Report for the academic year - Libraries - Institute for Advanced Study

Report for the academic year - Libraries - Institute for Advanced Study

Report for the academic year - Libraries - Institute for Advanced Study

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO FINANCIAL STATEMENTS<br />

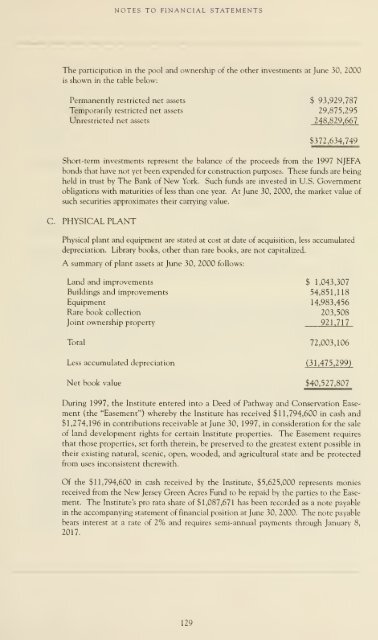

The participation in <strong>the</strong> pool and ownership of <strong>the</strong> o<strong>the</strong>r investments at June 30, 2000<br />

is shown in <strong>the</strong> table below:<br />

Permanently restricted net assets $ 93,929,787<br />

Temporarily restricted net assets 29,875,295<br />

Unrestricted net assets 248,829,667<br />

$372,634,749<br />

Short-term investments represent <strong>the</strong> balance of <strong>the</strong> proceeds from <strong>the</strong> 1997 NJEFA<br />

bonds that have not yet been expended <strong>for</strong> construction purposes. These funds are being<br />

held in trust by The Bank of New York. Such funds are invested in U.S. Government<br />

obligations with maturities of less than one <strong>year</strong>. At June 30, 2000, <strong>the</strong> market value of<br />

such securities approximates <strong>the</strong>ir carrying value.<br />

C. PHYSICAL PLANT<br />

Physical plant and equipment are stated at cost at date of acquisition, less accumulated<br />

depreciation. Library books, o<strong>the</strong>r than rare books, are not capitalized.<br />

A summary of plant assets at June 30, 2000 follows:<br />

Land and improvements $ 1,043,307<br />

Buildings and improvements 54,851,118<br />

Equipment 14,983,456<br />

Rare book collection 203,508<br />

Joint ownership property 921,717<br />

Total 72,003,106<br />

Less accumulated depreciation (31,475,299)<br />

Net book value $40,527,807<br />

During 1997, <strong>the</strong> <strong>Institute</strong> entered into a Deed of Pathway and Conservation Easement<br />

(<strong>the</strong> "Easement") whereby <strong>the</strong> <strong>Institute</strong> has received $11,794,600 in cash and<br />

$1,274,196 in contributions receivable at June 30, 1997, in consideration <strong>for</strong> <strong>the</strong> sale<br />

of land development rights <strong>for</strong> certain <strong>Institute</strong> properties. The Easement requires<br />

that those properties, set <strong>for</strong>th <strong>the</strong>rein, be preserved to <strong>the</strong> greatest extent possible in<br />

<strong>the</strong>ir existing natural, scenic, open, wooded, and agricultural state and be protected<br />

from uses inconsistent <strong>the</strong>rewith.<br />

Of <strong>the</strong> $11,794,600 in cash received by <strong>the</strong> <strong>Institute</strong>, $5,625,000 represents monies<br />

received from <strong>the</strong> New Jersey Green Acres Fund to be repaid by <strong>the</strong> parties to <strong>the</strong> Ease-<br />

ment. The <strong>Institute</strong>'s pro rata share of $1,087,671 has been recorded as a note payable<br />

in <strong>the</strong> accompanying statement of financial position at June 30, 2000. The note payable<br />

bears interest at a rate of 2% and requires semi-annual payments through January 8,<br />

2017.<br />

129