annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)<br />

34. Financial Risk Management (continued)<br />

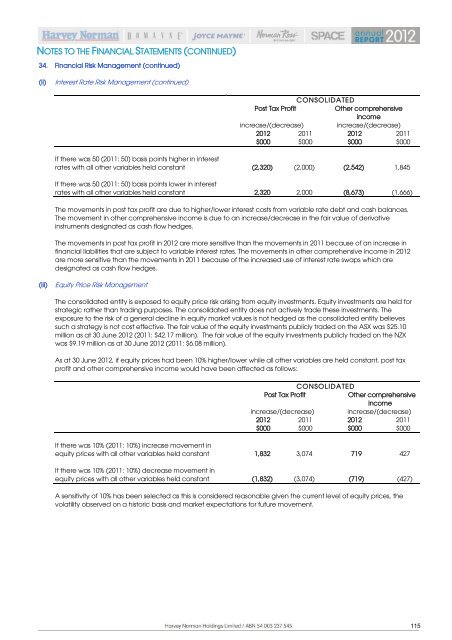

(ii) Interest Rate Risk Management (continued)<br />

If there was 50 (2011: 50) basis points higher in interest<br />

rates with all other variables held constant<br />

If there was 50 (2011: 50) basis points lower in interest<br />

rates with all other variables held constant<br />

CONSOLIDA TED<br />

Post Tax Profit<br />

Other comprehensive<br />

income<br />

increase/(decrease)<br />

increase/(decrease)<br />

2012 2011 2012 2011<br />

$000 $000 $000 $000<br />

(2,320)<br />

2,320<br />

(2,000)<br />

2,000<br />

(2,542)<br />

(8,673)<br />

The movements in post tax profit are due to higher/lower interest costs from variable rate debt and cash balances.<br />

The movement in other comprehensive income is due to an increase/decrease in the fair value of derivative<br />

instruments designated as cash flow hedges.<br />

1,845<br />

(1,666)<br />

The movements in post tax profit in 2012 are more sensitive than the movements in 2011 because of an increase in<br />

financial liabilities that are subject to variable interest rates. The movements in other comprehensive income in 2012<br />

are more sensitive than the movements in 2011 because of the increased use of interest rate swaps which are<br />

designated as cash flow hedges.<br />

(iii) Equity Price Risk Management<br />

The consolidated entity is exposed to equity price risk arising from equity investments. Equity investments are held for<br />

strategic rather than trading purposes. The consolidated entity does not actively trade these investments. The<br />

exposure to the risk of a general decline in equity market values is not hedged as the consolidated entity believes<br />

such a strategy is not cost effective. The fair value of the equity investments publicly traded on the ASX was $25.10<br />

million as at 30 June 2012 (2011: $42.17 million). The fair value of the equity investments publicly traded on the NZX<br />

was $9.19 million as at 30 June 2012 (2011: $6.08 million).<br />

As at 30 June 2012, if equity prices had been 10% higher/lower while all other variables are held constant, post tax<br />

profit and other comprehensive income would have been affected as follows:<br />

If there was 10% (2011: 10%) increase movement in<br />

equity prices with all other variables held constant<br />

If there was 10% (2011: 10%) decrease movement in<br />

equity prices with all other variables held constant<br />

CONSOLIDA TED<br />

Post Tax Profit<br />

Other comprehensive<br />

income<br />

increase/(decrease)<br />

increase/(decrease)<br />

2012 2011 2012 2011<br />

$000 $000 $000 $000<br />

1,832<br />

(1,832)<br />

3,074<br />

(3,074)<br />

A sensitivity of 10% has been selected as this is considered reasonable given the current level of equity prices, the<br />

volatility observed on a historic basis and market expectations for future movement.<br />

719<br />

(719)<br />

427<br />

(427)<br />

115