notes to the financial statements - Far East Orchard Limited

notes to the financial statements - Far East Orchard Limited

notes to the financial statements - Far East Orchard Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

For <strong>the</strong> <strong>financial</strong> year ended 31 December 2008<br />

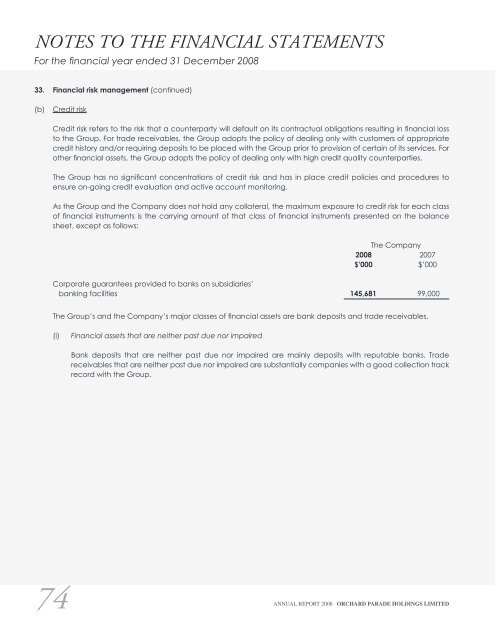

33. Financial risk management (continued)<br />

(b) Credit risk<br />

74<br />

Credit risk refers <strong>to</strong> <strong>the</strong> risk that a counterparty will default on its contractual obligations resulting in <strong>financial</strong> loss<br />

<strong>to</strong> <strong>the</strong> Group. For trade receivables, <strong>the</strong> Group adopts <strong>the</strong> policy of dealing only with cus<strong>to</strong>mers of appropriate<br />

credit his<strong>to</strong>ry and/or requiring deposits <strong>to</strong> be placed with <strong>the</strong> Group prior <strong>to</strong> provision of certain of its services. For<br />

o<strong>the</strong>r <strong>financial</strong> assets, <strong>the</strong> Group adopts <strong>the</strong> policy of dealing only with high credit quality counterparties.<br />

The Group has no significant concentrations of credit risk and has in place credit policies and procedures <strong>to</strong><br />

ensure on-going credit evaluation and active account moni<strong>to</strong>ring.<br />

As <strong>the</strong> Group and <strong>the</strong> Company does not hold any collateral, <strong>the</strong> maximum exposure <strong>to</strong> credit risk for each class<br />

of <strong>financial</strong> instruments is <strong>the</strong> carrying amount of that class of <strong>financial</strong> instruments presented on <strong>the</strong> balance<br />

sheet, except as follows:<br />

The Company<br />

2008 2007<br />

$’000 $’000<br />

Corporate guarantees provided <strong>to</strong> banks on subsidiaries’<br />

banking facilities 145,681 99,000<br />

The Group’s and <strong>the</strong> Company’s major classes of <strong>financial</strong> assets are bank deposits and trade receivables.<br />

(i) Financial assets that are nei<strong>the</strong>r past due nor impaired<br />

Bank deposits that are nei<strong>the</strong>r past due nor impaired are mainly deposits with reputable banks. Trade<br />

receivables that are nei<strong>the</strong>r past due nor impaired are substantially companies with a good collection track<br />

record with <strong>the</strong> Group.<br />

ANNUAL REPORT 2008 ORCHARD PARADE HOLDINGS LIMITED