BayWa AG Annual Report 2011

BayWa AG Annual Report 2011

BayWa AG Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 • <strong>BayWa</strong> and the Capital Market • The Share<br />

The Share<br />

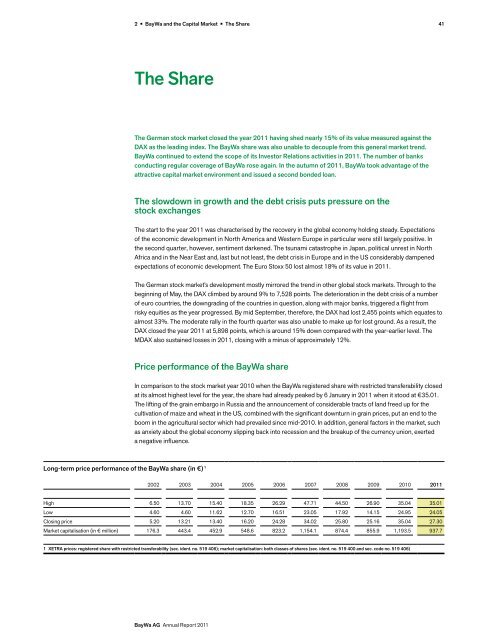

Long-term price performance of the <strong>BayWa</strong> share (in €) 1<br />

The German stock market closed the year <strong>2011</strong> having shed nearly 15% of its value measured against the<br />

DAX as the leading index. The <strong>BayWa</strong> share was also unable to decouple from this general market trend.<br />

<strong>BayWa</strong> continued to extend the scope of its Investor Relations activities in <strong>2011</strong>. The number of banks<br />

conducting regular coverage of <strong>BayWa</strong> rose again. In the autumn of <strong>2011</strong>, <strong>BayWa</strong> took advantage of the<br />

attractive capital market environment and issued a second bonded loan.<br />

The slowdown in growth and the debt crisis puts pressure on the<br />

stock exchanges<br />

The start to the year <strong>2011</strong> was characterised by the recovery in the global economy holding steady. Expectations<br />

of the economic development in North America and Western Europe in particular were still largely positive. In<br />

the second quarter, however, sentiment darkened. The tsunami catastrophe in Japan, political unrest in North<br />

Africa and in the Near East and, last but not least, the debt crisis in Europe and in the US considerably dampened<br />

expectations of economic development. The Euro Stoxx 50 lost almost 18% of its value in <strong>2011</strong>.<br />

The German stock market’s development mostly mirrored the trend in other global stock markets. Through to the<br />

beginning of May, the DAX climbed by around 9% to 7,528 points. The deterioration in the debt crisis of a number<br />

of euro countries, the downgrading of the countries in question, along with major banks, triggered a flight from<br />

risky equities as the year progressed. By mid September, therefore, the DAX had lost 2,455 points which equates to<br />

almost 33%. The moderate rally in the fourth quarter was also unable to make up for lost ground. As a result, the<br />

DAX closed the year <strong>2011</strong> at 5,898 points, which is around 15% down compared with the year-earlier level. The<br />

MDAX also sustained losses in <strong>2011</strong>, closing with a minus of approximately 12%.<br />

Price performance of the <strong>BayWa</strong> share<br />

In comparison to the stock market year 2010 when the <strong>BayWa</strong> registered share with restricted transferability closed<br />

at its almost highest level for the year, the share had already peaked by 6 January in <strong>2011</strong> when it stood at €35.01.<br />

The lifting of the grain embargo in Russia and the announcement of considerable tracts of land freed up for the<br />

cultivation of maize and wheat in the US, combined with the significant downturn in grain prices, put an end to the<br />

boom in the agricultural sector which had prevailed since mid-2010. In addition, general factors in the market, such<br />

as anxiety about the global economy slipping back into recession and the breakup of the currency union, exerted<br />

a negative influence.<br />

2002 2003 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong><br />

High 6.50 13.70 15.40 18.35 26.29 47.71 44.50 26.90 35.04 35.01<br />

Low 4.60 4.60 11.62 12.70 16.51 23.05 17.92 14.15 24.95 24.05<br />

Closing price 5.20 13.21 13.40 16.20 24.28 34.02 25.80 25.16 35.04 27.30<br />

Market capitalisation (in € million) 176.3 443.4 452.9 548.6 823.2 1,154.1 874.4 855.9 1,193.5 937.7<br />

1 XETRA prices: registered share with restricted transferability (sec. ident. no. 519 406); market capitalisation: both classes of shares (sec. ident. no. 519 400 and sec. code no. 519 406)<br />

<strong>BayWa</strong> <strong>AG</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

41