The European Pharmaceutical Wholesale Industry: - phagro

The European Pharmaceutical Wholesale Industry: - phagro

The European Pharmaceutical Wholesale Industry: - phagro

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> <strong>European</strong> <strong>Pharmaceutical</strong> <strong>Wholesale</strong> <strong>Industry</strong><br />

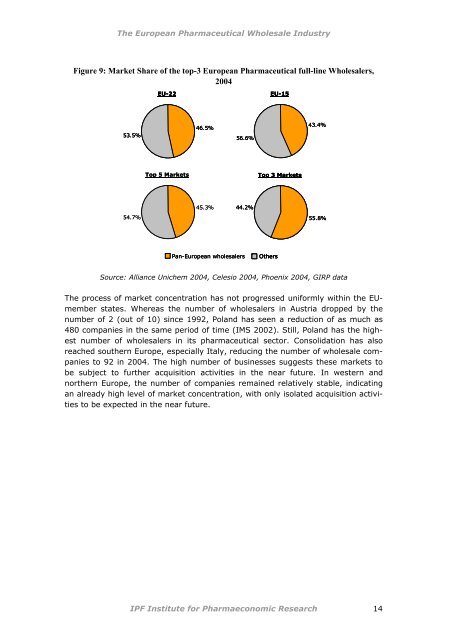

Figure 9: Market Share of the top-3 <strong>European</strong> <strong>Pharmaceutical</strong> full-line <strong>Wholesale</strong>rs,<br />

2004<br />

53.5%<br />

54.7%<br />

EU-22<br />

Top 5 Markets<br />

46.5%<br />

45.3%<br />

56.6%<br />

44.2%<br />

Pan-<strong>European</strong> wholesalers Others<br />

EU-15<br />

Top 3 Markets<br />

43.4%<br />

55.8%<br />

Source: Alliance Unichem 2004, Celesio 2004, Phoenix 2004, GIRP data<br />

<strong>The</strong> process of market concentration has not progressed uniformly within the EUmember<br />

states. Whereas the number of wholesalers in Austria dropped by the<br />

number of 2 (out of 10) since 1992, Poland has seen a reduction of as much as<br />

480 companies in the same period of time (IMS 2002). Still, Poland has the highest<br />

number of wholesalers in its pharmaceutical sector. Consolidation has also<br />

reached southern Europe, especially Italy, reducing the number of wholesale companies<br />

to 92 in 2004. <strong>The</strong> high number of businesses suggests these markets to<br />

be subject to further acquisition activities in the near future. In western and<br />

northern Europe, the number of companies remained relatively stable, indicating<br />

an already high level of market concentration, with only isolated acquisition activities<br />

to be expected in the near future.<br />

IPF Institute for Pharmaeconomic Research 14