notes to the financial statements - Far East Orchard Limited

notes to the financial statements - Far East Orchard Limited

notes to the financial statements - Far East Orchard Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

For <strong>the</strong> <strong>financial</strong> year ended 31 December 2008<br />

33. Financial risk management (continued)<br />

(a) Market risk (continued)<br />

(i) Cash flow and fair value interest rate risk (continued)<br />

The Group’s and <strong>the</strong> Company’s borrowings at variable rates are denominated in Singapore Dollars. If<br />

<strong>the</strong> interest rates increase/decrease by 1% (2007: 1%) with all o<strong>the</strong>r variables including tax rate being held<br />

constant, <strong>the</strong> profit after tax will be lower/higher by $4,340,000 (2007: $4,231,000) and $3,067,000 (2007:<br />

$3,383,000) as a result of higher/lower interest expense on <strong>the</strong>se borrowings.<br />

(ii) Currency risk<br />

The Group’s currency exposure <strong>to</strong> foreign exchange risk is not significant as most of its transactions are<br />

denominated in Singapore Dollars, except for <strong>the</strong> activities undertaken by its Malaysian subsidiary, which<br />

are mainly denominated in Malaysia Ringgit. The Malaysian subsidiary mainly owns an investment property<br />

in Kuala Lumpur [Note 21(c)] and does not have significant <strong>financial</strong> assets and liabilities as <strong>the</strong> property is<br />

currently vacant awaiting redevelopment <strong>to</strong> commence.<br />

The Company’s business is not exposed <strong>to</strong> any significant foreign exchange risk as majority of its <strong>financial</strong><br />

assets and liabilities are denominated in Singapore Dollars.<br />

(iii) Price risk<br />

The Group is exposed <strong>to</strong> equity securities price risk because of <strong>the</strong> investments held by <strong>the</strong> Group which<br />

are classified on <strong>the</strong> consolidated balance sheet as <strong>financial</strong> assets at fair value through profit or loss. These<br />

securities are listed in Singapore. The investment decisions are undertaken by a team, which comprises<br />

certain direc<strong>to</strong>rs of <strong>the</strong> Company.<br />

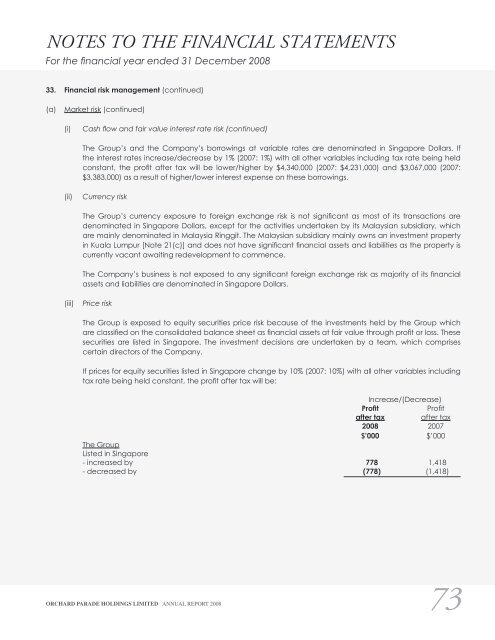

If prices for equity securities listed in Singapore change by 10% (2007: 10%) with all o<strong>the</strong>r variables including<br />

tax rate being held constant, <strong>the</strong> profit after tax will be:<br />

Increase/(Decrease)<br />

Profit Profit<br />

after tax after tax<br />

2008 2007<br />

$’000 $’000<br />

The Group<br />

Listed in Singapore<br />

- increased by 778 1,418<br />

- decreased by (778) (1,418)<br />

ORCHARD PARADE HOLDINGS LIMITED ANNUAL REPORT 2008 73