annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIRECTOR‟S REPORT (CONTINUED)<br />

Remuneration Report (Audited) (continued)<br />

The amount of aggregate remuneration sought to be approved by shareholders and the fee structure is reviewed <strong>annual</strong>ly<br />

against fees paid to NEDs of comparable companies. The board considers published material from external sources and<br />

makes its own enquiries when undertaking the <strong>annual</strong> review process.<br />

The <strong>Company</strong>‟s constitution and the ASX listing rules specify that the NED fee pool shall be determined from time to time by<br />

a general meeting. The latest determination was at the 2006 <strong>annual</strong> general meeting (AGM) held on 21 November 2006<br />

when shareholders approved an aggregate NED pool of $1,000,000 per year.<br />

The board will not seek any increase for the NED pool at the 2012 AGM.<br />

Structure<br />

The remuneration of NEDs consists of directors‟ fees. NEDs do not receive retirement benefits, nor do they participate in any<br />

incentive programs. Each NED receives a fee for being a director of the <strong>Company</strong>. The structure of NED remuneration is<br />

separate and distinct from executive remuneration. The remuneration of NEDs for the year ended 30 June 2012 and 30<br />

June 2011 are disclosed in table 1 on page 28 of this <strong>report</strong>.<br />

Executive Remuneration Arrangements<br />

Remuneration Levels and Mix<br />

The consolidated entity aims to reward executives with a level and mix of remuneration commensurate with their position<br />

and responsibilities within the consolidated entity and to align operations with strategy.<br />

The policy of the consolidated entity is to position total employment cost (TEC) so as to ensure a competitive offering. Total<br />

reward opportunities are between the 50 th and 100 th percentile of the comparator group. The <strong>Company</strong> and the<br />

consolidated entity undertakes an <strong>annual</strong> remuneration review to determine the total remuneration of executives having<br />

regard to the circumstances of the consolidated entity.<br />

The CEO‟s target remuneration mix comprises approximately 75% fixed remuneration and 25% target STI opportunity. The<br />

CEO did not have any target LTI during the year. Target remuneration mix of executive directors ranges from 50% to 55%<br />

fixed remuneration, 15% to 25% target STI opportunity and 0% to 30% LTI.<br />

Structure<br />

In the 2012 financial year, the executive remuneration framework consisted of the following components:<br />

Fixed remuneration<br />

Variable remuneration<br />

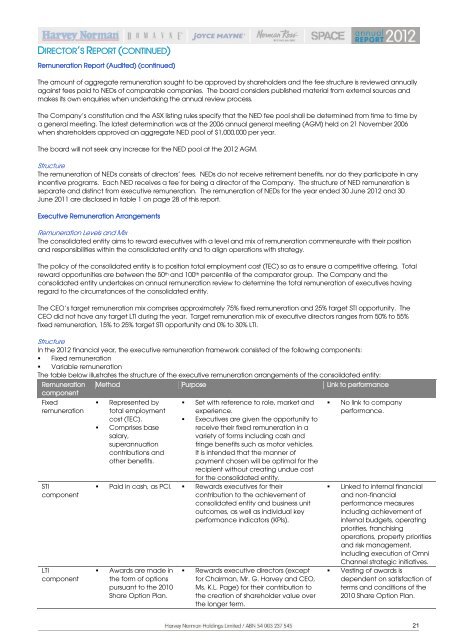

The table below illustrates the structure of the executive remuneration arrangements of the consolidated entity:<br />

Remuneration<br />

component<br />

Fixed<br />

remuneration<br />

STI<br />

component<br />

LTI<br />

component<br />

Method Purpose Link to performance<br />

Represented by<br />

total employment<br />

cost (TEC).<br />

Comprises base<br />

salary,<br />

superannuation<br />

contributions and<br />

other benefits.<br />

Set with reference to role, market and<br />

experience.<br />

Executives are given the opportunity to<br />

receive their fixed remuneration in a<br />

variety of forms including cash and<br />

fringe benefits such as motor vehicles.<br />

It is intended that the manner of<br />

payment chosen will be optimal for the<br />

recipient without creating undue cost<br />

for the consolidated entity.<br />

Paid in cash, as PCI. Rewards executives for their<br />

contribution to the achievement of<br />

consolidated entity and business unit<br />

outcomes, as well as individual key<br />

performance indicators (KPIs).<br />

Awards are made in<br />

the form of options<br />

pursuant to the 2010<br />

Share Option Plan.<br />

Rewards executive directors (except<br />

for Chairman, Mr. G. <strong>Harvey</strong> and CEO,<br />

Ms. K.L. Page) for their contribution to<br />

the creation of shareholder value over<br />

the longer term.<br />

No link to company<br />

performance.<br />

Linked to internal financial<br />

and non-financial<br />

performance measures<br />

including achievement of<br />

internal budgets, operating<br />

priorities, franchising<br />

operations, property priorities<br />

and risk management,<br />

including execution of Omni<br />

Channel strategic initiatives.<br />

Vesting of awards is<br />

dependent on satisfaction of<br />

terms and conditions of the<br />

2010 Share Option Plan.<br />

21