Report for the academic year - Libraries - Institute for Advanced Study

Report for the academic year - Libraries - Institute for Advanced Study

Report for the academic year - Libraries - Institute for Advanced Study

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

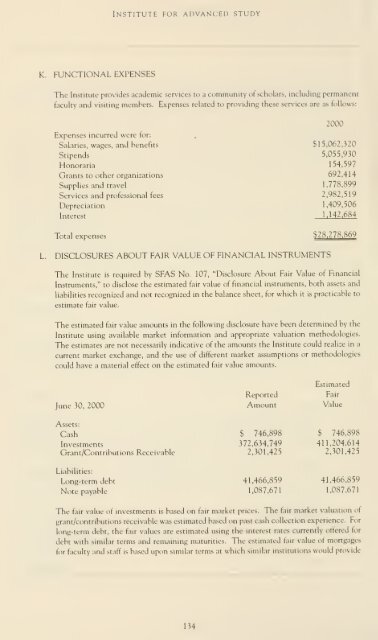

K. FUNCTIONAL EXPENSES<br />

<strong>Institute</strong> <strong>for</strong> advanced study<br />

The <strong>Institute</strong> provides <strong>academic</strong> services to a community of scholars, including permanent<br />

faculty and visiting memhers. Expenses related to providing <strong>the</strong>se services are as follows:<br />

Expenses incurred were <strong>for</strong>:<br />

Salaries, wages, and benefits<br />

Stipends<br />

Honoraria<br />

Grants to o<strong>the</strong>r organizations<br />

Supplies and travel<br />

Services and professional fees<br />

Depreciation<br />

Interest<br />

Total expenses<br />

L. DISCLOSURES ABOUT FAIR VALUE OF FINANCIAL INSTRUMENTS<br />

2000<br />

$15,062,320<br />

5,055,930<br />

154,597<br />

692,414<br />

1,778,899<br />

2,982,519<br />

1,409,506<br />

1,142,684<br />

$28,278,869<br />

The <strong>Institute</strong> is required by SFAS No. 107, "Disclosure About Fair Value of Financial<br />

Instruments," to disclose <strong>the</strong> estimated fair value of financial instruments, both assets and<br />

liabilities recognized and not recognized in <strong>the</strong> balance sheet, <strong>for</strong> which it is practicable to<br />

estimate fair value.<br />

The estimated fair value amounts in <strong>the</strong> following disclosure have been determined by <strong>the</strong><br />

<strong>Institute</strong> using available market in<strong>for</strong>mation and appropriate valuation methodologies.<br />

The estimates are not necessarily indicative of <strong>the</strong> amounts <strong>the</strong> <strong>Institute</strong> could realize in a<br />

current market exchange, and <strong>the</strong> use of different market assumptions or methodologies<br />

could have a material effect on <strong>the</strong> estimated fair value amounts.<br />

June 30, 2000<br />

Assets:<br />

Cash<br />

Investments<br />

Grant/Contributions Receivable<br />

Liabilities:<br />

Long-term debt<br />

Note payable<br />

<strong>Report</strong>ed<br />

Amount<br />

The fair value of investments is based on fair market prices. The fair market valuat ion d<br />

grant/contributions receivable was estimated based on past cash collection experience. For<br />

long-term debt, <strong>the</strong> fail value- are estimated using <strong>the</strong> interest rates currently ottered <strong>for</strong><br />

debt with Bimilar terms and remaining maturities. The estimated fail value of mortgages<br />

tor faculty and atari i- based upon similar terms at which similar institutions would provide