, is believed to be much higher.3 Therefore, <strong>in</strong> the absence of such a break-up,<br />

it is not possible to analyse any trends <strong>in</strong> the cross-border mergers <strong>in</strong> India.<br />

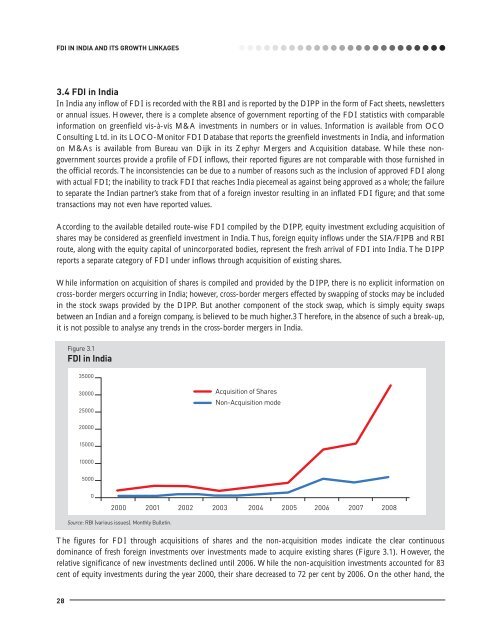

The figures for FDI through acquisitions of shares <strong>and</strong> the non-acquisition modes <strong>in</strong>dicate the clear cont<strong>in</strong>uous<br />

dom<strong>in</strong>ance of fresh foreign <strong>in</strong>vestments over <strong>in</strong>vestments made to acquire exist<strong>in</strong>g shares (Figure 3.1). However, the<br />

relative significance of new <strong>in</strong>vestments decl<strong>in</strong>ed until 2006. While the non-acquisition <strong>in</strong>vestments accounted for 83<br />

cent of equity <strong>in</strong>vestments dur<strong>in</strong>g the year 2000, their share decreased to 72 per cent by 2006. On the other h<strong>and</strong>, the<br />

28<br />

Figure 3.1<br />

FDI <strong>in</strong> India<br />

Source: RBI (various issues). Monthly Bullet<strong>in</strong>.