notes to the financial statements - Far East Orchard Limited

notes to the financial statements - Far East Orchard Limited

notes to the financial statements - Far East Orchard Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

For <strong>the</strong> <strong>financial</strong> year ended 31 December 2008<br />

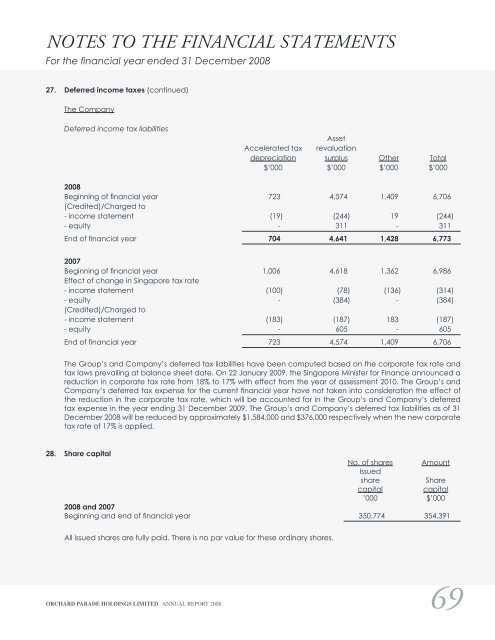

27. Deferred income taxes (continued)<br />

The Company<br />

Deferred income tax liabilities<br />

Asset<br />

Accelerated tax revaluation<br />

depreciation surplus O<strong>the</strong>r Total<br />

$’000 $’000 $’000 $’000<br />

2008<br />

Beginning of <strong>financial</strong> year 723 4,574 1,409 6,706<br />

(Credited)/Charged <strong>to</strong><br />

- income statement (19) (244) 19 (244)<br />

- equity - 311 - 311<br />

End of <strong>financial</strong> year 704 4,641 1,428 6,773<br />

2007<br />

Beginning of <strong>financial</strong> year 1,006 4,618 1,362 6,986<br />

Effect of change in Singapore tax rate<br />

- income statement (100) (78) (136) (314)<br />

- equity - (384) - (384)<br />

(Credited)/Charged <strong>to</strong><br />

- income statement (183) (187) 183 (187)<br />

- equity - 605 - 605<br />

End of <strong>financial</strong> year 723 4,574 1,409 6,706<br />

The Group’s and Company’s deferred tax liabilities have been computed based on <strong>the</strong> corporate tax rate and<br />

tax laws prevailing at balance sheet date. On 22 January 2009, <strong>the</strong> Singapore Minister for Finance announced a<br />

reduction in corporate tax rate from 18% <strong>to</strong> 17% with effect from <strong>the</strong> year of assessment 2010. The Group’s and<br />

Company’s deferred tax expense for <strong>the</strong> current <strong>financial</strong> year have not taken in<strong>to</strong> consideration <strong>the</strong> effect of<br />

<strong>the</strong> reduction in <strong>the</strong> corporate tax rate, which will be accounted for in <strong>the</strong> Group’s and Company’s deferred<br />

tax expense in <strong>the</strong> year ending 31 December 2009. The Group’s and Company’s deferred tax liabilities as of 31<br />

December 2008 will be reduced by approximately $1,584,000 and $376,000 respectively when <strong>the</strong> new corporate<br />

tax rate of 17% is applied.<br />

28. Share capital<br />

No. of shares<br />

Issued<br />

Amount<br />

share Share<br />

capital capital<br />

’000 $’000<br />

2008 and 2007<br />

Beginning and end of <strong>financial</strong> year 350,774 354,391<br />

All issued shares are fully paid. There is no par value for <strong>the</strong>se ordinary shares.<br />

ORCHARD PARADE HOLDINGS LIMITED ANNUAL REPORT 2008 69