annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

annual report - Harvey Norman Company Reports & Announcements

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

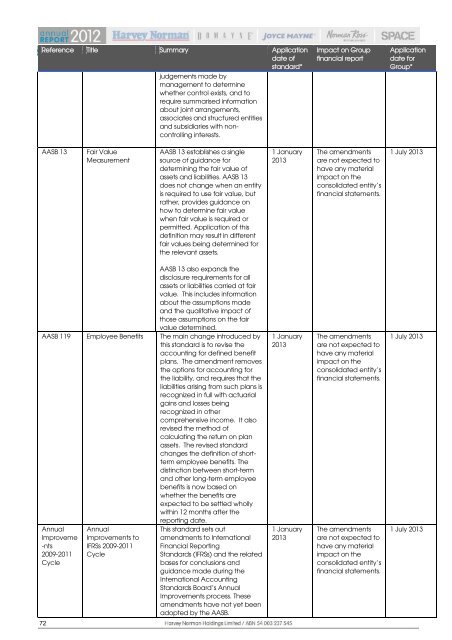

Reference Title Summary Application<br />

STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)<br />

date of<br />

standard*<br />

AASB 13 Fair Value<br />

Measurement<br />

72<br />

judgements made by<br />

management to determine<br />

whether control exists, and to<br />

require summarised information<br />

about joint arrangements,<br />

associates and structured entities<br />

and subsidiaries with noncontrolling<br />

interests.<br />

AASB 13 establishes a single<br />

source of guidance for<br />

determining the fair value of<br />

assets and liabilities. AASB 13<br />

does not change when an entity<br />

is required to use fair value, but<br />

rather, provides guidance on<br />

how to determine fair value<br />

when fair value is required or<br />

permitted. Application of this<br />

definition may result in different<br />

fair values being determined for<br />

the relevant assets.<br />

AASB 119 Employee Benefits<br />

AASB 13 also expands the<br />

disclosure requirements for all<br />

assets or liabilities carried at fair<br />

value. This includes information<br />

about the assumptions made<br />

and the qualitative impact of<br />

those assumptions on the fair<br />

value determined.<br />

The main change introduced by<br />

this standard is to revise the<br />

accounting for defined benefit<br />

plans. The amendment removes<br />

the options for accounting for<br />

the liability, and requires that the<br />

liabilities arising from such plans is<br />

recognized in full with actuarial<br />

gains and losses being<br />

recognized in other<br />

comprehensive income. It also<br />

revised the method of<br />

calculating the return on plan<br />

assets. The revised standard<br />

changes the definition of shortterm<br />

employee benefits. The<br />

distinction between short-term<br />

and other long-term employee<br />

benefits is now based on<br />

whether the benefits are<br />

expected to be settled wholly<br />

within 12 months after the<br />

<strong>report</strong>ing date.<br />

Annual<br />

Improveme<br />

-nts<br />

2009-2011<br />

Cycle<br />

Annual<br />

Improvements to<br />

IFRSs 2009-2011<br />

Cycle<br />

This standard sets out<br />

amendments to International<br />

Financial Reporting<br />

Standards (IFRSs) and the related<br />

bases for conclusions and<br />

guidance made during the<br />

International Accounting<br />

Standards Board‟s Annual<br />

Improvements process. These<br />

amendments have not yet been<br />

adopted by the AASB.<br />

1 January<br />

2013<br />

1 January<br />

2013<br />

1 January<br />

2013<br />

Impact on Group<br />

financial <strong>report</strong><br />

The amendments<br />

are not expected to<br />

have any material<br />

impact on the<br />

consolidated entity‟s<br />

financial statements.<br />

The amendments<br />

are not expected to<br />

have any material<br />

impact on the<br />

consolidated entity‟s<br />

financial statements.<br />

The amendments<br />

are not expected to<br />

have any material<br />

impact on the<br />

consolidated entity‟s<br />

financial statements.<br />

Application<br />

date for<br />

Group*<br />

1 July 2013<br />

1 July 2013<br />

1 July 2013