annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

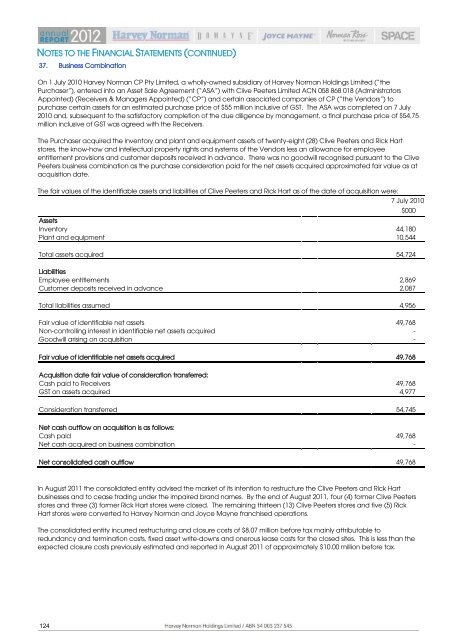

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)<br />

37. Business Combination<br />

On 1 July 2010 <strong>Harvey</strong> <strong>Norman</strong> CP Pty Limited, a wholly-owned subsidiary of <strong>Harvey</strong> <strong>Norman</strong> Holdings Limited (“the<br />

Purchaser”), entered into an Asset Sale Agreement (“ASA”) with Clive Peeters Limited ACN 058 868 018 (Administrators<br />

Appointed) (Receivers & Managers Appointed) (“CP”) and certain associated companies of CP (“the Vendors”) to<br />

purchase certain assets for an estimated purchase price of $55 million inclusive of GST. The ASA was completed on 7 July<br />

2010 and, subsequent to the satisfactory completion of the due diligence by management, a final purchase price of $54.75<br />

million inclusive of GST was agreed with the Receivers.<br />

The Purchaser acquired the inventory and plant and equipment assets of twenty-eight (28) Clive Peeters and Rick Hart<br />

stores, the know-how and intellectual property rights and systems of the Vendors less an allowance for employee<br />

entitlement provisions and customer deposits received in advance. There was no goodwill recognised pursuant to the Clive<br />

Peeters business combination as the purchase consideration paid for the net assets acquired approximated fair value as at<br />

acquisition date.<br />

The fair values of the identifiable assets and liabilities of Clive Peeters and Rick Hart as of the date of acquisition were:<br />

124<br />

7 July 2010<br />

Assets<br />

Inventory 44,180<br />

Plant and equipment 10,544<br />

Total assets acquired<br />

$000<br />

54,724<br />

Liabilities<br />

Employee entitlements 2,869<br />

Customer deposits received in advance 2,087<br />

Total liabilities assumed<br />

Fair value of identifiable net assets 49,768<br />

Non-controlling interest in identifiable net assets acquired -<br />

Goodwill arising on acquisition -<br />

Fair value of identifiable net assets acquired<br />

4,956<br />

49,768<br />

Acquisition date fair value of consideration transferred:<br />

Cash paid to Receivers 49,768<br />

GST on assets acquired 4,977<br />

Consideration transferred<br />

54,745<br />

Net cash outflow on acquisition is as follows:<br />

Cash paid 49,768<br />

Net cash acquired on business combination -<br />

Net consolidated cash outflow<br />

49,768<br />

In August 2011 the consolidated entity advised the market of its intention to restructure the Clive Peeters and Rick Hart<br />

businesses and to cease trading under the impaired brand names. By the end of August 2011, four (4) former Clive Peeters<br />

stores and three (3) former Rick Hart stores were closed. The remaining thirteen (13) Clive Peeters stores and five (5) Rick<br />

Hart stores were converted to <strong>Harvey</strong> <strong>Norman</strong> and Joyce Mayne franchised operations.<br />

The consolidated entity incurred restructuring and closure costs of $8.07 million before tax mainly attributable to<br />

redundancy and termination costs, fixed asset write-downs and onerous lease costs for the closed sites. This is less than the<br />

expected closure costs previously estimated and <strong>report</strong>ed in August 2011 of approximately $10.00 million before tax.