annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

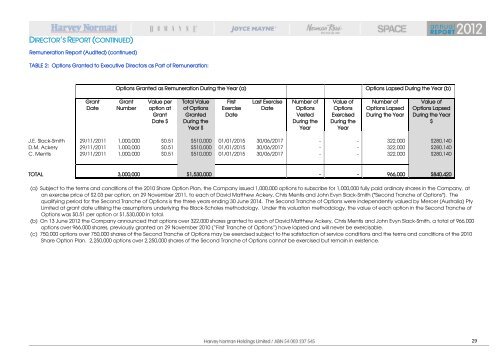

DIRECTOR‟S REPORT (CONTINUED)<br />

Remuneration Report (Audited) (continued)<br />

TABLE 2: Options Granted to Executive Directors as Part of Remuneration:<br />

Grant<br />

Date<br />

Options Granted as Remuneration During the Year (a)<br />

Grant<br />

Number<br />

Value per<br />

option at<br />

Grant<br />

Date $<br />

Total Value<br />

of Options<br />

Granted<br />

During the<br />

Year $<br />

First<br />

Exercise<br />

Date<br />

Last Exercise<br />

Date<br />

Number of<br />

Options<br />

Vested<br />

During the<br />

Year<br />

Value of<br />

Options<br />

Exercised<br />

During the<br />

Year<br />

Options Lapsed During the Year (b)<br />

Number of<br />

Options Lapsed<br />

During the Year<br />

Value of<br />

Options Lapsed<br />

During the Year<br />

$<br />

J.E. Slack-Smith 29/11/2011 1,000,000 $0.51 $510,000 01/01/2015 30/06/2017 - - 322,000 $280,140<br />

D.M. Ackery 29/11/2011 1,000,000 $0.51 $510,000 01/01/2015 30/06/2017 - - 322,000 $280,140<br />

C. Mentis 29/11/2011 1,000,000 $0.51 $510,000 01/01/2015 30/06/2017 - - 322,000 $280,140<br />

TOTAL<br />

3,000,000<br />

$1,530,000<br />

(a) Subject to the terms and conditions of the 2010 Share Option Plan, the <strong>Company</strong> issued 1,000,000 options to subscribe for 1,000,000 fully paid ordinary shares in the <strong>Company</strong>, at<br />

an exercise price of $2.03 per option, on 29 November 2011, to each of David Matthew Ackery, Chris Mentis and John Evyn Slack-Smith ("Second Tranche of Options"). The<br />

qualifying period for the Second Tranche of Options is the three years ending 30 June 2014. The Second Tranche of Options were independently valued by Mercer (Australia) Pty<br />

Limited at grant date utilising the assumptions underlying the Black-Scholes methodology. Under this valuation methodology, the value of each option in the Second Tranche of<br />

Options was $0.51 per option or $1,530,000 in total.<br />

(b) On 13 June 2012 the <strong>Company</strong> announced that options over 322,000 shares granted to each of David Matthew Ackery, Chris Mentis and John Evyn Slack-Smith, a total of 966,000<br />

options over 966,000 shares, previously granted on 29 November 2010 (“First Tranche of Options”) have lapsed and will never be exercisable.<br />

(c) 750,000 options over 750,000 shares of the Second Tranche of Options may be exercised subject to the satisfaction of service conditions and the terms and conditions of the 2010<br />

Share Option Plan. 2,250,000 options over 2,250,000 shares of the Second Tranche of Options cannot be exercised but remain in existence.<br />

-<br />

-<br />

966,000<br />

$840,420<br />

29