Report for the academic year - Libraries - Institute for Advanced Study

Report for the academic year - Libraries - Institute for Advanced Study

Report for the academic year - Libraries - Institute for Advanced Study

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to financial statements<br />

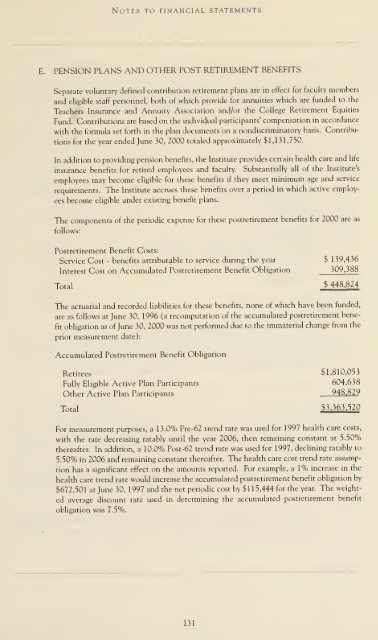

E. PENSION PLANS AND OTHER POST RETIREMENT BENEFITS<br />

Separate voluntary defined contribution retirement plans are in effect <strong>for</strong> faculty members<br />

and eligible staff personnel, both of which provide <strong>for</strong> annuities which are funded to <strong>the</strong><br />

Teachers Insurance and Annuity Association and/or <strong>the</strong> College Retirement Equities<br />

Fund. Contributions are based on <strong>the</strong> individual participants' compensation in accordance<br />

with <strong>the</strong> <strong>for</strong>mula set <strong>for</strong>th in <strong>the</strong> plan documents on a nondiscriminatory basis. Contribu-<br />

tions <strong>for</strong> <strong>the</strong> <strong>year</strong> ended June 30, 2000 totaled approximately $1,131,750.<br />

In addition to providing pension benefits, <strong>the</strong> <strong>Institute</strong> provides certain health care and life<br />

insurance benefits <strong>for</strong> retired employees and faculty. Substantially all of <strong>the</strong> <strong>Institute</strong>'s<br />

employees may become eligible <strong>for</strong> <strong>the</strong>se benefits if <strong>the</strong>y meet minimum age and service<br />

requirements. The <strong>Institute</strong> accrues <strong>the</strong>se benefits over a period in which active employ-<br />

ees become eligible under existing benefit plans.<br />

The components of <strong>the</strong> periodic expense <strong>for</strong> <strong>the</strong>se postretiremen! benefits <strong>for</strong> 2000 are as<br />

follows:<br />

Postretirement Benefit Costs:<br />

Service Cost<br />

- benefits attributable to service during <strong>the</strong> <strong>year</strong> $ 139,436<br />

Interest Cost on Accumulated Postretirement Benefit Obligation 309,388<br />

Total<br />

$ 448,824<br />

The actuarial and recorded liabilities <strong>for</strong> <strong>the</strong>se benefits, none of which have been funded,<br />

are as follows at June 30, 1996 (a recomputation of <strong>the</strong> accumulated postretirement bene-<br />

fit obligation as of June 30, 2000 was not per<strong>for</strong>med due to <strong>the</strong> immaterial change from <strong>the</strong><br />

prior measurement date):<br />

Accumulated Postretirement Benefit Obligation<br />

Retirees<br />

Fully Eligible Active Plan Participants<br />

O<strong>the</strong>r Active Plan Participants<br />

Total<br />

$1,810,053<br />

604,638<br />

948,829<br />

$3.363,520<br />

For measurement purposes, a 13.0% Pre-62 trend rate was used <strong>for</strong> 1997 health care costs,<br />

with <strong>the</strong> rate decreasing ratably until <strong>the</strong> <strong>year</strong> 2006, <strong>the</strong>n remaining constant at 5.50%<br />

<strong>the</strong>reafter. In addition, a 10.0% Post-62 trend rate was used <strong>for</strong> 1997, declining ratably to<br />

5.50% in 2006 and remaining constant <strong>the</strong>reafter. The health care cost trend rate assump-<br />

tion has a significant effect on <strong>the</strong> amounts reported. For example, a 1% increase in <strong>the</strong><br />

health care trend rate would increase <strong>the</strong> accumulated postretirement benefit obligation by<br />

$672,501 at June 30, 1997 and <strong>the</strong> net periodic cost by $1 15,444 <strong>for</strong> <strong>the</strong> <strong>year</strong>. The weight-<br />

ed average discount rate used in determining <strong>the</strong> accumulated postretirement benefit<br />

obligation was 7.5%.<br />

131